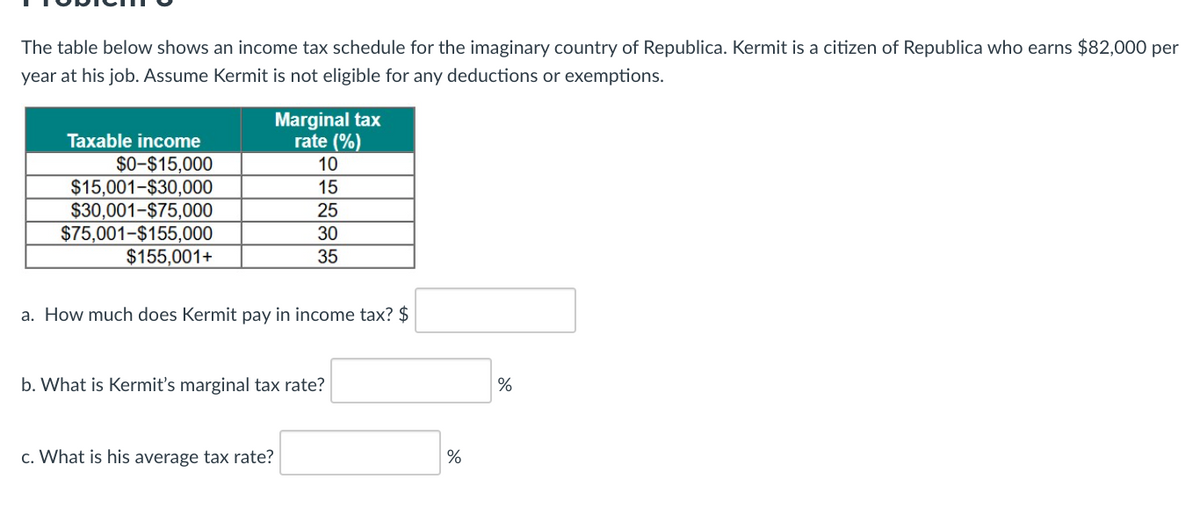

The table below shows an income tax schedule for the imaginary country of Republica. Kermit is a citizen of Republica who earns $82,000 per year at his job. Assume Kermit is not eligible for any deductions or exemptions. Marginal tax rate (%) 10 Taxable income $0-$15,000 $15,001-$30,000 $30,001-$75,000 $75,001-$155,000 $155,001+ 15 25 30 35 a. How much does Kermit pay in income tax? $ b. What is Kermit's marginal tax rate? c. What is his average tax rate?

The table below shows an income tax schedule for the imaginary country of Republica. Kermit is a citizen of Republica who earns $82,000 per year at his job. Assume Kermit is not eligible for any deductions or exemptions. Marginal tax rate (%) 10 Taxable income $0-$15,000 $15,001-$30,000 $30,001-$75,000 $75,001-$155,000 $155,001+ 15 25 30 35 a. How much does Kermit pay in income tax? $ b. What is Kermit's marginal tax rate? c. What is his average tax rate?

Chapter16: The Public Sector

Section: Chapter Questions

Problem 3SQ

Related questions

Question

Please answer sections a-f.

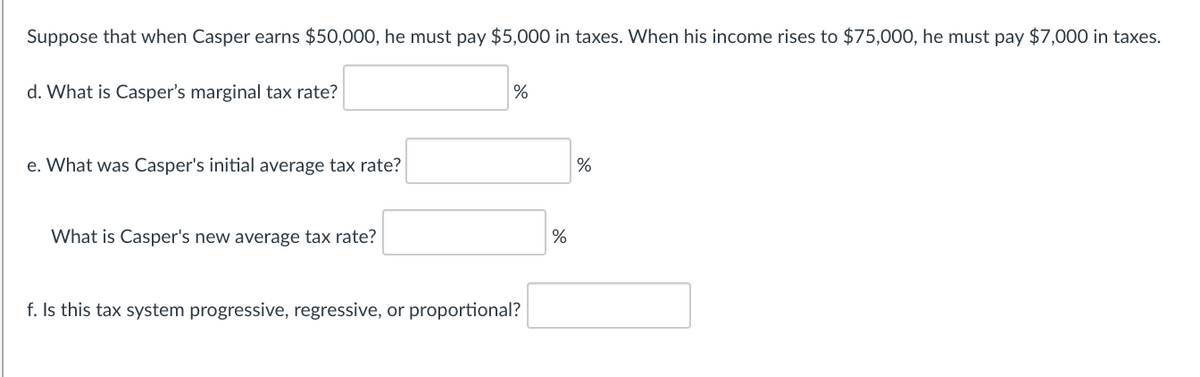

Transcribed Image Text:Suppose that when Casper earns $50,000, he must pay $5,000 in taxes. When his income rises to $75,000, he must pay $7,000 in taxes.

d. What is Casper's marginal tax rate?

e. What was Casper's initial average tax rate?

%

What is Casper's new average tax rate?

%

f. Is this tax system progressive, regressive, or proportional?

Transcribed Image Text:The table below shows an income tax schedule for the imaginary country of Republica. Kermit is a citizen of Republica who earns $82,000 per

year at his job. Assume Kermit is not eligible for any deductions or exemptions.

Marginal tax

rate (%)

Taxable income

$0-$15,000

$15,001-$30,000

$30,001-$75,000

$75,001-$155,000

$155,001+

10

15

25

30

35

a. How much does Kermit pay in income tax? $

b. What is Kermit's marginal tax rate?

%

c. What is his average tax rate?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning