XYZ, Inc., produces and commercializes engines for cars. To stimulate sales, the financial manager is contemplating lengthening its credit period from the existing net 30 terms to net 35 terms. The credit analyst estimates that the new credit policy increases sales by 15 percent The financial manager asks you to analyze the impacts of the proposed credit change on the firm's value. The variable costs, as a percent of sales, equal 70%. The existing monthly credit sales is $90 million. The existing bad debt loss rate is 2% and will increase by 0.75% after lengthening the credit period. The existing credit & collection expenses equal 2.5% of sales and those under 35-day terms will be 3% of sales. The company's cost of capital is presently 1o percent. Under the new credit policy, the firm offers a 2% cash discount if they pay within one week and the percent of sales made to cash discount-takers will be 15%. 1) Calculate the NPV of one day's sales under the existing credit policy. 2) Calculate the NPV of one day's sales under the new credit policy. 3) Calculate the ANPV. Do you recommend lengthening the credit period?Why?

XYZ, Inc., produces and commercializes engines for cars. To stimulate sales, the financial manager is contemplating lengthening its credit period from the existing net 30 terms to net 35 terms. The credit analyst estimates that the new credit policy increases sales by 15 percent The financial manager asks you to analyze the impacts of the proposed credit change on the firm's value. The variable costs, as a percent of sales, equal 70%. The existing monthly credit sales is $90 million. The existing bad debt loss rate is 2% and will increase by 0.75% after lengthening the credit period. The existing credit & collection expenses equal 2.5% of sales and those under 35-day terms will be 3% of sales. The company's cost of capital is presently 1o percent. Under the new credit policy, the firm offers a 2% cash discount if they pay within one week and the percent of sales made to cash discount-takers will be 15%. 1) Calculate the NPV of one day's sales under the existing credit policy. 2) Calculate the NPV of one day's sales under the new credit policy. 3) Calculate the ANPV. Do you recommend lengthening the credit period?Why?

Chapter18: The Management Of Accounts Receivable And Inventories

Section: Chapter Questions

Problem 10P

Related questions

Question

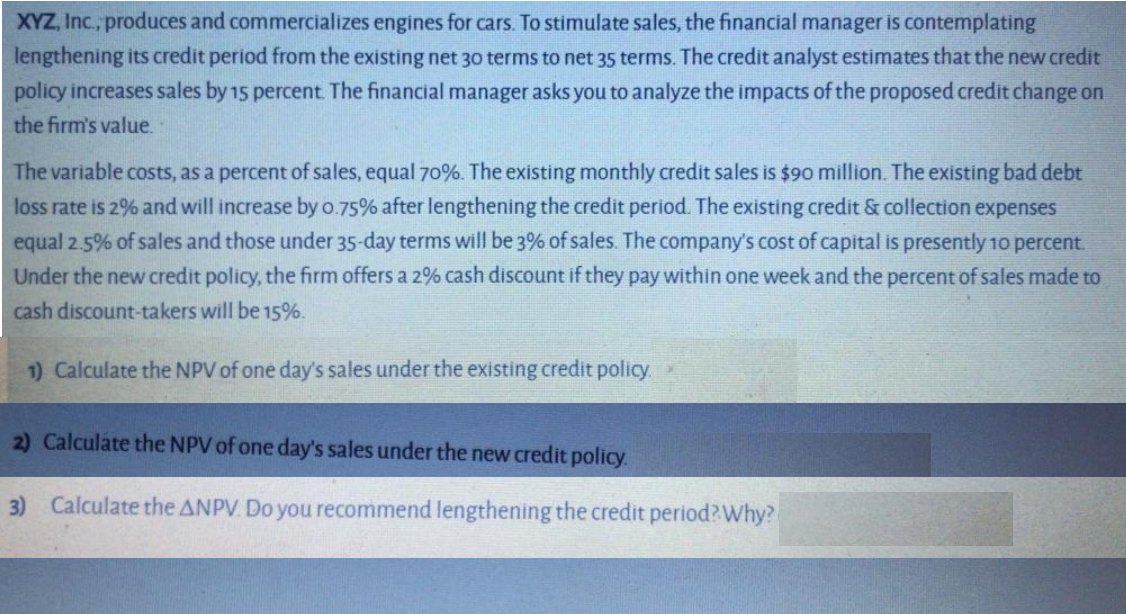

Transcribed Image Text:XYZ, Inc., produces and commercializes engines for cars. To stimulate sales, the financial manager is contemplating

lengthening its credit period from the existing net 30 terms to net 35 terms. The credit analyst estimates that the new credit

policy increases sales by 15 percent The financial manager asks you to analyze the impacts of the proposed credit change on

the firm's value.

The variable costs, as a percent of sales, equal 70%. The existing monthly credit sales is $90 million. The existing bad debt

loss rate is 2% and will increase by 0.75% after lengthening the credit period. The existing credit & collection expenses

equal 2.5% of sales and those under 35-day terms will be 3% of sales. The company's cost of capital is presently 1o percent.

Under the new credit policy, the firm offers a 2% cash discount if they pay within one week and the percent of sales made to

cash discount-takers will be 15%.

1) Calculate the NPV of one day's sales under the existing credit policy.

2) Calculate the NPV of one day's sales under the new credit policy.

3) Calculate the ANPV. Do you recommend lengthening the credit period?Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College