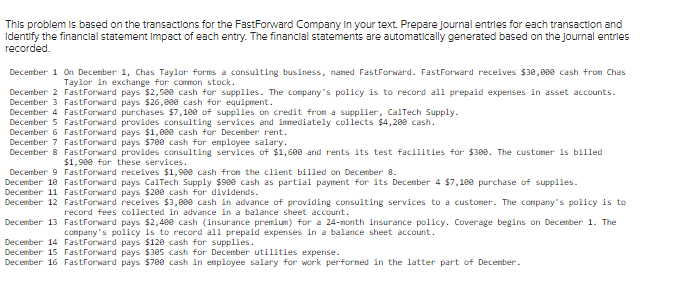

This problem is based on the transactions for the FastForward Company in your text. Prepare Journal entries for each transaction and Identify the financial statement impact of each entry. The financial statements are automatically generated based on the journal entries recorded. December 1 On December 1, Chas Taylor forms a consulting business, named FastForward. FastForward receives $30,000 cash from Chas Taylor in exchange for common stock. December 2 FastForward pays $2,500 cash for supplies. The company's policy is to record all prepaid expenses in asset accounts. December 3 FastForward pays $26,000 cash for equipment. December 4 FastForward purchases $7,100 of supplies on credit from a supplier, CalTech Supply. December 5 FastForward provides consulting services and immediately collects $4,200 cash. December 6 FastForward pays $1,000 cash for December rent. December 7 FastForward pays $700 cash for employee salary. December 8 FastForward provides consulting services of $1,600 and rents its test facilities for $300. The customer is billed $1,900 for these services. December 9 FastForward receives $1,900 cash from the client billed on December 8. December 10 FastForward pays CalTech Supply $900 cash as partial payment for its December 4 $7,100 purchase of supplies. December 11 FastForward pays $200 cash for dividends. December 12 FastForward receives $3,000 cash in advance of providing consulting services to a customer. The company's policy is to record fees collected in advance in a balance sheet account. December 13 FastForward pays $2,400 cash (insurance premium) for a 24-month insurance policy. Coverage begins on December 1. The company's policy is to record all prepaid expenses in a balance sheet account. December 14 FastForward pays $120 cash for supplies. December 15 FastForward pays $305 cash for December utilities expense. December 16 FastForward pays $700 cash in employee salary for work performed in the latter part of December.

This problem is based on the transactions for the FastForward Company in your text. Prepare Journal entries for each transaction and Identify the financial statement impact of each entry. The financial statements are automatically generated based on the journal entries recorded. December 1 On December 1, Chas Taylor forms a consulting business, named FastForward. FastForward receives $30,000 cash from Chas Taylor in exchange for common stock. December 2 FastForward pays $2,500 cash for supplies. The company's policy is to record all prepaid expenses in asset accounts. December 3 FastForward pays $26,000 cash for equipment. December 4 FastForward purchases $7,100 of supplies on credit from a supplier, CalTech Supply. December 5 FastForward provides consulting services and immediately collects $4,200 cash. December 6 FastForward pays $1,000 cash for December rent. December 7 FastForward pays $700 cash for employee salary. December 8 FastForward provides consulting services of $1,600 and rents its test facilities for $300. The customer is billed $1,900 for these services. December 9 FastForward receives $1,900 cash from the client billed on December 8. December 10 FastForward pays CalTech Supply $900 cash as partial payment for its December 4 $7,100 purchase of supplies. December 11 FastForward pays $200 cash for dividends. December 12 FastForward receives $3,000 cash in advance of providing consulting services to a customer. The company's policy is to record fees collected in advance in a balance sheet account. December 13 FastForward pays $2,400 cash (insurance premium) for a 24-month insurance policy. Coverage begins on December 1. The company's policy is to record all prepaid expenses in a balance sheet account. December 14 FastForward pays $120 cash for supplies. December 15 FastForward pays $305 cash for December utilities expense. December 16 FastForward pays $700 cash in employee salary for work performed in the latter part of December.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.10MCE: Journal Entries Recorded Directly in T Accounts Record each of the following transactions directly...

Related questions

Question

100%

Don't give answer in image format

Transcribed Image Text:This problem is based on the transactions for the FastForward Company in your text. Prepare Journal entries for each transaction and

Identify the financial statement Impact of each entry. The financial statements are automatically generated based on the journal entries

recorded.

December 1 On December 1, Chas Taylor forms a consulting business, named FastForward. FastForward receives $30,000 cash from Chas

Taylor in exchange for common stock.

December 2 FastForward pays $2,500 cash for supplies. The company's policy is to record all prepaid expenses in asset accounts.

December 3 FastForward pays $26,000 cash for equipment.

December 4 FastForward purchases $7,100 of supplies on credit from a supplier, CalTech Supply.

December 5

FastForward provides consulting services and immediately collects $4,200 cash.

FastForward pays $1,000 cash for December rent.

December 6

December 7

FastForward pays $700 cash for employee salary.

December 8 FastForward provides consulting services of $1,600 and rents its test facilities for $300. The customer is billed

$1,980 for these services.

December 9 FastForward receives $1,980 cash from the client billed on December 8.

December 18 FastForward pays CalTech Supply $980 cash as partial payment for its December 4 $7,180 purchase of supplies.

December 11 FastForward pays $200 cash for dividends.

December 12 FastForward

receives $3,000 cash in advance of providing consulting services to a customer. The company's policy is to

record fees collected in advance in a balance sheet account.

December 13 FastForward pays $2,400 cash (insurance premium) for a 24-month insurance policy. Coverage begins on December 1. The

company's policy is to record all prepaid expenses in a balance sheet account.

December 14 FastForward pays $120 cash for supplies.

December 15

FastForward pays $385 cash for December utilities expense.

December 16 FastForward pays $700 cash in employee salary for work performed in the latter part of December.

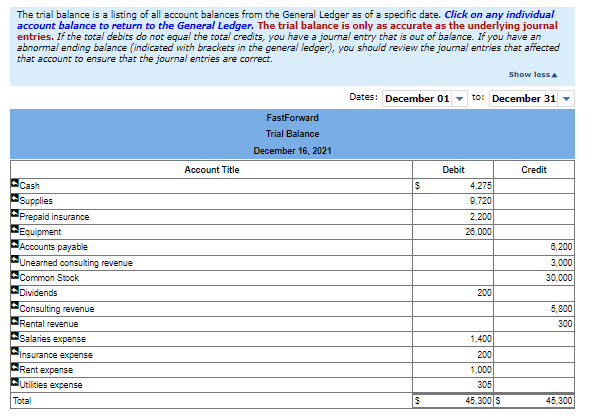

Transcribed Image Text:The trial balance is a listing of all account balances from the General Ledger as of a specific date. Click on any individual

account balance to return to the General Ledger. The trial balance is only as accurate as the underlying journal

entries. If the total debits do not equal the total credits, you have a journal entry that is out of balance. If you have an

abnormal ending balance (indicated with brackets in the general ledger), you should review the journal entries that affected

that account to ensure that the journal entries are correct.

Cash

Supplies

Prepaid insurance

Equipment

Accounts payable

Unearned consulting revenue

Common Stock

Dividends

Consulting revenue

Rental revenue

Salaries expense

Insurance expense

Rent expense

Utilities expense

Total

Account Title

FastForward

Trial Balance

December 16, 2021

Dates: December 01

$

$

Debit

to: December 31

4,275

9,720

2,200

26,000

200

Show less A

1,400

200

1,000

305

45,300 S

Credit

6,200

3,000

30,000

5,800

300

45,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub