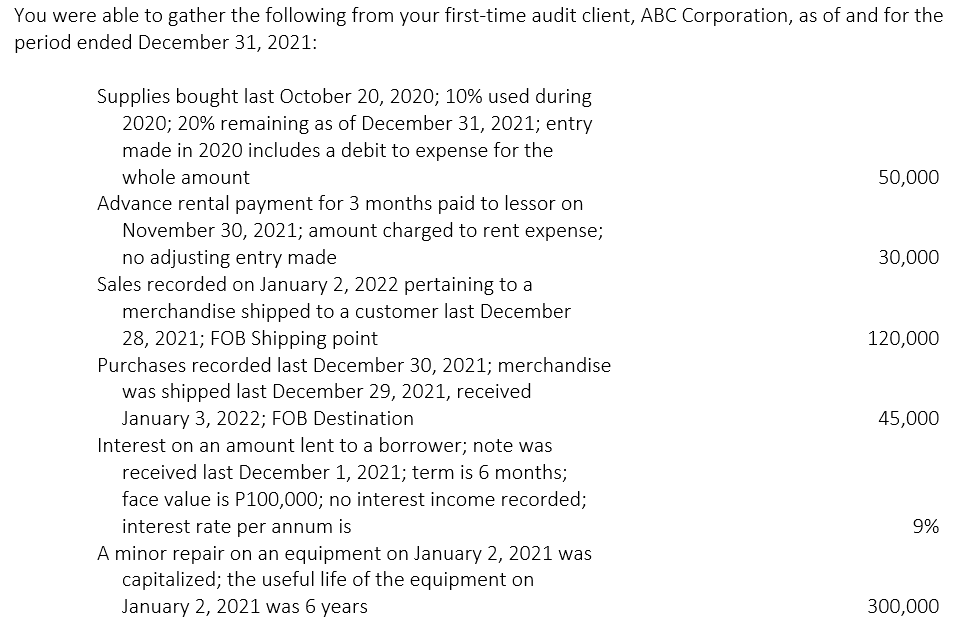

You were able to gather the following from your first-time audit client, ABC Corporation, as of and for the period ended December 31, 2021: Supplies bought last October 20, 2020; 10% used during 2020; 20% remaining as of December 31, 2021; entry made in 2020 includes a debit to expense for the whole amount 50,000 Advance rental payment for 3 months paid to lessor on November 30, 2021; amount charged to rent expense; no adjusting entry made Sales recorded on January 2, 2022 pertaining to a 30,000 merchandise shipped to a customer last December 28, 2021; FOB Shipping point 120,000 Purchases recorded last December 30, 2021; merchandise was shipped last December 29, 2021, received January 3, 2022; FOB Destination Interest on an amount lent to a borrower; note was received last December 1, 2021; term is 6 months; face value is P100,000; no interest income recorded; 45,000 9% interest rate per annum is A minor repair on an equipment on January 2, 2021 was capitalized; the useful life of the equipment on January 2, 2021 was 6 years 300,000

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

required:

1. Determine the net increase/decrease in net income for 2021.

2.Prepare a compound

for 2021, assuming that the books of 2021 are still open (do not use “income

summary” as an account title).

Trending now

This is a popular solution!

Step by step

Solved in 2 steps