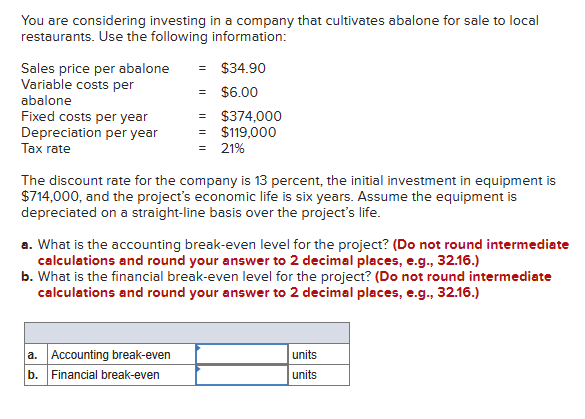

You are considering investing in a company that cultivates abalone for sale to local restaurants. Use the following information: Sales price per abalone Variable costs per abalone Fixed costs per year Depreciation per year Tax rate = $34.90 = $6.00 = $374,000 = $119,000 = 21% The discount rate for the company is 13 percent, the initial investment in equipment is $714,000, and the project's economic life is six years. Assume the equipment is depreciated on a straight-line basis over the project's life. a. What is the accounting break-even level for the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the financial break-even level for the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Accounting break-even b. Financial break-even units units

You are considering investing in a company that cultivates abalone for sale to local restaurants. Use the following information: Sales price per abalone Variable costs per abalone Fixed costs per year Depreciation per year Tax rate = $34.90 = $6.00 = $374,000 = $119,000 = 21% The discount rate for the company is 13 percent, the initial investment in equipment is $714,000, and the project's economic life is six years. Assume the equipment is depreciated on a straight-line basis over the project's life. a. What is the accounting break-even level for the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the financial break-even level for the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Accounting break-even b. Financial break-even units units

Chapter14: Capital Structure Management In Practice

Section14.A: Breakeven Analysis

Problem 8P

Related questions

Question

F1

Transcribed Image Text:You are considering investing in a company that cultivates abalone for sale to local

restaurants. Use the following information:

Sales price per abalone

Variable costs per

abalone

Fixed costs per year

Depreciation per year

Tax rate

= $34.90

= $6.00

=

$374,000

= $119,000

= 21%

The discount rate for the company is 13 percent, the initial investment in equipment is

$714,000, and the project's economic life is six years. Assume the equipment is

depreciated on a straight-line basis over the project's life.

a. What is the accounting break-even level for the project? (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

b. What is the financial break-even level for the project? (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

a. Accounting break-even

b. Financial break-even

units

units

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,