vere required to undergo accounting department a ct an audit to the followin tures last February 1, 20 ge value of P20,000 after 000 dated January 1, 20 ed February 29, 2020 wi une 30, 2020 (with comE

vere required to undergo accounting department a ct an audit to the followin tures last February 1, 20 ge value of P20,000 after 000 dated January 1, 20 ed February 29, 2020 wi une 30, 2020 (with comE

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter3: The Basics Of Record Keeping And Financial Statement Preparation: Income Statement

Section: Chapter Questions

Problem 19E

Related questions

Question

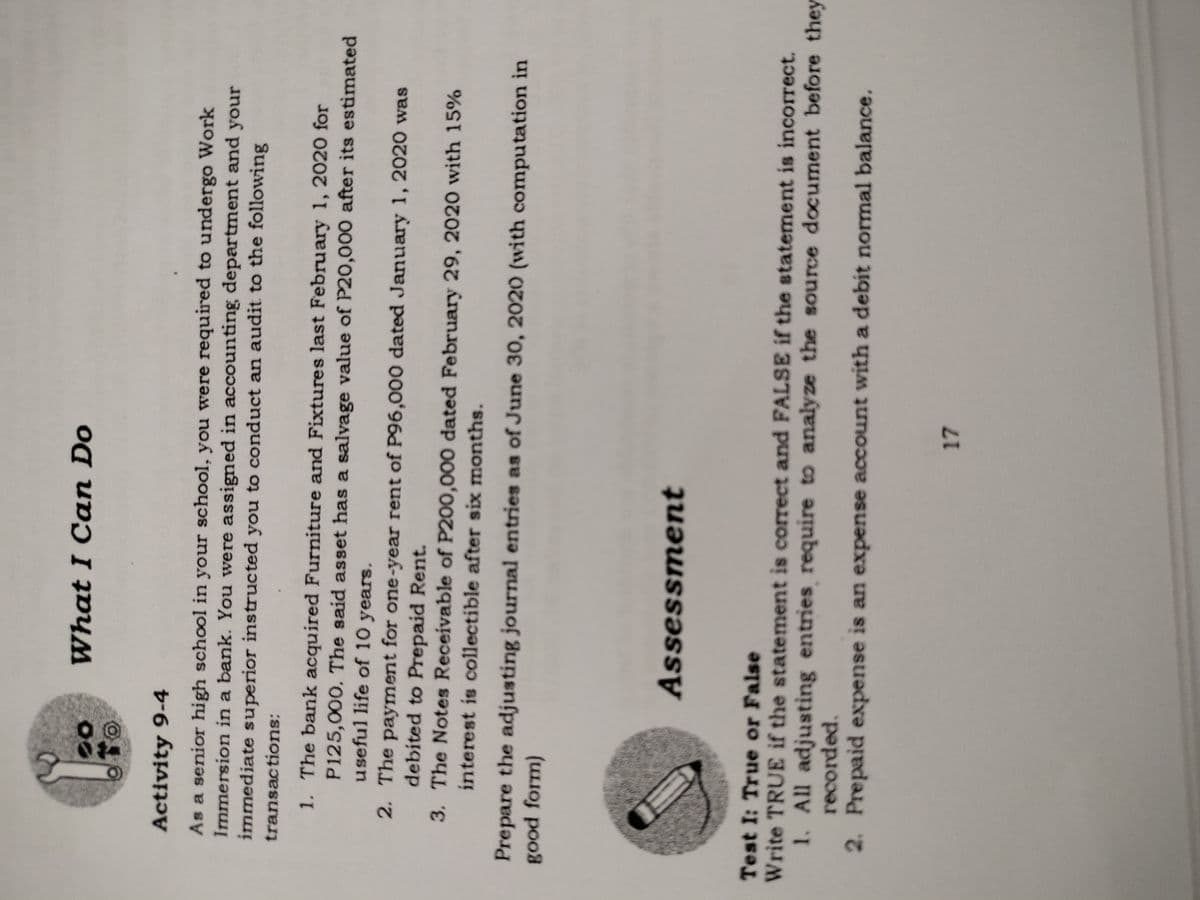

Transcribed Image Text:What I Can Do

Activity 9-4

As a senior high school in your school, you were required to undergo Work

Immersion in a bank. You were assigned in accounting department and your

immediate superior instructed you to conduct an audit to the following

transactions:

1. The bank acquired Furniture and Fixtures last February 1, 2020 for

P125,000. The said asset has a salvage value of P20,000 after its estimated

useful life of 10 years.

2. The payment for one-year rent of P96,000 dated January 1, 2020 was

debited to Prepaid Rent.

3. The Notes Receivable of P200,000 dated February 29, 2020 with 15%

interest is collectible after six months.

Prepare the adjusting journal entries as of June 30, 2020 (with computation in

good form)

Assessment

Test I: True or False

Write TRUE if the statement is corect and FALSE if the statement is incorrect.

1. All adjusting entries require to analyze the source document before they

recorded.

2. Prepaid expense is an expense account with a debit normal balance.

17

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you