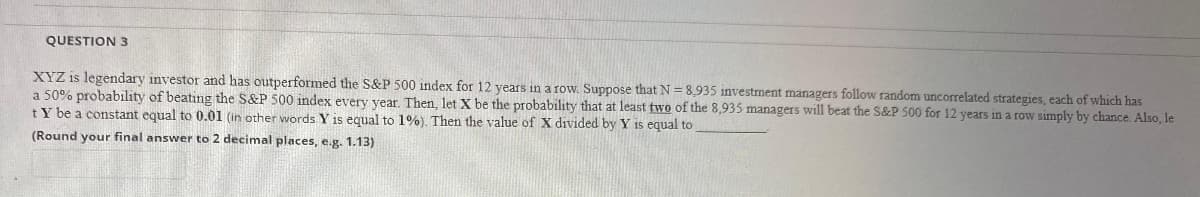

XYZ is legendary investor and has outperformed the S&P 500 index for 12 years in a row. Suppose that N = 8,935 investment managers follow random uncorrelated strategies, each of which has a 50% probability of beating the S&P 500 index every year. Then, let X be the probability that at least two of the 8,935 managers will beat the S&P 500 for 12 years in a row simply by chance. Also, le tY be a constant equal to 0.01 (in other words Y is equal to 1%). Then the value of X divided by Y is equal to (Round your final answer to 2 decimal places, e.g. 1.13)

Q: 1) When disposable income increases from $14,500 to $18,700, consumption increases from $12,300 to…

A: "Marginal propensity to consume represents the proportion of addition to the disposable income spent…

Q: Diogo has a utility function, U(q1, q2) = q1^.8q2^.2, where q1 is chocolate candy and q2 is slices…

A: In economics, utility function is an important concept that measures preferences over a set of goods…

Q: Briefly discuss some ways the government could ensure a market with a positive externality could…

A: Economists define a “socially optimal solution” as “the optimal distribution of resources in…

Q: The figure shown reflects the presence of Social Cost Private Cost P. Demand Quantity positive…

A: Externality refers to cost or benefit which occurs from production and falls on the third party who…

Q: What policies will a Neoclassical Economist tell the government to enact in order to foster a…

A: According to Neoclassical economists, economic growth is highly dependent on the supply side. This…

Q: A monopolist firm faces a demand with constant elasticity of -2.0. It has a constant marginal cost…

A: Given the elasticity = -2 MC = 20 dollars

Q: Outline the extent of international business and the world economic outlook for trade.

A: Meaning of Macroeconomics: The term macroeconomics refers to the situation of economic and…

Q: Q1) Would you expect the short-run marginal propensity to consume to be different between farmers…

A: We know that the formula of Marginal Propensity to Consume (MPC) is as follows:- Change in…

Q: Consider the short run and the long run and then choose the statement that is correct. A. The…

A: The money supply is a term you may or may not be familiar with. This refers to all of the liquid…

Q: Which of the following is not considered a characteristic of money? Question 3 options: It is a…

A: Money is used as a medium of exchange, store of value, unit of account and standard of deferred…

Q: An oligopoly is a market structure in which there are Question 6 options: many sellers selling a…

A: There are four types of market structures, perfect competition, monopoly, monopolistic competition…

Q: A company has issued a 20 year bonds, with a face value of $50,000. Interest at 8% is paid…

A: The information given as:- A company has issued a 20 year bonds, with a face value of $50,000.…

Q: rock paper scissors rock 0. -3 1 раper 0. -1 scissors -1 (a) Show that xT= ( ) and yT= ( ) together…

A: Game xT=13,13,13 yT=13,13,13

Q: Prospect Y = ($7, 0.25 ; $17, 0.75) If Will's utility of wealth function is given by u (x) = a0.25,…

A:

Q: 5. Some argue that practice variations exist because information on practice style is disseminated…

A: A policy is a plan of action with specific goals in mind to influence or manage the economic…

Q: What is the importance of exports to the U.S. economy?

A: Export and import of goods and services are two most important components of International trade.…

Q: Calculate your income demand elasticity of demand as your income increases from $10,000 to $12,000…

A: Income elasticity of Demand (I.Ed) = %change in quantity demanded%change in Income Given that: I1 =…

Q: 3. What are the effects of the following events on the monetary base? i. The Treasury writes checks…

A: The monetary base is defined as currency in circulation along with bank reserves.

Q: Variable cost Quantity (number of cups) (taka) Rahim operates a small tea stall in his neighborhood…

A: (a) Total cost is sum of variable cost and fixed cost. => Total cost = variable cost + fixed…

Q: Kermit is setting up an education fund for his nephew Robin, who will be attending college 18 years…

A: After 18yeara the Robin will be attending tye College so the total cost of college for 4years and…

Q: The diagram below shows a natural monopoly. If the firm is unregulated, how much deadweight loss…

A: Note:- Since we can only answer one question at a time, we'll answer the first one. Please repost…

Q: Some media scholars might consider Marshall McLuhan a technological determinist because: Select one:…

A:

Q: 1. 1pt. Mark appropriate circle for correct answer for matching term with its descriptions. Quantity…

A: The right options for each statment is as follows:-

Q: A young engineer borrowed $12,000 at 10% interest and paid $3,000 per annum for the last 4 years.…

A: Here the annual payment of $3000 for 4 year is the ordinary annuity with interest rate of 10% .…

Q: Global trade Question) Explain the Rules and regulations of the Indonesian county with their local…

A: Indonesia - a huge archipelago comprising quite 17,000 islands. The Republic of state, the world's…

Q: The table contains price and quantity information for two vehicle models produced by Ford Motor…

A: Gross domestic product is all goods and services produced by an economy over an accounting year. The…

Q: Refer to the figure. The section of the demand curve labeled "A" represents Price Quantity the…

A: Demand curve shows different combinations of price and quantity demanded.

Q: ifa country goes from autarky to importing a good that they have a comparative advantage in, then…

A: Answer is given below

Q: A perfectly competitive market arises when A) there are few buyers and many sellers. B) each of the…

A: One of the Main characteristics of perfectly competitive market is that

Q: The figure below illustrates the impact of an export subsidy as imposed by a large country. No…

A: When a large country implements export subsidies, then it increases the domestic price for consumers…

Q: Determine the mixed strategy equilibrium for the following game Firm 1 Firm 2 Introduce Not to…

A:

Q: 1) Consider the long-run production of shirts. The cost of the indivisible inputs used in the…

A: When all inputs are considered variable and production scale is flexible, the long-run average total…

Q: 1. Restructuring a. is the change in the structure of output. b. substitution of machinery for…

A: Restructuring is a sort of corporate activity that entails dramatically altering a company's debt,…

Q: Consider two economies, A and B. Economy A has a marginal propensity to consume of 0.9, a net tax…

A: In economics, the marginal propensity to consume (MPC) is defined as the proportion of an aggregate…

Q: fa perfectly competitive firm finds that the price exceeds its ATC, then the firm A) is incurring an…

A: If a business is perfectly competitive, it can sell as much as it wants as long as the current…

Q: Sort each of the scenarios as to whether or not they are characteristic of price leadership. Assume…

A:

Q: Supply side economics says we should talk about "the economy" because can't explain incentives to…

A: The above question is about "Reaganomics" and the term Reaganomics states the economic policies of…

Q: Suppose a firm is planning to replace a labor intensive production process with an automated robot…

A: Given Labor-intensive production: L1= 24 workers and K1=3 machines Automated robot production: L2=…

Q: Investment Demand 12 $75 150 225 Investment ($) $50 100 150 Investment (5) AS AD, ($150) Quantity of…

A: Note: There was some mistake in the labeling of money demand and money supply curve. Above is the…

Q: We can transform the neoclassical production function to represent output per worker as a function…

A: Neoclassical growth theory refers to growth theory that explains how the confluence of driving…

Q: According to the IMF, what are the world economic growth projections for 2013 and 2014?

A: World Economic Outlook is released by IMF that projects the global economic growth rate for…

Q: B. Determine the inflation rate of Country ABC using its CPI from 2020 and 2021. Price Price 2020…

A: Here we are Assuming the base Year is 2020 Formula Used to Calculate cost of Basket basket= Cost of…

Q: If $5 is invested at 45% simple interest, its value after 13.1 years is

A: The investment amount is = $5 Simple interest = 45% Time period = 13.1 years

Q: Consider the aggregate supply-aggregate demand (AD-AS) model that we saw in class. Assume that…

A: The aggregate supply curve shows the positive relationship between the price level and the total…

Q: iii) Consider the following game Safaricom Airtel High price Medium price Low price High price…

A: Nash equilibrium is such an outcome in which neither of the players has any incentive to change…

Q: What is the present worth of 5 payments of $700 if the interest rate is 5% and the first payment…

A: Present worth means the current value of an amount of money expected in the future.

Q: g. Graphically illustrate and explain how an increase in the supply of coffee by a Third Wave Coffee…

A: The term "market equilibrium" refers to a scenario in which a commodity's demand and supply are…

Q: Widget factory Inc. in Wisconsin has the following production function: F(L,K)=2L L represents the…

A: Given production function: F(L, K) = 2L1/2 K1/2 w = $30 r = $25 P = $50 K0 = 900 (fixed) So, the…

Q: 18. The cross-price elasticity for textbooks and copies of old exams is -3.5. If the price of copies…

A: The cross elasticity of demand basically refers to an economic term that assesses how sensitive a…

Q: Problem #2 Suppose the Demand schedule of Rice was been revised during February 2021. Graph the…

A: Both the demand schedule data tables indicate the demand curve is a linear downward slopping curve.…

Step by step

Solved in 2 steps

- Suppose that there are two types of entrepreneur: skilled and unskilled. Skilled entrepreneurs have a probability p = 2/3 of success if they get the loan. Unskilled entrepreneurs have zero chance of being successful. Despite that, assume that unskilled entrepreneurs want to take up the loan, because it is cool to say you have a startup. The bank does not observe skill. The share of skilled entrepreneurs is s. Question 1: 1A). TRUE OR FALSE: If L = 2, R = 6, and s = 0.5, then the bank would have zero expected profits, but entrepreneurs would never take up the loan. 1B. ) TRUE OR FALSE: If the loan amount is L = 2, the payback amount is R = 3, and the share of skilled entrepreneurs is s = 0.9, then the bank will have positive expected profits.You are considering a $500,000 investment in the fast-food industry and have narrowed your choice to either a McDonald’s or a Penn Station East Coast Subs franchise. McDonald’s indicates that, based on the location where you are proposing to open a new restaurant, there is a 25 percent probability that aggregate 10-year profits (net of the initial investment) will be $16 million, a 50 percent probability that profits will be $8 million, and a 25 percent probability that profits will be −$1.6 million. The aggregate 10-year profit projections (net of the initial investment) for a Penn Station East Coast Subs franchise is $48 million with a 2.5 percent probability, $8 million with a 95 percent probability, and −$48 million with a 2.5 percent probability. Considering both the risk and expected profitability of these two investment opportunities, which is the better investment? Explain carefully.2. Kier, in The scenario, wants to determine how each of the 3 companies will decide on possible new investments. He was able to determine the new investment pay off for each of the three choices as well as the probability of the two types of market. If a company will launch product 1, it will gain 50,000 if the market is successful and lose 50,000 if the market is a failure. If a company will launch product 2, it will gain 25,000 if the market is successful and lose 25,000 if the market will fail. If a company decides not to launch any of the product, it will not be affected whether the market will succeed or fail. There is a 56% probability that the market will succeed and 44% probability that the market will fail. What will be the companies decision based on EMV? What is the decision of each company based on expected utility value?

- Consider the constant relative risk aversion utility of wealth function from Chapter 3 for an investor with gamma parameter equal to 0.25: U(W) = W^(0.25)/(0.25) = 4W^(0.25). Suppose this investor is faced with a 50-50 bet to receive nothing or to receive 1000 dollars. What's a fair price for this bet to the investor? I.e., what is the certainty equivalent wealth (CEW) associated with this bet, for this investorTrue/False a. Consider a strategic game, in which player i has two actions, a and b. Let s−i be some strategy profile of her opponents. If a IS a best response to s−i, then b is NOT a best response to s−i. b. Consider the same game in (a). If a IS NOT a best response to s−i, then a does NOT weakly dominates b. c. Consider the same game in (a). If a mixed strategy of i that assigns probabilities 13 and 23 to a and b, respectively, IS a best response to s−i, SO IS a mixed strategy that assigns probabilities 32 and 13 to a and b, respectively. d. Consider the same game in (a). If a mixed strategy of i that assigns probabilities 13 and 23 to a and b, respectively, is NOT a best response to some strategy profile of her opponents, s−i, NEITHER is a mixed strategy that assigns probabilities 32 and 13 to a and b, respectively. e. Consider the same game in (a). If a IS a best response to s−i, SO IS any mixed strategy that assigns positive probability to a. f. Consider the same game in (a). If a…Exercise 3: Risky Investment Charlie has von Neumann-Morgenstern utility function u(x) = ln x and has wealth W = 250, 000. She is offered the opportunity to purchase a risky project for price P = 160, 000. 1 1 With probability p = 2 the project will be a success and return V > 160, 000. With probability 1 −p = 2 the project will fail and be worthless (i.e. it returns 0). For simplicity assume there is no interest between the time of the investment and the time of its return, that is r = 0 . How large must V be in order for Charlie to want to purchase the risky project? [Hint: What is Charlie’s expected utility is she does not purchase the project? What is Charlie’s expected utility is she purchases the project?]

- Apple and Google are interested in hiring a new CEO. Both firms have the same set of final candidates for the CEO position: Indra, Cao, and Virginia. Both firms need to decide who to make a job offer to, and the hiring process is such that they each only make one job offer.If, say, Apple makes a job offer to Indra and Google makes a job offer to one of the other candidates, then Apple’s probability of success in hiring Indra is pIndra. The same is true for Google. If they both make a job offer to Indra, each has probability pIndra/2 of success. It has been estimated that pIndra = 20%, and pCao = pVirginia = 30% (Note that these probabilities need not add up to 100%).Suppose that both Apple and Google attach a valuation of 10 to successfully hiring Indra, and a valuation of 7 to successfully hiring each of the other candidates. A hiring attempt, if unsuccessful, has a valuation of zero. (a) Convert this story into a game by completing the following game table;GoogleIndra Cao…Apple and Google are interested in hiring a new CEO. Both firms have the same set of final candidates for the CEO position: Indra, Cao, and Virginia. Both firms need to decide who to make a job offer to, and the hiring process is such that they each only make one job offer. If, say, Apple makes a job offer to Indra and Google makes a job offer to one of the other candidates, then Apple’s probability of success in hiring Indra is pIndra. The same is true for Google. If they both make a job offer to Indra, each has probability pIndra/2 of success. It has been estimated that pIndra = 20%, and pCao = pVirginia = 30% (Note that these probabilities need not add up to 100%). Suppose that both Apple and Google attach a valuation of 10 to successfully hiring Indra, and a valuation of 7 to successfully hiring each of the other candidates. A hiring attempt, if unsuccessful, has a valuation of zero. Convert this story into a game by completing the following game table; Google…A risk-averse expected-utility maximizer has initial wealth w0 and utility function u. She facesa risk of a financial loss of L dollars, which occurs with probability π. An insurance companyoffers to sell a policy that costs p dollars per dollar of coverage (per dollar paid back in theevent of a loss). Denote by x the number of dollars of coverage.(a) Give the formula for her expected utility V (x) as a function of x.(b) Suppose that u(z) = −e−zλ, π = 1/4, L = 100 and p = 1/3. Write V (x)using these values. There should be three variables, x, λ and w. Find the optimal value of x,as a function of λ and w, by solving the first-order condition (set the derivative of the expectedutility with respect to x equal to zero). (The second-order condition for this problem holds butyou do not need to check it.) Does the optimal amount of coverage increase or decrease in λ,where λ > 0?(c) Repeat exercise (b), but with p = 1/6.(d) You should find that for either (b) or (c), the optimal coverage…

- In any year, the weather can inflict storm damage to a home. From year to year, thedamage is random. Let Y denote the dollar value of damage in any given year.Suppose that in 95% of the years Y = 0, but in 5% of the years Y = 20,000.a. What is the mean of the damage in any year?b. What is the standard deviation of the damage in any year?c. Consider an “insurance pool” of 100 people who homes are sufficientlydispersed so that, in any year, the damage to different homes can be viewed asindependently distributed random variables. What is the probability that ?exceeds $2000?Let U(x)= x^(beta/2) denote an agent's utility function, where Beta > 0 is a parameter that defines the agent's attitude towards risk. Consider a gamble that pays a prize X = 10 with probability 0.2, a price X = 50 with probability 0.4 and a price X = 100 with probability 0.4. Compute the agentís expected utility for such gamble and find the value of Beta such that the agentis risk neutral? Suppose B= 1, what is the certainty equivalent of the gamble described above? What is the Arrow-Pratt measure of absolute risk aversion?Farmer Brown faces a 25% chance of there being a year with prolongeddrought, with zero yields and zero profit, and he faces a 75% chance of a normal year, with good yields and$100,000 profit. These probabilities are well-known. Suppose that an insurance company offered a droughtinsurance policy that pays the farmer $100,000 if a prolonged drought occurs. Assume that the farmer’sutility function is u(c) = ln(c). He has initial wealth of $40,000. What is the economic intuition on why X > Y? Confine your answer to at most three sentences.