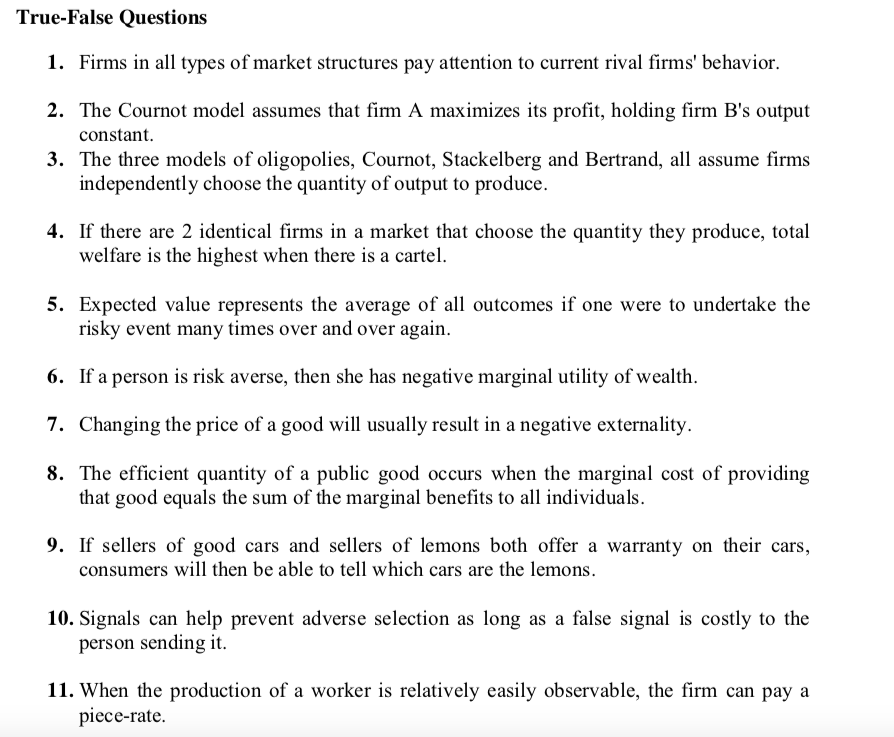

True-False Questions 1. Firms in all types of market structures pay attention to current rival firms' behavior. 2. The Cournot model assumes that firm A maximizes its profit, holding firm B's output constant. 3. The three models of oligopolies, Cournot, Stackelberg and Bertrand, all assume firms independently choose the quantity of output to produce. 4. If there are 2 identical firms in a market that choose the quantity they produce, total welfare is the highest when there is a cartel. 5. Expected value represents the average of all outcomes if one were to undertake the risky event many times over and over again. 6. If a person is risk averse, then she has negative marginal utility of wealth. 7. Changing the price of a good will usually result in a negative externality. 8. The efficient quantity of a public good occurs when the marginal cost of providing that good equals the sum of the marginal benefits to all individuals. 9. If sellers of good cars and sellers of lemons both offer a warranty on their cars, consumers will then be able to tell which cars are the lemons. 10. Signals can help prevent adverse selection as long as a false signal is costly to the person sending it. 11. When the production of a worker is relatively easily observable, the firm can pay a piece-rate.

True-False Questions 1. Firms in all types of market structures pay attention to current rival firms' behavior. 2. The Cournot model assumes that firm A maximizes its profit, holding firm B's output constant. 3. The three models of oligopolies, Cournot, Stackelberg and Bertrand, all assume firms independently choose the quantity of output to produce. 4. If there are 2 identical firms in a market that choose the quantity they produce, total welfare is the highest when there is a cartel. 5. Expected value represents the average of all outcomes if one were to undertake the risky event many times over and over again. 6. If a person is risk averse, then she has negative marginal utility of wealth. 7. Changing the price of a good will usually result in a negative externality. 8. The efficient quantity of a public good occurs when the marginal cost of providing that good equals the sum of the marginal benefits to all individuals. 9. If sellers of good cars and sellers of lemons both offer a warranty on their cars, consumers will then be able to tell which cars are the lemons. 10. Signals can help prevent adverse selection as long as a false signal is costly to the person sending it. 11. When the production of a worker is relatively easily observable, the firm can pay a piece-rate.

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter10: Monopolistic Competition And Oligopoly

Section: Chapter Questions

Problem 3SCQ: Consider the curve in the figure below, which shows the market demand. marginal cost, and marginal...

Related questions

Question

Dear tutor, please solve all the parts of the question as very clear and detailed. THANK YOU SO MUCH!!!

Transcribed Image Text:True-False Questions

1. Firms in all types of market structures pay attention to current rival firms' behavior.

2. The Cournot model assumes that firm A maximizes its profit, holding firm B's output

constant.

3. The three models of oligopolies, Cournot, Stackelberg and Bertrand, all assume firms

independently choose the quantity of output to produce.

4. If there are 2 identical firms in a market that choose the quantity they produce, total

welfare is the highest when there is a cartel.

5. Expected value represents the average of all outcomes if one were to undertake the

risky event many times over and over again.

6. If a person is risk averse, then she has negative marginal utility of wealth.

7. Changing the price of a good will usually result in a negative externality.

8. The efficient quantity of a public good occurs when the marginal cost of providing

that good equals the sum of the marginal benefits to all individuals.

9. If sellers of good cars and sellers of lemons both offer a warranty on their cars,

consumers will then be able to tell which cars are the lemons.

10. Signals can help prevent adverse selection as long as a false signal is costly to the

person sending it.

11. When the production of a worker is relatively easily observable, the firm can pay a

piece-rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning