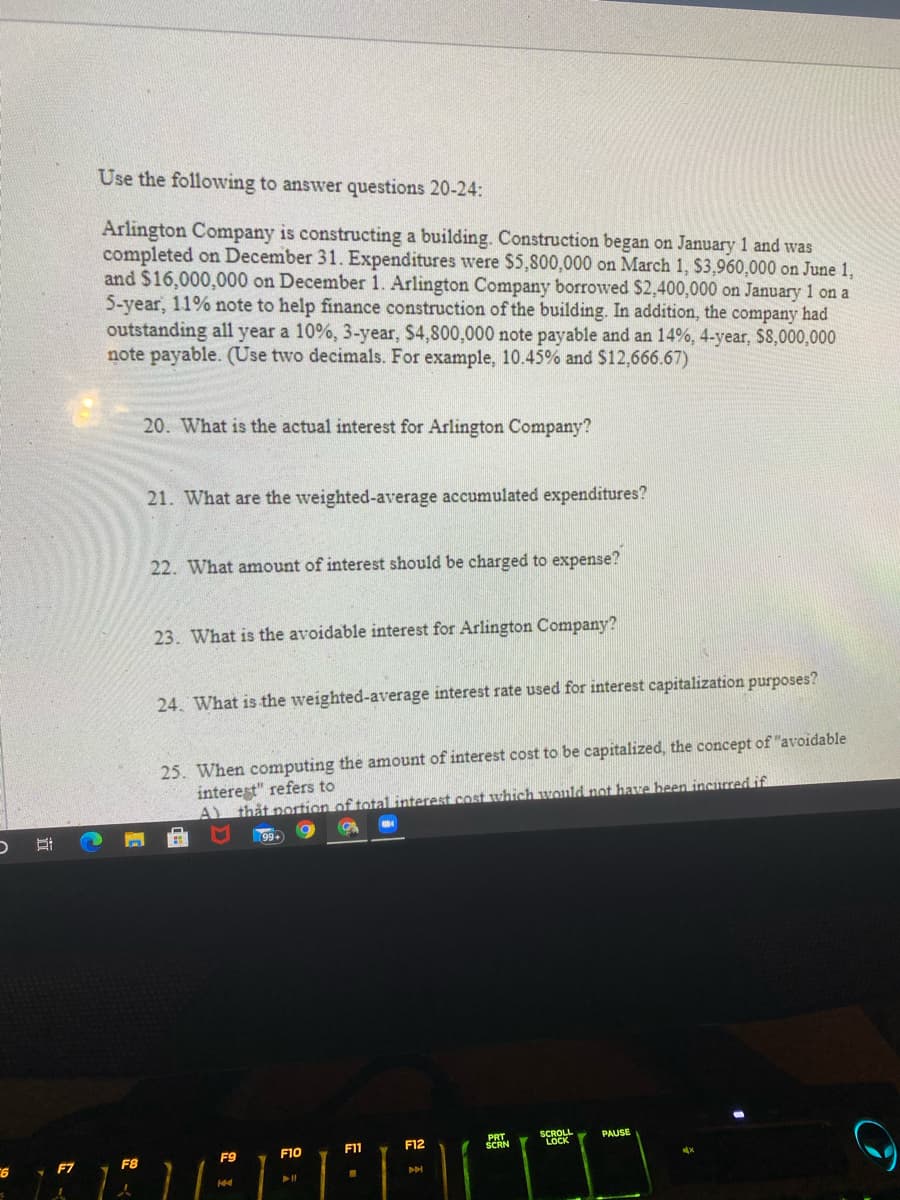

Use the following to answer questions 20-24: Arlington Company is constructing a building. Construction began on January 1 and was completed on December 31. Expenditures were $5,800,000 on March 1, $3,960,000 on June and $16,000,000 on December 1. Arlington Company borrowed S2,400,000 on January 1 on: 5-year, 11% note to help finance construction of the building. In addition, the company had outstanding all year a 10%, 3-year, $4,800,000 note payable and an 14%, 4-year, $8,000,000 note payable. (Use two decimals. For example, 10.45% and $12,666.67) 20. What is the actual interest for Arlington Company? 21. What are the weighted-average accumulated expenditures? 22. What amount of interest should be charged to expense? 23. What is the avoidable interest for Arlington Company? 24. What is the weighted-average interest rate used for interest capitalization purposes? 25. When computing the amount of interest cost to be capitalized, the concept of "avoidable interegt" refers to ortion of total interest cost which wonld not have been incured if

Use the following to answer questions 20-24: Arlington Company is constructing a building. Construction began on January 1 and was completed on December 31. Expenditures were $5,800,000 on March 1, $3,960,000 on June and $16,000,000 on December 1. Arlington Company borrowed S2,400,000 on January 1 on: 5-year, 11% note to help finance construction of the building. In addition, the company had outstanding all year a 10%, 3-year, $4,800,000 note payable and an 14%, 4-year, $8,000,000 note payable. (Use two decimals. For example, 10.45% and $12,666.67) 20. What is the actual interest for Arlington Company? 21. What are the weighted-average accumulated expenditures? 22. What amount of interest should be charged to expense? 23. What is the avoidable interest for Arlington Company? 24. What is the weighted-average interest rate used for interest capitalization purposes? 25. When computing the amount of interest cost to be capitalized, the concept of "avoidable interegt" refers to ortion of total interest cost which wonld not have been incured if

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 8RE

Related questions

Question

100%

Please answer

Transcribed Image Text:Use the following to answer questions 20-24:

Arlington Company is constructing a building. Construction began on January 1 and was

completed on December 31. Expenditures were $5,800,000 on March 1, $3,960,000 on June 1,

and $16,000,000 on December 1. Arlington Company borrowed S$2,400,000 on January 1 on a

5-year, 11% note to help finance construction of the building. In addition, the company had

outstanding all year a 10%, 3-year, $4,800,000 note payable and an 14%, 4-year, $8,000,000

note payable. (Use two decimals. For example, 10.45% and $12,666.67)

20. What is the actual interest for Arlington Company?

21. What are the weighted-average accumulated expenditures?

22. What amount of interest should be charged to expense?

23. What is the avoidable interest for Arlington Company?

24. What is the weighted-average interest rate used for interest capitalization purposes?

25. When computing the amount of interest cost to be capitalized, the concept of "avoidable

interest" refers to

A thắt portion of total interest .cost which would not have heen incured if

PRT

SCRN

SCROLL

LOCK

PAUSE

F10

F1

F12

F9

F7

F8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning