Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter18: Auctions

Section: Chapter Questions

Problem 9MC

Related questions

Question

a) which trader get filled and for what volume

b)what will be the market

c) Determine economic surplus for each trader

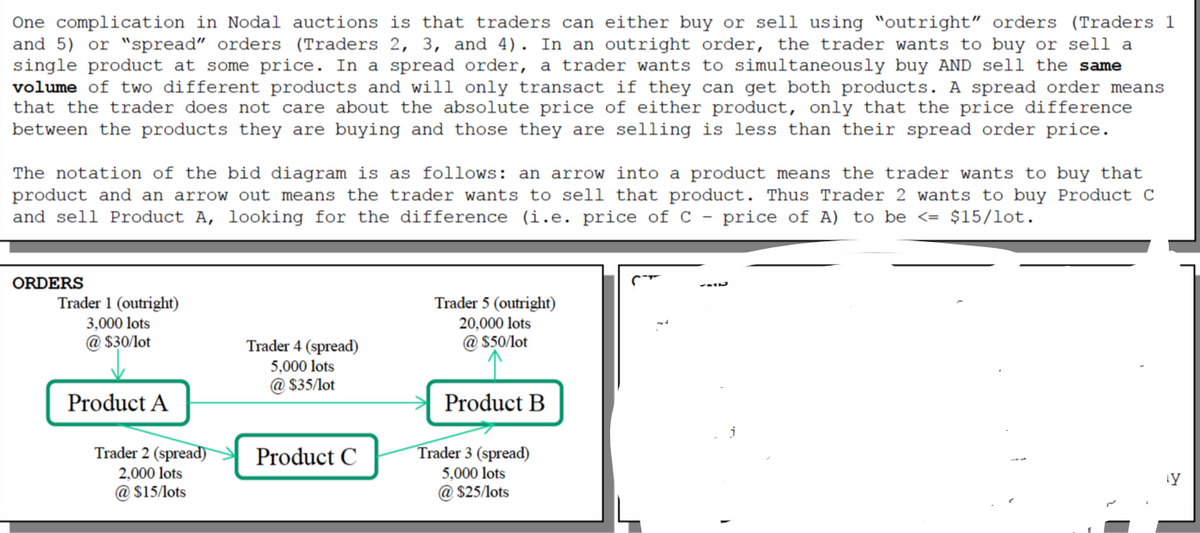

Transcribed Image Text:One complication in Nodal auctions is that traders can either buy or sell using "outright" orders (Traders 1

and 5) or "spread" orders (Traders 2, 3, and 4). In an outright order, the trader wants to buy or sell a

single product at some price. In a spread order, a trader wants to simultaneously buy AND sell the same

volume of two different products and will only transact if they can get both products. A spread order means

that the trader does not care about the absolute price of either product, only that the price difference

between the products they are buying and those they are selling is less than their spread order price.

The notation of the bid diagram is as follows: an arrow into a product means the trader wants to buy that

product and an arrow out means the trader wants to sell that product. Thus Trader 2 wants to buy Product C

and sell Product A, looking for the difference (i.e. price of C - price of A) to be <= $15/lot.

ORDERS

Trader 1 (outright)

3,000 lots

Trader 5 (outright)

20,000 lots

@ $50/lot

@ $30/lot

Trader 4 (spread)

5,000 lots

@ $35/lot

Product A

Product B

Trader 2 (spread)

Product C

Trader 3 (spread)

5,000 lots

@ $25/lots

2,000 lots

@ $15/lots

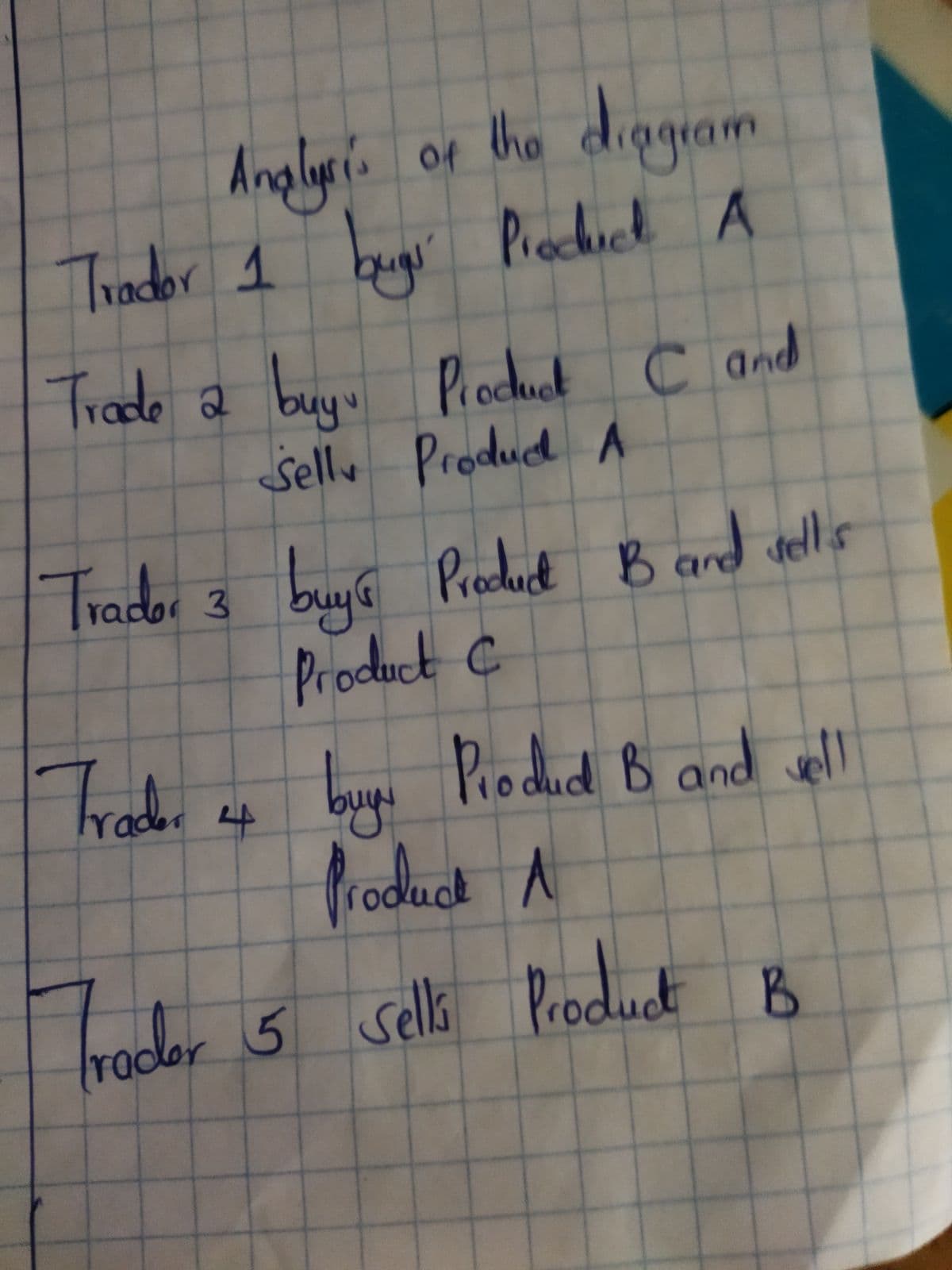

Transcribed Image Text:Anglyr's or the diggram

Thador 1 buge Piechuck A

Trado a buyu Piochuck C and

selly ProdudA

Producd

Trador 3 buye Preduct B and vello

Product C

B and del

Trado

bun Piodud B and vel

froduck A

roder 5 sello Product R

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 58 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning