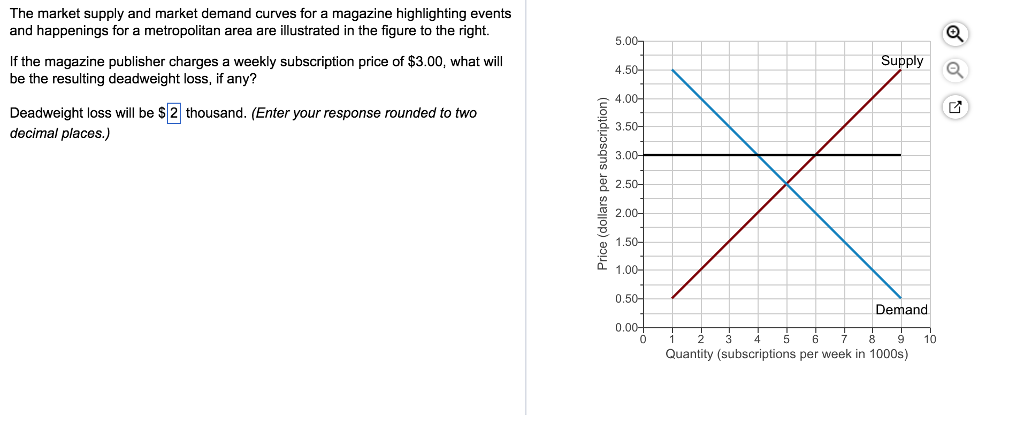

The market supply and market demand curves for a magazine highlighting events and happenings for a metropolitan area are illustrated in the figure to the right 5.00 4.50- 4.00 If the magazine publisher charges a weekly subscription price of $3.00, what will be the resulting deadweight loss, if any? Supplya Deadweight loss will be $2 thousand. (Enter your response rounded to two decimal places.) 3.50- 3.00 2.50 2.00- 1.50 1.00 0.50 8 CO Demand 0 1 2 3 4 5 6 789 10 Quantity (subscriptions per week in 1000s)

The market supply and market demand curves for a magazine highlighting events and happenings for a metropolitan area are illustrated in the figure to the right 5.00 4.50- 4.00 If the magazine publisher charges a weekly subscription price of $3.00, what will be the resulting deadweight loss, if any? Supplya Deadweight loss will be $2 thousand. (Enter your response rounded to two decimal places.) 3.50- 3.00 2.50 2.00- 1.50 1.00 0.50 8 CO Demand 0 1 2 3 4 5 6 789 10 Quantity (subscriptions per week in 1000s)

Chapter8: Market Failure

Section: Chapter Questions

Problem 2P: Draw a standard supply and demand diagram for televisions, and indicate the equilibrium price and...

Related questions

Question

Please help with this

Transcribed Image Text:The market supply and market demand curves for a magazine highlighting events

and happenings for a metropolitan area are illustrated in the figure to the right

5.00

4.50-

4.00

If the magazine publisher charges a weekly subscription price of $3.00, what will

be the resulting deadweight loss, if any?

Supplya

Deadweight loss will be $2 thousand. (Enter your response rounded to two

decimal places.)

3.50-

3.00

2.50

2.00-

1.50

1.00

0.50

8

CO

Demand

0 1 2 3 4 5 6 789 10

Quantity (subscriptions per week in 1000s)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc