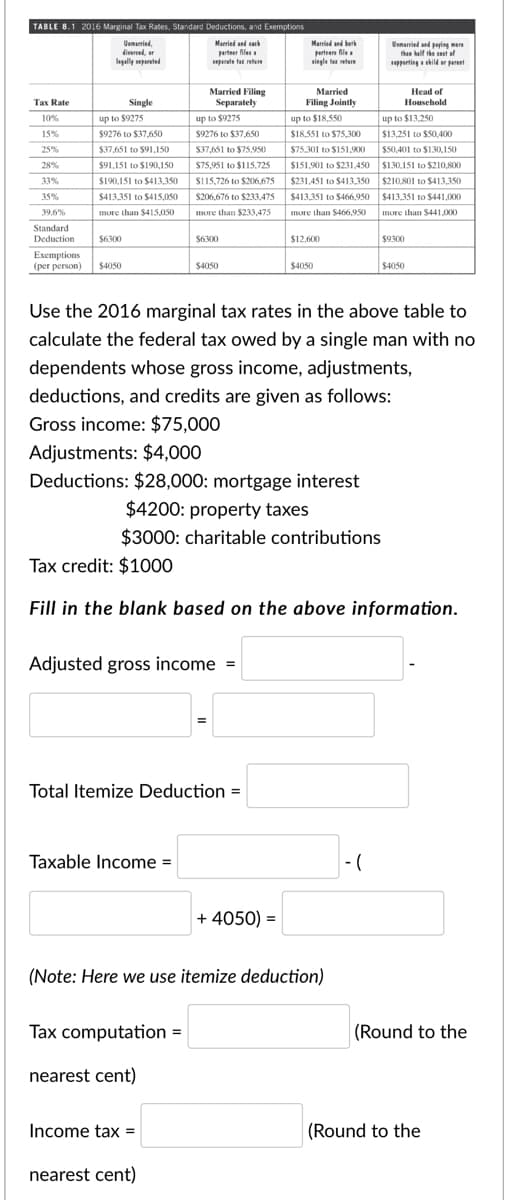

Use the 2016 marginal tax rates in the above table to calculate the federal tax owed by a single man with no dependents whose gross income, adjustments, deductions, and credits are given as follows: Gross income: $75,000 Adjustments: $4,000 Deductions: $28,000: mortgage interest

Use the 2016 marginal tax rates in the above table to calculate the federal tax owed by a single man with no dependents whose gross income, adjustments, deductions, and credits are given as follows: Gross income: $75,000 Adjustments: $4,000 Deductions: $28,000: mortgage interest

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 6DQ

Related questions

Question

100%

Transcribed Image Text:TABLE 8.1 2016 Marginal Tax Rates, Standard Deductions, and Exemptions

Uemaried,

direrced, or

legally separated

Married snd sk

parteer Ales

Married and ber

partres fle

single tar etere

Usnarried and paying mare

than half the cest l

seppertinga hil ar pareet

pate tar rete

Married Filing

Separately

Married

Head of

Tax Rate

Single

Filing Jointly

Household

10%

up to $9275

up to $9275

up to $18,550

up to $13,250

$18,551 to $75,300

$13,251 to $50,400

$50,401 to $130,150

15%

$9276 to $37,650

$9276 to $37,650

25%

$37,651 to $91,1I50

S37,651 to $75,950

$75,301 to $151.900

28%

$91,151 to $190,150

$75,951 to $115,725

$151,901 to $231,450 $130,151 to $210,S00

33%

$190,151 to $413,350

S115,726 to $206,675

$231,451 to $413,350 $210,801 to $413,350

35%

$413.351 to $415,050

$206,676 to $233,475

$413,351 to $466,950 $413,351 to $441,000

39.6%

more than $415,050

more than $233,475

more than $466,950

more than S441.000

Standard

Deduction

$6300

$6300

$12,600

$9300

Exemptions

(рer person)

$4050

$4050

$4050

$4050

Use the 2016 marginal tax rates in the above table to

calculate the federal tax owed by a single man with no

dependents whose gross income, adjustments,

deductions, and credits are given as follows:

Gross income: $75,000

Adjustments: $4,000

Deductions: $28,000: mortgage interest

$4200: property taxes

$3000: charitable contributions

Tax credit: $1000

Fill in the blank based on the above information.

Adjusted gross income =

Total Itemize Deduction =

Taxable Income =

- (

+ 4050) =

(Note: Here we use itemize deduction)

Tax computation =

(Round to the

nearest cent)

Income tax =

(Round to the

nearest cent)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning