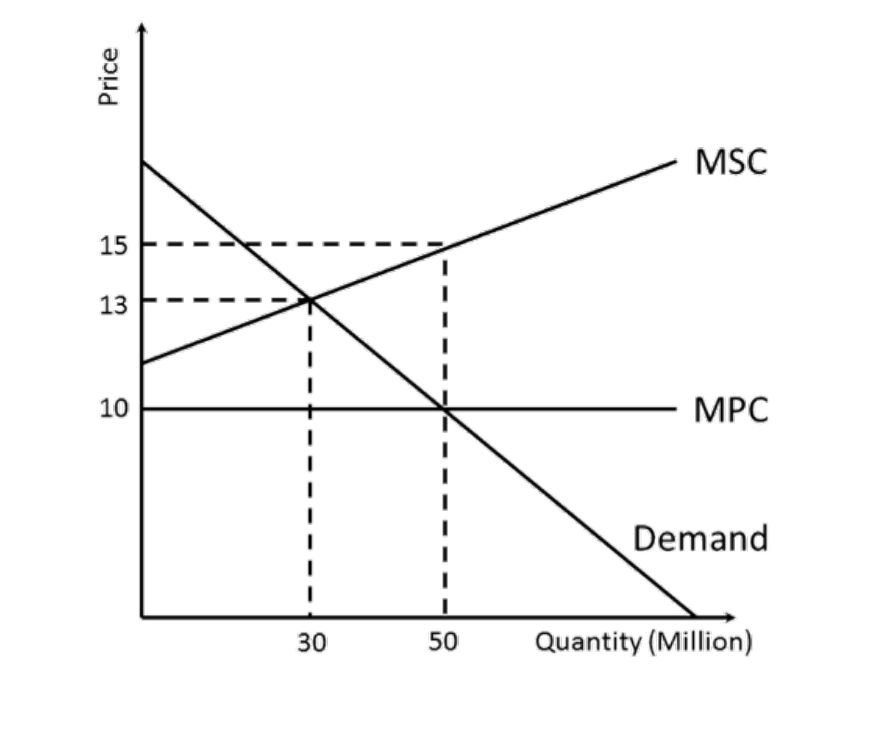

The production of plastic creates pollution, which, in sufficient quantities, can harm people’s health. Assume that the plastic industry is perfectly competitive. We know that the industry will produce more output than is socially optimal, since firms do not bear the costs of pollution (that is, pollution is a negative externality). Without government intervention, the market output will be 50 million units at a price of $10, where $10 is the minimum AC of firms in the industry. This cost is the long-run marginal private cost (MPC) of making plastic. The marginal social cost (MSC) of plastic is $15 at this level of output; the MSC includes the external social cost of pollution. Since MSC exceeds price, output is too high. The socially optimal output is 30 million units at a price of $13. This output can be attained by levying an excise tax of $3 on each unit of plastic. Assume that the demand and marginal social cost (MSC) curves are linear, as shown in the graph below. (a) Calculate the loss of consumer surplus associated with the $3 tax. This is the loss that buyers of plastic incur when we move to the socially optimal output level. (b) Calculate the reduction in pollution costs that occurs because of the tax. (c) Calculate the government revenues from the tax.

The production of plastic creates pollution, which, in sufficient quantities, can harm people’s health. Assume that the plastic industry is

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 1 images