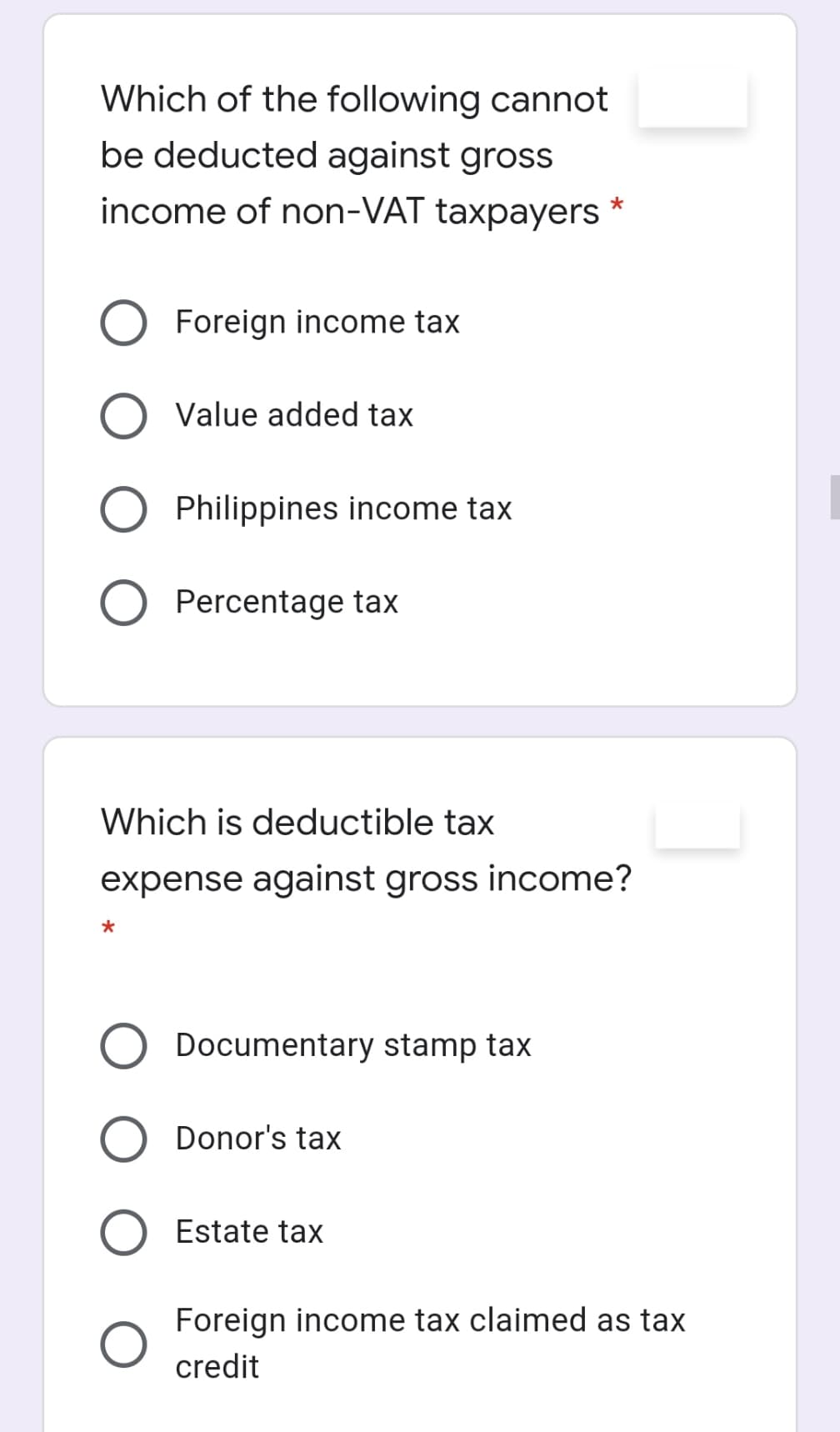

Which of the following cannot be deducted against gross income of non-VAT taxpayers Foreign income tax Value added tax Philippines income tax Percentage tax Which is deductible tax expense against gross income? Documentary stamp tax Donor's tax Estate tax Foreign income tax claimed as tax credit

Which of the following cannot be deducted against gross income of non-VAT taxpayers Foreign income tax Value added tax Philippines income tax Percentage tax Which is deductible tax expense against gross income? Documentary stamp tax Donor's tax Estate tax Foreign income tax claimed as tax credit

Chapter3: Economic Decision Makers

Section: Chapter Questions

Problem 3.11P

Related questions

Question

Transcribed Image Text:Which of the following cannot

be deducted against gross

income of non-VAT taxpayers

Foreign income tax

Value added tax

Philippines income tax

Percentage tax

Which is deductible tax

expense against gross income?

*

Documentary stamp tax

Donor's tax

Estate tax

Foreign income tax claimed as tax

credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax