You are currently employed as an Investment Analyst at Oman Investment Agency (OIA). The Company is currently considering investing in Raysut Cement Company. Required: 1- Evaluate the Liquidity position for Raysut Cament Company using Cash-Based Ratio measures for the year 2019. Explain the company’s current liquidity position clearly with clear reference to the company’s operational environment. (The statement of financial position is attached)

You are currently employed as an Investment Analyst at Oman Investment Agency (OIA). The Company is currently considering investing in Raysut Cement Company. Required: 1- Evaluate the Liquidity position for Raysut Cament Company using Cash-Based Ratio measures for the year 2019. Explain the company’s current liquidity position clearly with clear reference to the company’s operational environment. (The statement of financial position is attached)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2P

Related questions

Question

You are currently employed as an Investment Analyst at Oman Investment Agency (OIA). The Company is currently considering investing in Raysut Cement Company.

Required:

1- Evaluate the Liquidity position for Raysut Cament Company using Cash-Based Ratio measures for the year 2019. Explain the company’s current liquidity position clearly with clear reference to the company’s operational environment. (The

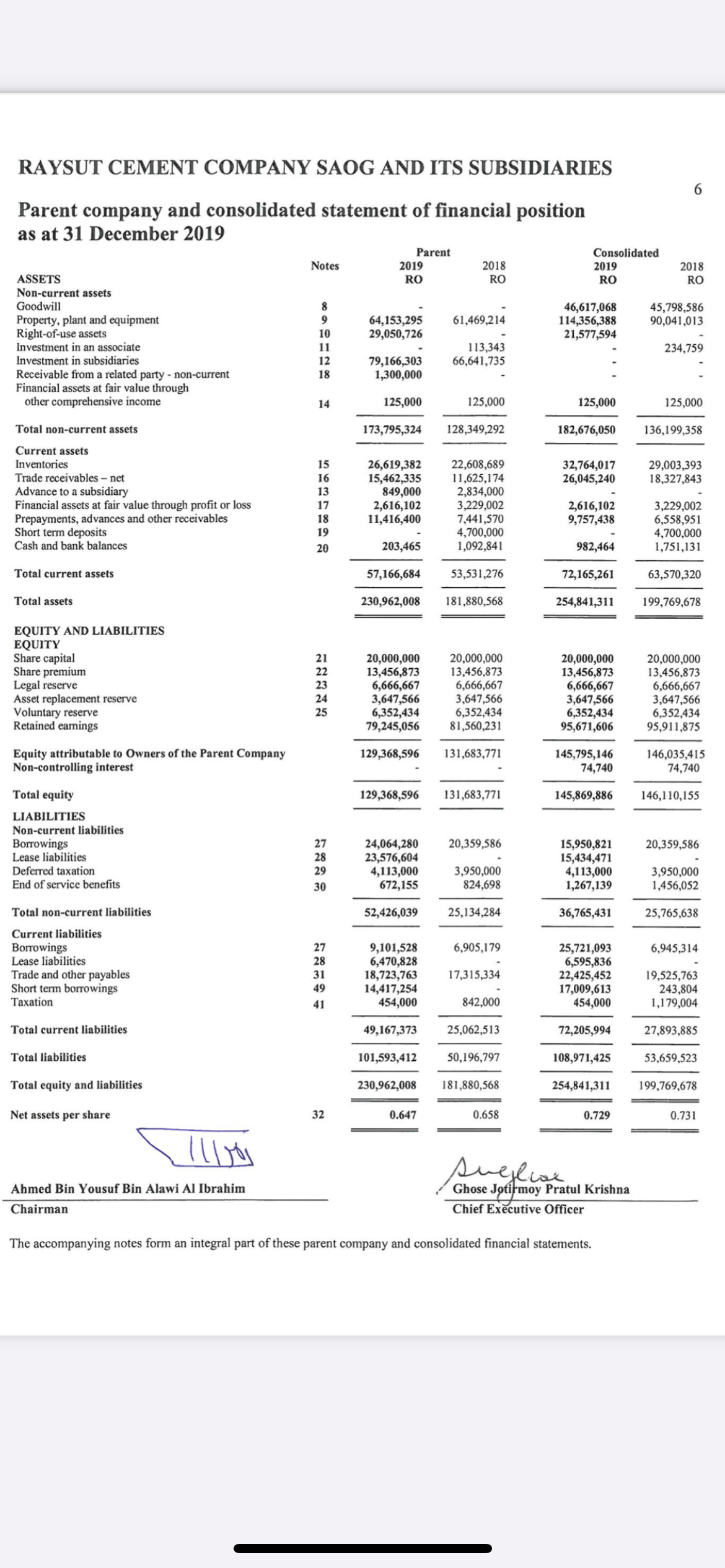

Transcribed Image Text:RAYSUT CEMENT COMPANY SAOG AND ITS SUBSIDIARIES

Parent company and consolidated statement of financial position

as at 31 December 2019

Parent

Consolidated

Notes

2019

2018

2019

2018

ASSETS

Non-current assets

RO

RO

RO

RO

Goodwill

64,153,295

29,050,726

46,617,068

114,356,388

21,577,594

45,798,586

90,041,013

Property, plant and equipment

Right-of-use assets

Investment in an associate

Investment in subsidiaries

Receivable from a related party - non-current

Financial assets at fair value through

other comprehensive income

61,469,214

10

113,343

66,641,735

11

234,759

79,166,303

1,300,000

12

18

14

125,000

125,000

125,000

125,000

Total non-current assets

173,795,324

128,349,292

182,676,050

136,199,358

Current assets

Inventories

Trade receivables – net

15

26,619,382

15,462,335

849,000

2,616,102

11,416,400

22,608,689

11,625,174

2,834,000

3,229,002

7,441,570

4,700,000

1,092,841

32,764,017

26,045,240

29,003,393

18,327,843

16

Advance to a subsidiary

Financial assets at fair value through profit or loss

Prepayments, advances and other receivables

Short term deposits

Cash and bank balances

13

17

2,616,102

9,757,438

3,229,002

6,558,951

4,700,000

1,751,131

18

19

20

203,465

982,464

Total current assets

57,166,684

53,531,276

72,165,261

63,570,320

Total assets

230,962,008

181,880,568

254,841,311

199,769,678

EQUITY AND LIABILITIES

EQUITY

Share capital

Share premium

Legal reserve

Asset replacement reserve

Voluntary reserve

Retained earnings

20,000,000

13,456,873

6,666,667

3,647,566

6,352,434

79,245,056

20,000,000

13,456,873

6,666,667

3,647,566

6,352,434

81,560,231

21

20,000,000

13,456,873

6,666,667

3,647,566

6,352,434

95,671,606

20,000,000

13,456,873

6,666,667

3,647,566

6,352,434

95,911,875

22

23

24

25

Equity attributable to Owners of the Parent Company

Non-controlling interest

129,368,596

131,683,771

145,795,146

74,740

146,035,415

74,740

Total equity

129,368,596

131,683,771

145,869,886

146,110,155

LIABILITIES

Non-current liabilities

Borrowings

Lease liabilities

27

20,359,586

24,064,280

23,576,604

4,113,000

672,155

15,950,821

15,434,471

4,113,000

1,267,139

20,359,586

28

Deferred taxation

29

3,950,000

824,698

3,950,000

1,456,052

End of service benefits

30

Total non-current liabilities

52,426,039

25,134,284

36,765,431

25,765,638

Current liabilities

Borrowings

Lease liabilities

Trade and other payables

Short term borrowings

Taxation

9,101,528

6,470,828

18,723,763

14,417,254

454,000

27

6,905,179

25,721,093

6,595,836

22,425,452

17,009,613

454,000

6,945,314

28

31

17,315,334

19,525,763

243,804

1,179,004

49

41

842,000

Total current liabilities

49,167,373

25,062,513

72,205,994

27,893,885

Total liabilities

101,593,412

50,196,797

108,971,425

53,659,523

Total equity and liabilities

230,962,008

181,880,568

254,841,311

199,769,678

Net assets per share

32

0.647

0.658

0.729

0.731

suegliae

Ghose Jøtirmoy Pratul Krishna

Chief Executive Officer

Ahmed Bin Yousuf Bin Alawi Al Ibrahim

Chairman

The accompanying notes form an integral part of these parent company and consolidated financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning