Tiger-el is an upstream manufacturer of electric trains that sells wholesale to Ihe Great Toy Store, the only such store in the area. Demand for the trains at the retail store level in inverse form is P 1,000- 2Q, where Q is the total number of trains sold. The Great Toy Store incurs no service cost in selling the train. Its only cost is the wholesale price it pays for each train. Tiger-el incurs a production cost of $40 per train. a. What wholesale price should Tiger-el charge for its trains? What price will these trains sell for at retail? How many trains will be sold? b. What profit will the toy store and the retailer earn under the pricing choices found in part (a)? c. How would the quantity of trains sold and the retail price change if Tiger-el sold the trains to The Great Toy Store at cost but also received a 66.67% sales royalty on every train sold? How would your profit calculations in part (b) change?

Tiger-el is an upstream manufacturer of electric trains that sells wholesale to Ihe Great Toy Store, the only such store in the area. Demand for the trains at the retail store level in inverse form is P 1,000- 2Q, where Q is the total number of trains sold. The Great Toy Store incurs no service cost in selling the train. Its only cost is the wholesale price it pays for each train. Tiger-el incurs a production cost of $40 per train. a. What wholesale price should Tiger-el charge for its trains? What price will these trains sell for at retail? How many trains will be sold? b. What profit will the toy store and the retailer earn under the pricing choices found in part (a)? c. How would the quantity of trains sold and the retail price change if Tiger-el sold the trains to The Great Toy Store at cost but also received a 66.67% sales royalty on every train sold? How would your profit calculations in part (b) change?

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter24: Price-searcher Markets With High Entry Barriers

Section: Chapter Questions

Problem 13CQ

Related questions

Question

i need the answer for part C. please solve part C ??

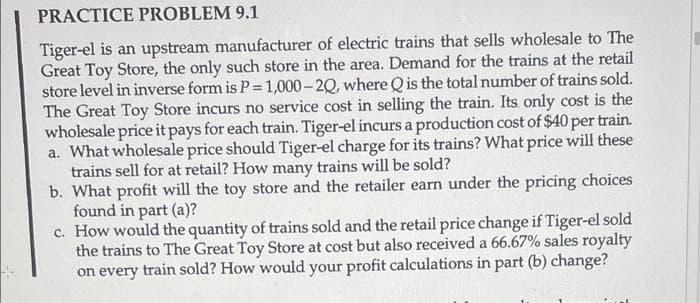

Transcribed Image Text:PRACTICE PROBLEM 9.1

Tiger-el is an upstream manufacturer of electric trains that sells wholesale to The

Great Toy Store, the only such store in the area. Demand for the trains at the retail

store level in inverse form is P 1,000- 2Q, where Qis the total number of trains sold.

The Great Toy Store incurs no service cost in selling the train. Its only cost is the

wholesale price it pays for each train. Tiger-el incurs a production cost of $40 per train.

a. What wholesale price should Tiger-el charge for its trains? What price will these

trains sell for at retail? How many trains will be sold?

b. What profit will the toy store and the retailer earn under the pricing choices

found in part (a)?

c. How would the quantity of trains sold and the retail price change if Tiger-el sold

the trains to The Great Toy Store at cost but also received a 66.67% sales royalty

on every train sold? How would your profit calculations in part (b) change?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning