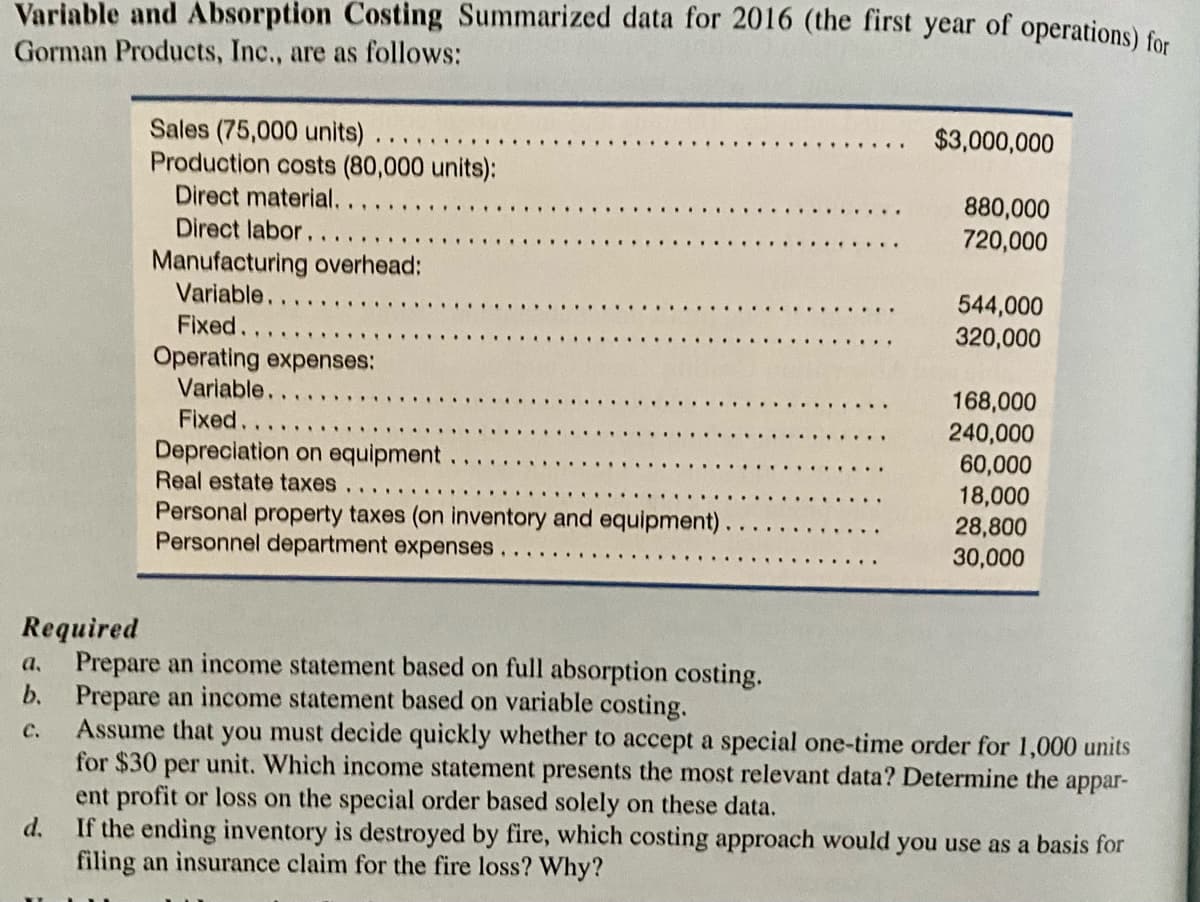

Variable and Absorption Costing Summarized data for 2016 (the first year of operations) for Gorman Products, Inc., are as follows: Sales (75,000 units). Production costs (80,000 units): Direct material... Direct labor. $3,000,000 ... 880,000 720,000 Manufacturing overhead: Variable. Fixed.. Operating expenses: Variable.. Fixed.... 544,000 320,000 168,000 240,000 60,000 18,000 28,800 30,000 Depreciation on equipment Real estate taxes Personal property taxes (on inventory and equipment) Personnel department expenses Required Prepare an income statement based on full absorption costing. b. Prepare an income statement based on variable costing. Assume that you must decide quickly whether to accept a special one-time order for 1,000 units for $30 per unit. Which income statement presents the most relevant data? Determine the appar- ent profit or loss on the special order based solely on these data. d. a, с. If the ending inventory is destroyed by fire, which costing approach would you use as a basis for filing an insurance claim for the fire loss? Why?

Variable and Absorption Costing Summarized data for 2016 (the first year of operations) for Gorman Products, Inc., are as follows: Sales (75,000 units). Production costs (80,000 units): Direct material... Direct labor. $3,000,000 ... 880,000 720,000 Manufacturing overhead: Variable. Fixed.. Operating expenses: Variable.. Fixed.... 544,000 320,000 168,000 240,000 60,000 18,000 28,800 30,000 Depreciation on equipment Real estate taxes Personal property taxes (on inventory and equipment) Personnel department expenses Required Prepare an income statement based on full absorption costing. b. Prepare an income statement based on variable costing. Assume that you must decide quickly whether to accept a special one-time order for 1,000 units for $30 per unit. Which income statement presents the most relevant data? Determine the appar- ent profit or loss on the special order based solely on these data. d. a, с. If the ending inventory is destroyed by fire, which costing approach would you use as a basis for filing an insurance claim for the fire loss? Why?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 29P: Jellison Company had the following operating data for its first two years of operations: Jellison...

Related questions

Question

Please help me figure a-d

Transcribed Image Text:Variable and Absorption Costing Summarized data for 2016 (the first year of operations) fo.

Gorman Products, Inc., are as follows:

Sales (75,000 units)...

Production costs (80,000 units):

Direct material.... .. .

$3,000,000

880,000

720,000

Direct labor.

Manufacturing overhead:

Variable..

544,000

320,000

Fixed.

Operating expenses:

Variable..

168,000

240,000

60,000

18,000

28,800

30,000

Fixed.

Depreciation on equipment

Real estate taxes

Personal property taxes (on inventory and equipment).

Personnel department expenses.

Required

Prepare an income statement based on full absorption costing.

b. Prepare an income statement based on variable costing.

Assume that you must decide quickly whether to accept a special one-time order for 1,000 units

for $30 per unit. Which income statement presents the most relevant data? Determine the appar-

ent profit or loss on the special order based solely on these data.

d.

a,

C.

If the ending inventory is destroyed by fire, which costing approach would you use as a basis for

filing an insurance claim for the fire loss? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,