You manage a pension fund that will provide retired workers with lifetime annuities. You determine that the payouts of the fund are (approximately) level perpetuities of $1 million per year. The interest rate is 10%. You plan to fully fund the obligation using 5-year maturity and 20-year maturity zero-coupon bonds. How much market value of each of the zeros will be necessary to fund the plan if you desire an immunized position? 4 million for 5 year bond and 6 million of 20-year bond. 6 million for 5 year bond and 4 million of 20-year bond. 6.67 million for 5 year bond and 3.33 million of 20-year bond. O 3.33 million for 5 year bond and 6.67 million of 20-year bond.

You manage a pension fund that will provide retired workers with lifetime annuities. You determine that the payouts of the fund are (approximately) level perpetuities of $1 million per year. The interest rate is 10%. You plan to fully fund the obligation using 5-year maturity and 20-year maturity zero-coupon bonds. How much market value of each of the zeros will be necessary to fund the plan if you desire an immunized position? 4 million for 5 year bond and 6 million of 20-year bond. 6 million for 5 year bond and 4 million of 20-year bond. 6.67 million for 5 year bond and 3.33 million of 20-year bond. O 3.33 million for 5 year bond and 6.67 million of 20-year bond.

Chapter5: The Time Value Of Money

Section5.A: Continous Compounding And Discounting

Problem 1P

Related questions

Question

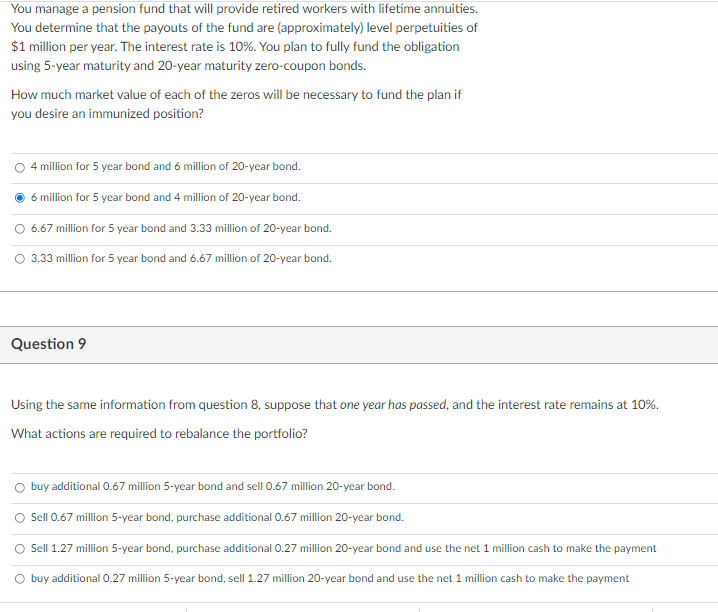

Transcribed Image Text:You manage a pension fund that will provide retired workers with lifetime annuities.

You determine that the payouts of the fund are (approximately) level perpetuities of

$1 million per year. The interest rate is 10%. You plan to fully fund the obligation

using 5-year maturity and 20-year maturity zero-coupon bonds.

How much market value of each of the zeros will be necessary to fund the plan if

you desire an immunized position?

4 million for 5 year bond and 6 million of 20-year bond.

6 million for 5 year bond and 4 million of 20-year bond.

O 6.67 million for 5 year bond and 3.33 million of 20-year bond.

O 3.33 million for 5 year bond and 6.67 million of 20-year bond.

Question 9

Using the same information from question 8, suppose that one year has passed, and the interest rate remains at 10%.

What actions are required to rebalance the portfolio?

O buy additional 0.67 million 5-year bond and sell 0.67 million 20-year bond.

Sell 0.67 million 5-year bond, purchase additional 0.67 million 20-year bond.

Sell 1.27 million 5-year bond, purchase additional 0.27 million 20-year bond and use the net 1 million cash to make the payment

O buy additional 0.27 million 5-year bond, sell 1.27 million 20-year bond and use the net 1 million cash to make the payment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT