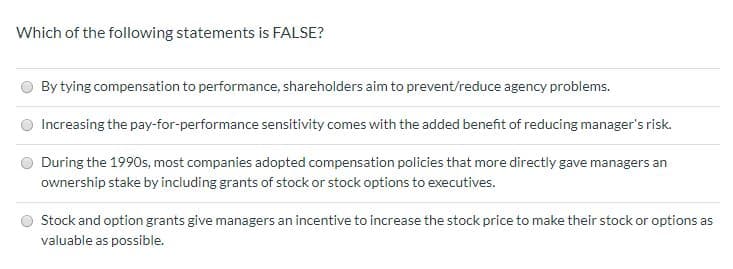

Which of the following statements is FALSE? By tying compensation to performance, shareholders aim to prevent/reduce agency problems. Increasing the pay-for-performance sensitivity comes with the added benefit of reducing manager's risk. During the 1990s, most companies adopted compensation policies that more directly gave managers an ownership stake by including grants of stock or stock options to executives. Stock and option grants give managers an incentive to increase the stock price to make their stock or options as valuable as possible.

Which of the following statements is FALSE? By tying compensation to performance, shareholders aim to prevent/reduce agency problems. Increasing the pay-for-performance sensitivity comes with the added benefit of reducing manager's risk. During the 1990s, most companies adopted compensation policies that more directly gave managers an ownership stake by including grants of stock or stock options to executives. Stock and option grants give managers an incentive to increase the stock price to make their stock or options as valuable as possible.

Chapter12: Balanced Scorecard And Other Performance Measures

Section: Chapter Questions

Problem 8MC: What should an organization do if performance measures change? A. Make sure that the manager being...

Related questions

Question

Transcribed Image Text:Which of the following statements is FALSE?

By tying compensation to performance, shareholders aim to prevent/reduce agency problems.

Increasing the pay-for-performance sensitivity comes with the added benefit of reducing manager's risk.

During the 1990s, most companies adopted compensation policies that more directly gave managers an

ownership stake by including grants of stock or stock options to executives.

Stock and option grants give managers an incentive to increase the stock price to make their stock or options as

valuable as possible.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning