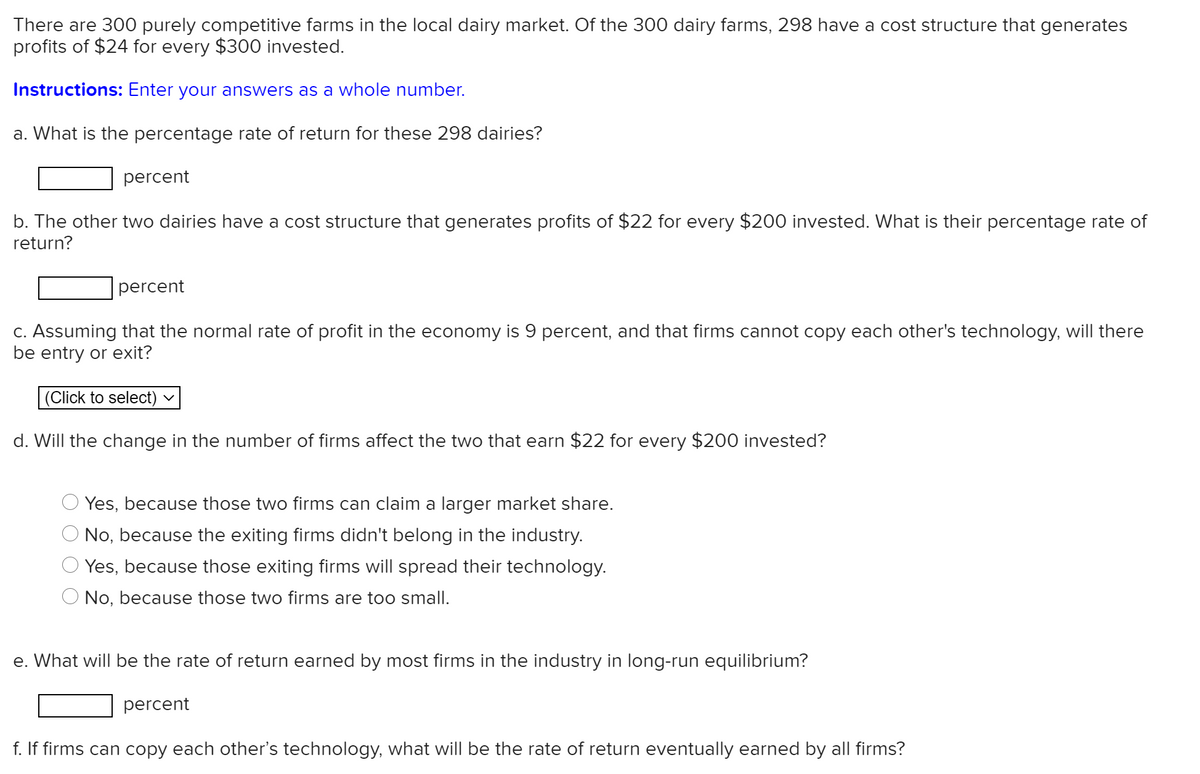

There are 300 purely competitive farms in the local dairy market. Of the 300 dairy farms, 298 have a cost structure that generates profits of $24 for every $300 invested. Instructions: Enter your answers as a whole number. a. What is the percentage rate of return for these 298 dairies? percent b. The other two dairies have a cost structure that generates profits of $22 for every $200 invested. What is their percentage rate of return? percent c. Assuming that the normal rate of profit in the economy is 9 percent, and that firms cannot copy each other's technology, will there be entry or exit?

There are 300 purely competitive farms in the local dairy market. Of the 300 dairy farms, 298 have a cost structure that generates profits of $24 for every $300 invested. Instructions: Enter your answers as a whole number. a. What is the percentage rate of return for these 298 dairies? percent b. The other two dairies have a cost structure that generates profits of $22 for every $200 invested. What is their percentage rate of return? percent c. Assuming that the normal rate of profit in the economy is 9 percent, and that firms cannot copy each other's technology, will there be entry or exit?

Chapter11: The Firm: Production And Costs

Section: Chapter Questions

Problem 3P

Related questions

Question

Info in images

Transcribed Image Text:There are 300 purely competitive farms in the local dairy market. Of the 300 dairy farms, 298 have a cost structure that generates

profits of $24 for every $300 invested.

Instructions: Enter your answers as a whole number.

a. What is the percentage rate of return for these 298 dairies?

percent

b. The other two dairies have a cost structure that generates profits of $22 for every $200 invested. What is their percentage rate of

return?

percent

C. Assuming that the normal rate of profit in the economy is 9 percent, and that firms cannot copy each other's technology, will there

be entry or exit?

(Click to select)

d. Will the change in the number of firms affect the two that earn $22 for every $200 invested?

Yes, because those two firms can claim a larger market share.

No, because the exiting firms didn't belong in the industry.

Yes, because those exiting firms will spread their technology.

No, because those two firms are too small.

e. What will be the rate of return earned by most firms in the industry in long-run equilibrium?

percent

f. If firms can copy each other's technology, what will be the rate of return eventually earned by all firms?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax