Year 1 Tax Worksheet Income taxed at 30% Total Tax Paid Person Year 1 Income Income taxcd at 15% Amy $20,000 Betty $40,000 Charlic $60,000 Dimitry $80,000 Evelyn $100,000 Year 1 Total Tax Revenue=

Year 1 Tax Worksheet Income taxed at 30% Total Tax Paid Person Year 1 Income Income taxcd at 15% Amy $20,000 Betty $40,000 Charlic $60,000 Dimitry $80,000 Evelyn $100,000 Year 1 Total Tax Revenue=

Economics (MindTap Course List)

13th Edition

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Roger A. Arnold

Chapter11: Fiscal Policy And The Federal Budget

Section: Chapter Questions

Problem 5WNG

Related questions

Question

100%

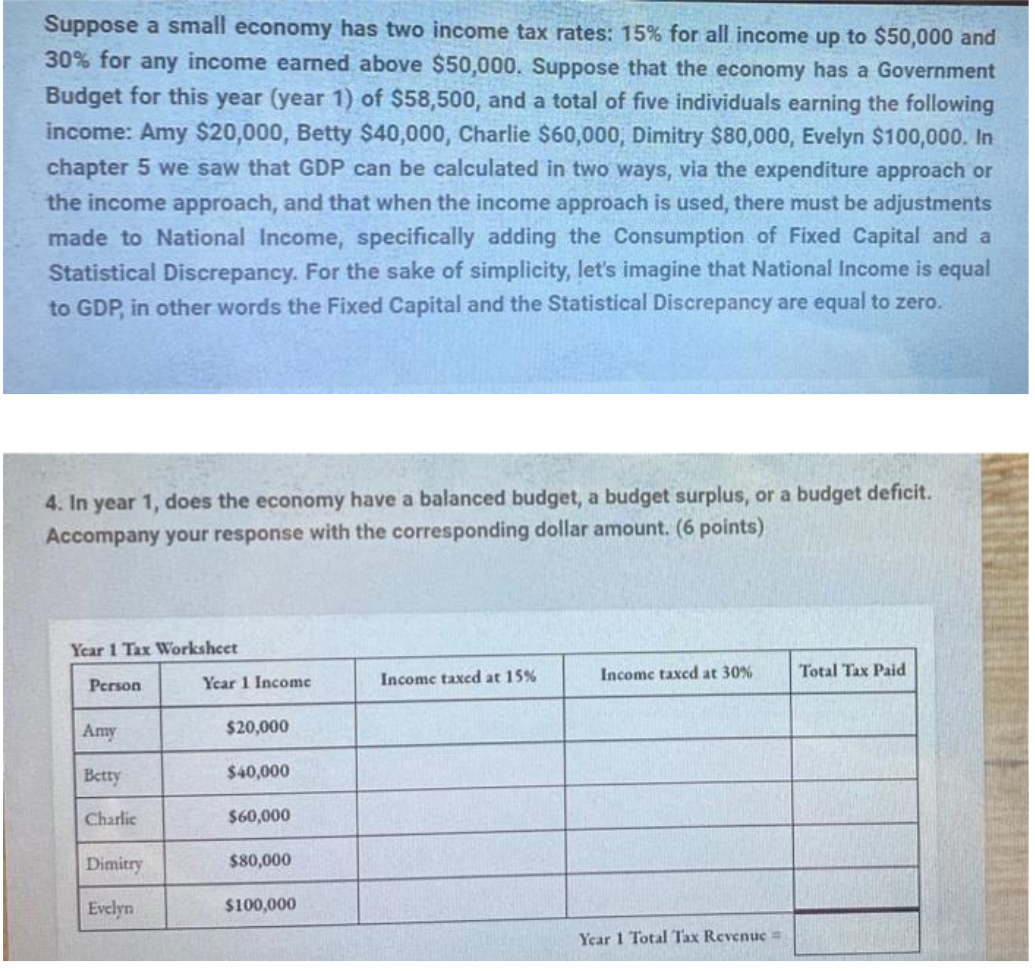

Transcribed Image Text:Suppose a small economy has two income tax rates: 15% for all income up to $50,000 and

30% for any income earned above $50,000. Suppose that the economy has a Government

Budget for this year (year 1) of $58,500, and a total of five individuals earning the following

income: Amy $20,000, Betty $40,000, Charlie $60,000, Dimitry $80,000, Evelyn $100,000. In

chapter 5 we saw that GDP can be calculated in two ways, via the expenditure approach or

the income approach, and that when the income approach is used, there must be adjustments

made to National Income, specifically adding the Consumption of Fixed Capital and a

Statistical Discrepancy. For the sake of simplicity, let's imagine that National Income is equal

to GDP, in other words the Fixed Capital and the Statistical Discrepancy are equal to zero.

4. In year 1, does the economy have a balanced budget, a budget surplus, or a budget deficit.

Accompany your response with the corresponding dollar amount. (6 points)

Year 1 Tax Worksheet

Income taxed at 30%

Total Tax Paid

Year 1 Income

Income taxed at 15%

Person

Amy

$20,000

Betty

$40,000

Charlic

$60,000

Dimitry

$80,000

Evelyn

$100,000

Year 1 Total Tax Revenue =

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning