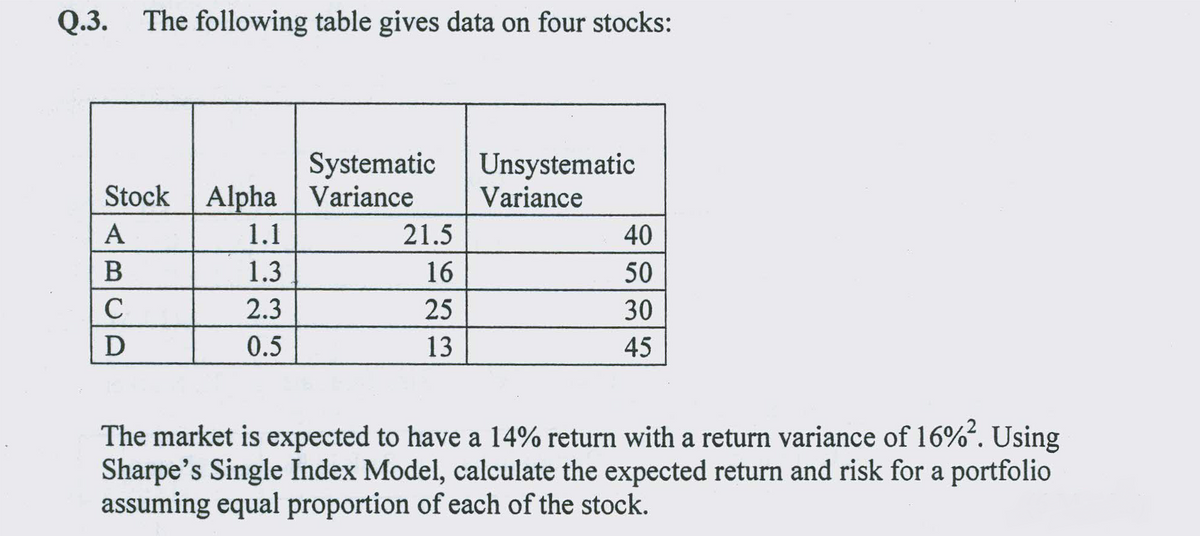

Q.3. The following table gives data on four stocks: Stock Alpha A 1.1 B 1.3 C 2.3 D 0.5 Systematic Variance 21.5 16 25 13 Unsystematic Variance 40 50 30 45 The market is expected to have a 14% return with a return variance of 16%². Using Sharpe's Single Index Model, calculate the expected return and risk for a portfolio assuming equal proportion of each of the stock.

Q.3. The following table gives data on four stocks: Stock Alpha A 1.1 B 1.3 C 2.3 D 0.5 Systematic Variance 21.5 16 25 13 Unsystematic Variance 40 50 30 45 The market is expected to have a 14% return with a return variance of 16%². Using Sharpe's Single Index Model, calculate the expected return and risk for a portfolio assuming equal proportion of each of the stock.

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:Q.3. The following table gives data on four stocks:

Systematic

Stock Alpha Variance

Unsystematic

Variance

А

1.1

21.5

40

1.3

16

50

2.3

25

30

0.5

13

45

The market is expected to have a 14% return with a return variance of 16%. Using

Sharpe's Single Index Model, calculate the expected return and risk for a portfolio

assuming equal proportion of each of the stock.

ABCA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning