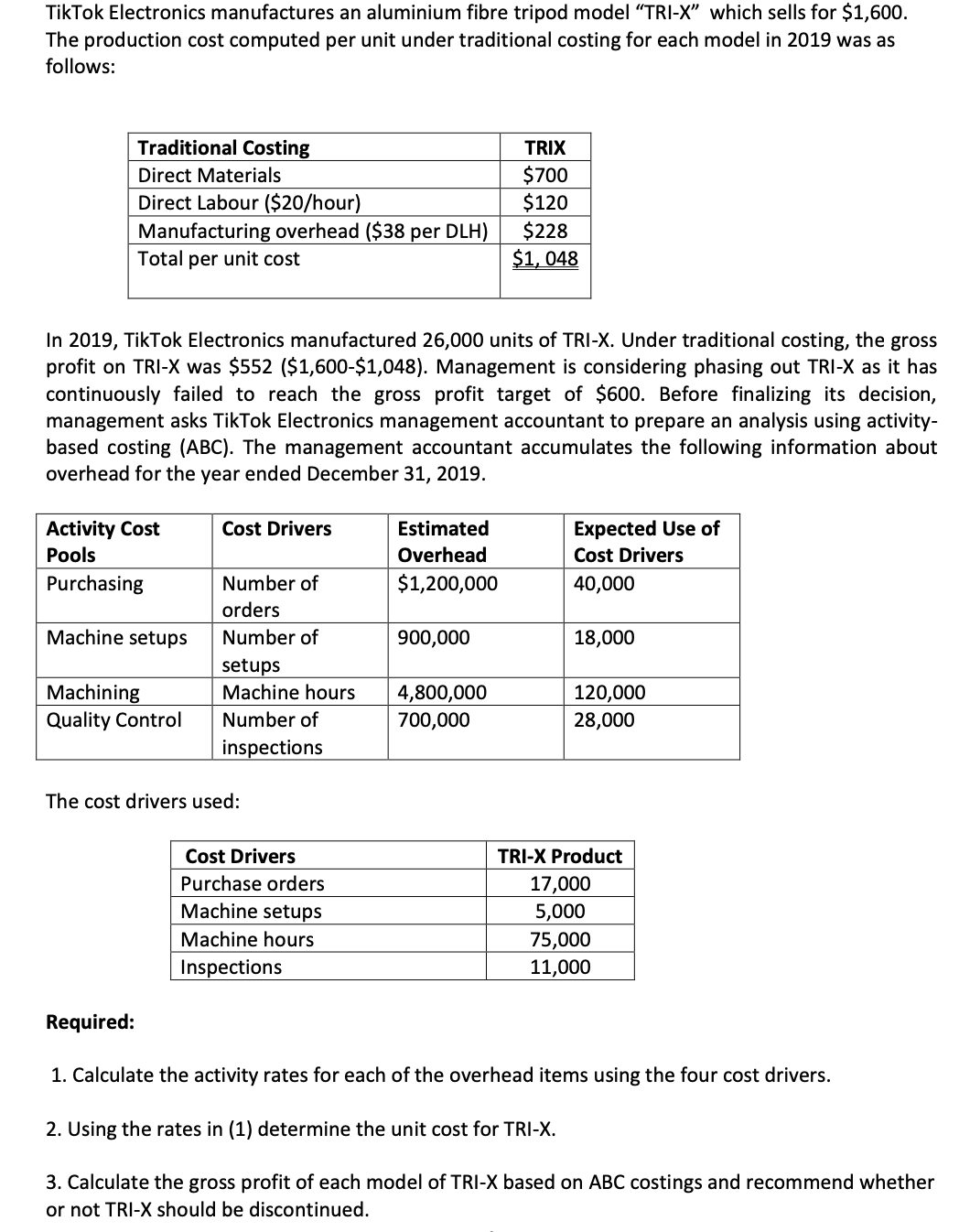

TikTok Electronics manufactures an aluminium fibre tripod model "TRI-X" which sells for $1,600. The production cost computed per unit under traditional costing for each model in 2019 was as follows: Traditional Costing TRIX $700 $120 $228 $1, 048 Direct Materials Direct Labour ($20/hour) Manufacturing overhead ($38 per DLH) Total per unit cost In 2019, TikTok Electronics manufactured 26,000 units of TRI-X. Under traditional costing, the gross profit on TRI-X was $552 ($1,600-$1,048). Management is considering phasing out TRI-X as it has continuously failed to reach the gross profit target of $600. Before finalizing its decision, management asks TikTok Electronics management accountant to prepare an analysis usir based costing (ABC). The management accountant accumulates the following information about overhead for the year ended December 31, 2019. ctivity- Activity Cost Pools Cost Drivers Estimated Expected Use of Overhead Cost Drivers Purchasing Number of $1,200,000 40,000 orders Machine setups Number of 900,000 18,000 setups Machine hours Machining Quality Control 4,800,000 120,000 Number of 700,000 28,000 inspections The cost drivers used: Cost Drivers TRI-X Product Purchase orders 17,000 Machine setups 5,000 Machine hours 75,000 Inspections 11,000 Required: 1. Calculate the activity rates for each of the overhead items using the four cost drivers. 2. Using the rates in (1) determine the unit cost for TRI-X. 3. Calculate the gross profit of each model of TRI-X based on ABC costings and recommend whether or not TRI-X should be discontinued.

TikTok Electronics manufactures an aluminium fibre tripod model "TRI-X" which sells for $1,600. The production cost computed per unit under traditional costing for each model in 2019 was as follows: Traditional Costing TRIX $700 $120 $228 $1, 048 Direct Materials Direct Labour ($20/hour) Manufacturing overhead ($38 per DLH) Total per unit cost In 2019, TikTok Electronics manufactured 26,000 units of TRI-X. Under traditional costing, the gross profit on TRI-X was $552 ($1,600-$1,048). Management is considering phasing out TRI-X as it has continuously failed to reach the gross profit target of $600. Before finalizing its decision, management asks TikTok Electronics management accountant to prepare an analysis usir based costing (ABC). The management accountant accumulates the following information about overhead for the year ended December 31, 2019. ctivity- Activity Cost Pools Cost Drivers Estimated Expected Use of Overhead Cost Drivers Purchasing Number of $1,200,000 40,000 orders Machine setups Number of 900,000 18,000 setups Machine hours Machining Quality Control 4,800,000 120,000 Number of 700,000 28,000 inspections The cost drivers used: Cost Drivers TRI-X Product Purchase orders 17,000 Machine setups 5,000 Machine hours 75,000 Inspections 11,000 Required: 1. Calculate the activity rates for each of the overhead items using the four cost drivers. 2. Using the rates in (1) determine the unit cost for TRI-X. 3. Calculate the gross profit of each model of TRI-X based on ABC costings and recommend whether or not TRI-X should be discontinued.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 21E: Ellerson Company provided the following information for the last calendar year: During the year,...

Related questions

Question

Transcribed Image Text:TikTok Electronics manufactures an aluminium fibre tripod model "TRI-X" which sells for $1,600.

The production cost computed per unit under traditional costing for each model in 2019 was as

follows:

Traditional Costing

TRIX

$700

$120

$228

$1, 048

Direct Materials

Direct Labour ($20/hour)

Manufacturing overhead ($38 per DLH)

Total per unit cost

In 2019, TikTok Electronics manufactured 26,000 units of TRI-X. Under traditional costing, the gross

profit on TRI-X was $552 ($1,600-$1,048). Management is considering phasing out TRI-X as it has

continuously failed to reach the gross profit target of $600. Before finalizing its decision,

anagement asks TikTok Electronics manag

based costing (ABC). The management accountant accumulates the following information about

overhead for the year ended December 31, 2019.

ent accountant to prepare an analysis using activity-

Activity Cost

Cost Drivers

Estimated

Expected Use of

Pools

Overhead

Cost Drivers

Purchasing

Number of

$1,200,000

40,000

orders

Machine setups

Number of

900,000

18,000

setups

Machine hours

Machining

Quality Control

120,000

4,800,000

700,000

Number of

28,000

inspections

The cost drivers used:

Cost Drivers

TRI-X Product

Purchase orders

17,000

Machine setups

5,000

Machine hours

75,000

Inspections

11,000

Required:

1. Calculate the activity rates for each of the overhead items using the four cost drivers.

2. Using the rates in (1) determine the unit cost for TRI-X.

3. Calculate the gross profit of each model of TRI-X based on ABC costings and recommend whether

or not TRI-X should be discontinued.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub