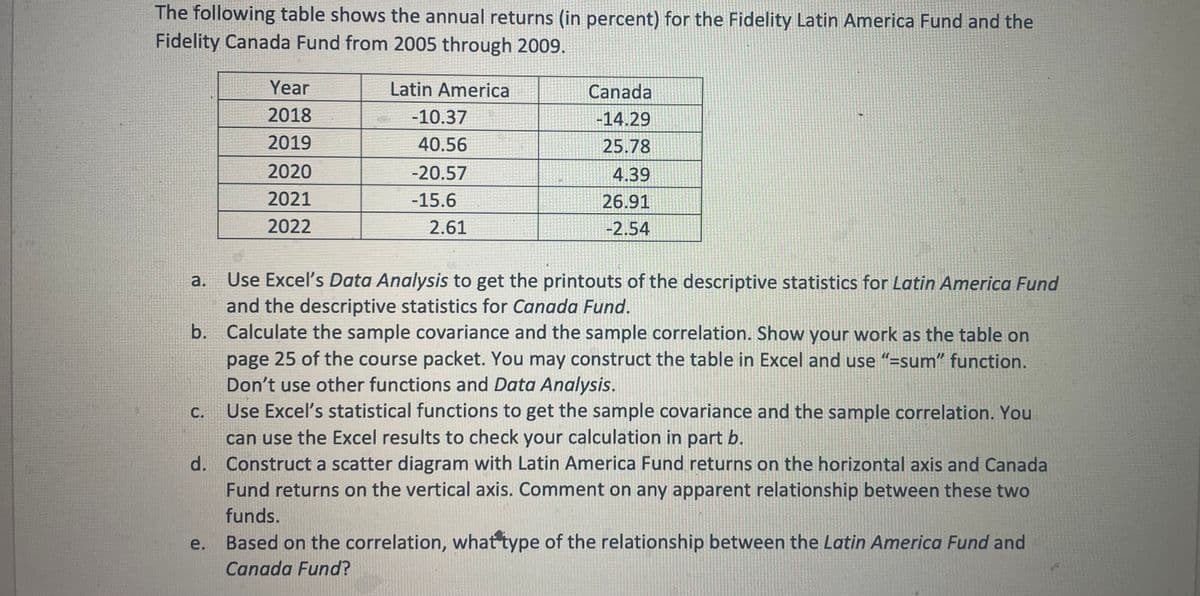

The following table shows the annual returns (in percent) for the Fidelity Latin America Fund and the Fidelity Canada Fund from 2005 through 2009. Latin America -10.37 40.56 -20.57 -15.6 a. Year 2018 2019 2020 2021 2022 C. 2.61 Canada -14.29 25.78 4.39 26.91 -2.54 o Use Excel's Data Analysis to get the printouts of the descriptive statistics for Latin America Fund and the descriptive statistics for Canada Fund. b. Calculate the sample covariance and the sample correlation. Show your work as the table on page 25 of the course packet. You may construct the table in Excel and use "=sum" function. Don't use other functions and Data Analysis. Use Excel's statistical functions to get the sample covariance and the sample correlation. You can use the Excel results to check your calculation in part b.

The following table shows the annual returns (in percent) for the Fidelity Latin America Fund and the Fidelity Canada Fund from 2005 through 2009. Latin America -10.37 40.56 -20.57 -15.6 a. Year 2018 2019 2020 2021 2022 C. 2.61 Canada -14.29 25.78 4.39 26.91 -2.54 o Use Excel's Data Analysis to get the printouts of the descriptive statistics for Latin America Fund and the descriptive statistics for Canada Fund. b. Calculate the sample covariance and the sample correlation. Show your work as the table on page 25 of the course packet. You may construct the table in Excel and use "=sum" function. Don't use other functions and Data Analysis. Use Excel's statistical functions to get the sample covariance and the sample correlation. You can use the Excel results to check your calculation in part b.

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 19PFA

Related questions

Question

Transcribed Image Text:The following table shows the annual returns (in percent) for the Fidelity Latin America Fund and the

Fidelity Canada Fund from 2005 through 2009.

Latin America

-10.37

40.56

-20.57

-15.6

a.

Year

2018

2019

C.

2020

2021

2022

e.

2.61

Canada

-14.29

25.78

4.39

26.91

-2.54

b. Calculate the sample covariance and the sample correlation. Show your work as the table on

page 25 of the course packet. You may construct the table in Excel and use "=sum" function.

Don't use other functions and Data Analysis.

Use Excel's Data Analysis to get the printouts of the descriptive statistics for Latin America Fund

and the descriptive statistics for Canada Fund.

Use Excel's statistical functions to get the sample covariance and the sample correlation. You

can use the Excel results to check your calculation in part b.

d. Construct a scatter diagram with Latin America Fund returns on the horizontal axis and Canada

Fund returns on the vertical axis. Comment on any apparent relationship between these two

funds.

Based on the correlation, what type of the relationship between the Latin America Fund and

Canada Fund?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL