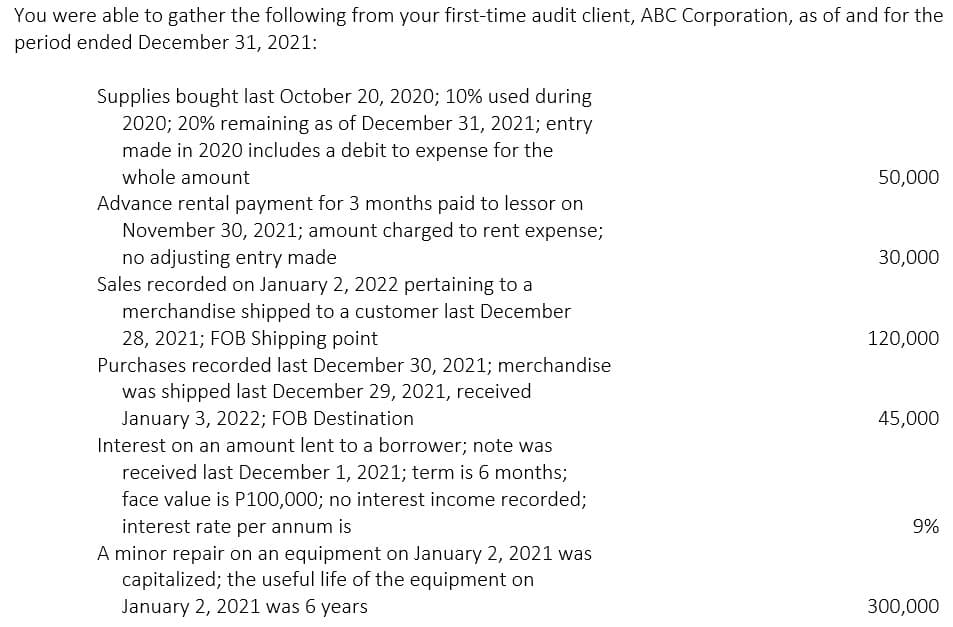

You were able to gather the following from your first-time audit client, ABC Corporation, as of and for the period ended December 31, 2021: Supplies bought last October 20, 2020; 10% used during 2020; 20% remaining as of December 31, 2021; entry made in 2020 includes a debit to expense for the whole amount 50,000 Advance rental payment for 3 months paid to lessor on November 30, 2021; amount charged to rent expense; no adjusting entry made Sales recorded on January 2, 2022 pertaining to a merchandise shipped to a customer last December 28, 2021; FOB Shipping point 30,000 120,000 Purchases recorded last December 30, 2021; merchandise was shipped last December 29, 2021, received January 3, 2022; FOB Destination Interest on an amount lent to a borrower; note was received last December 1, 2021; term is 6 months; 45,000 face value is P100,000; no interest income recorded; interest rate per annum is A minor repair on an equipment on January 2, 2021 was capitalized; the useful life of the equipment on 9% January 2, 2021 was 6 years 300,000

You were able to gather the following from your first-time audit client, ABC Corporation, as of and for the period ended December 31, 2021: Supplies bought last October 20, 2020; 10% used during 2020; 20% remaining as of December 31, 2021; entry made in 2020 includes a debit to expense for the whole amount 50,000 Advance rental payment for 3 months paid to lessor on November 30, 2021; amount charged to rent expense; no adjusting entry made Sales recorded on January 2, 2022 pertaining to a merchandise shipped to a customer last December 28, 2021; FOB Shipping point 30,000 120,000 Purchases recorded last December 30, 2021; merchandise was shipped last December 29, 2021, received January 3, 2022; FOB Destination Interest on an amount lent to a borrower; note was received last December 1, 2021; term is 6 months; 45,000 face value is P100,000; no interest income recorded; interest rate per annum is A minor repair on an equipment on January 2, 2021 was capitalized; the useful life of the equipment on 9% January 2, 2021 was 6 years 300,000

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter14: Activities Required In Completing A Quality Audit

Section: Chapter Questions

Problem 87RSCQ

Related questions

Question

Determine the net increase/decrease in net income for 2021.

Transcribed Image Text:You were able to gather the following from your first-time audit client, ABC Corporation, as of and for the

period ended December 31, 2021:

Supplies bought last October 20, 2020; 10% used during

2020; 20% remaining as of December 31, 2021; entry

made in 2020 includes a debit to expense for the

whole amount

50,000

Advance rental payment for 3 months paid to lessor on

November 30, 2021; amount charged to rent expense;

no adjusting entry made

Sales recorded on January 2, 2022 pertaining to a

30,000

merchandise shipped to a customer last December

28, 2021; FOB Shipping point

Purchases recorded last December 30, 2021; merchandise

was shipped last December 29, 2021, received

120,000

January 3, 2022; FOB Destination

Interest on an amount lent to a borrower; note was

received last December 1, 2021; term is 6 months;

45,000

face value is P100,000; no interest income recorded;

interest rate per annum is

A minor repair on an equipment on January 2, 2021 was

capitalized; the useful life of the equipment on

January 2, 2021 was 6 years

9%

300,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning