Why would a bank prefer making loans by borrowing funds in the fed funds market? Select one: OA. The fed funds rate is less than the interest rate on reserve balances B. The fed funds market is less regulated than bank reserves C. Banks need to maintain reserves above the Fed's required reserve ratio O D. Each of these answers is correct

Why would a bank prefer making loans by borrowing funds in the fed funds market? Select one: OA. The fed funds rate is less than the interest rate on reserve balances B. The fed funds market is less regulated than bank reserves C. Banks need to maintain reserves above the Fed's required reserve ratio O D. Each of these answers is correct

Chapter25: Money, Banking, And The Federal Reserve System

Section: Chapter Questions

Problem 24P

Related questions

Question

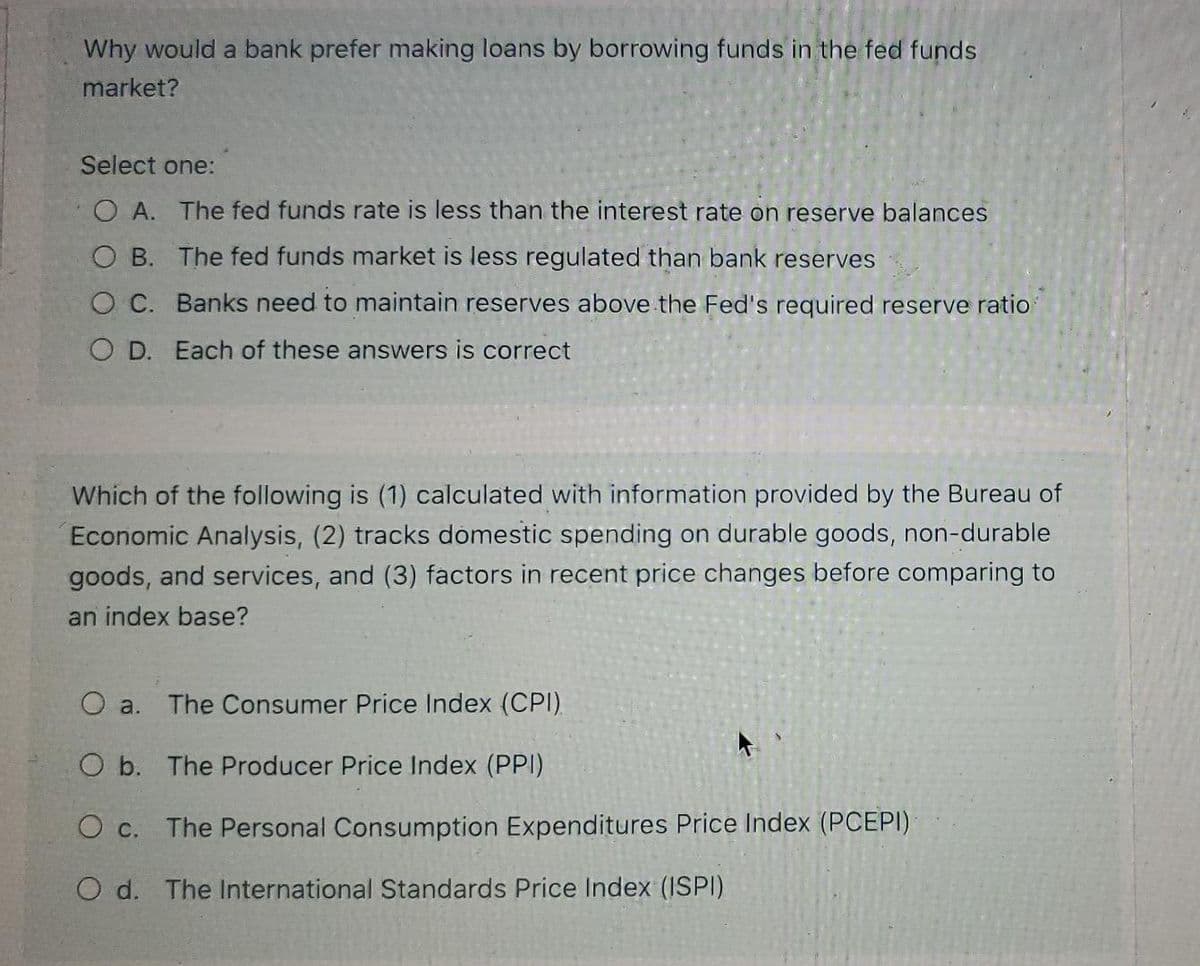

Transcribed Image Text:Why would a bank prefer making loans by borrowing funds in the fed funds

market?

Select one:

O A. The fed funds rate is less than the interest rate on reserve balances

OB. The fed funds market is less regulated than bank reserves

O C. Banks need to maintain reserves above the Fed's required reserve ratio

O D. Each of these answers is correct

Which of the following is (1) calculated with information provided by the Bureau of

Economic Analysis, (2) tracks domestic spending on durable goods, non-durable

goods, and services, and (3) factors in recent price changes before comparing to

an index base?

O a. The Consumer Price Index (CPI)

O b. The Producer Price Index (PPI)

O c. The Personal Consumption Expenditures Price Index (PCEPI)

O d. The International Standards Price Index (ISPI)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning