Soft Bound Version for Advanced Accounting 13th Edition

13th Edition

ISBN: 9781260110579

Author: Hoyle

Publisher: McGraw Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 12P

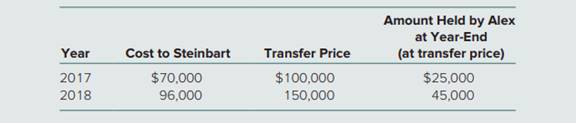

Alex, Inc., buys 40 percent of Steinbart Company on January 1, 2017, for $530,000. The equity method of accounting is to be used. Steinbart’s net assets on that date were $1.2 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart immediately begins supplying inventory to Alex as follows:

Inventory held at the end of one year by Alex is sold at the beginning of the next.

Steinbart reports net income of $80,000 in 2017 and $110,000 in 2018 and declares $30,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2018?

a. $34,050

b. $38,020

c. $46,230

d. $51,450

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Alex, Inc., buys 40 percent of Steinbart Company on January 1, 2017, for $530,000. The equity method of accounting is to be used. Steinbart’s net assets on that date were $1.2 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart immediately begins supplying inventory to Alex as follows:Inventory held at the end of one year by Alex is sold at the beginning of the next.Steinbart reports net income of $80,000 in 2017 and $110,000 in 2018 and declares $30,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2018?a. $34,050b. $38,020c. $46,230d. $51,450

Detner International purchases 80% of the outstanding stock of Hardy Company for $1,600,000 on January 1, 2015. At the purchase date, the inventory, equipment, and patents of Hardy Company have fair values of $10,000, $50,000, and $100,000, respectively, in excess of their book values. The other assets and liabilities of Hardy Company have book values equal to their fair values. The inventory is sold during the month following the purchase. The two companies agree that the equipment has a remaining life of eight years and the patents 10 years. Onthe purchase date, the owners’ equity of Hardy Company is as follows:Common stock ($10 stated value) . . . . . . . . . . . . . . . . $1,000,000Additional paid-in capital in excess of par . . . . . . . . . 300,000Retained earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . 400,000Total equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,700,000During 2015 and 2016, Hardy Company has income and pays dividends as…

RAM, Inc., acquired a 60 percent interest in LMU Company several years ago. During 2017, LMU sold inventory costing $160,000 to RAM for $200,000. A total of 18 percent of this inventory was not sold to outsiders until 2018. During 2018, LMU sold inventory costing $297,500 to RAM for $350,000. A total of 30 percent of this inventory was not sold to outsiders until 2019. In 2018, RAM reported cost of goods sold of $607,500 while LMU reported $450,000.

What consolidation entries will be made for these transactions in 2018 consolidation?

Chapter 1 Solutions

Soft Bound Version for Advanced Accounting 13th Edition

Ch. 1 - A company acquires a rather large investment in...Ch. 1 - What accounting treatments are appropriate for...Ch. 1 - Prob. 3QCh. 1 - Why does the equity method record dividends from...Ch. 1 - Prob. 5QCh. 1 - Smith. Inc., has maintained an ownership interest...Ch. 1 - Prob. 7QCh. 1 - Because of the acquisition of additional investee...Ch. 1 - Prob. 9QCh. 1 - Prob. 10Q

Ch. 1 - Prob. 11QCh. 1 - In a stock acquisition accounted for by the equity...Ch. 1 - Prob. 13QCh. 1 - What is the difference between downstream and...Ch. 1 - Prob. 15QCh. 1 - Prob. 16QCh. 1 - What is the fair-value option for reporting equity...Ch. 1 - When an investor uses the equity method to account...Ch. 1 - Which of the following does not indicate an...Ch. 1 - Prob. 3PCh. 1 - Under fair-value accounting for an equity...Ch. 1 - When an equity method investment account is...Ch. 1 - Prob. 6PCh. 1 - In January 2017, Domingo, Inc., acquired 20...Ch. 1 - Prob. 8PCh. 1 - Evan Company reports net income of 140,000 each...Ch. 1 - Perez, Inc., applies the equity method for its 25...Ch. 1 - Prob. 11PCh. 1 - Alex, Inc., buys 40 percent of Steinbart Company...Ch. 1 - Prob. 13PCh. 1 - Prob. 14PCh. 1 - Prob. 15PCh. 1 - On January 1, 2017, Alison, Inc., paid 60,000 for...Ch. 1 - Prob. 17PCh. 1 - Prob. 18PCh. 1 - Prob. 19PCh. 1 - Prob. 20PCh. 1 - Prob. 21PCh. 1 - Echo, Inc., purchased 10 percent of ProForm...Ch. 1 - Prob. 23PCh. 1 - Prob. 24PCh. 1 - Prob. 25PCh. 1 - Prob. 26PCh. 1 - Belden, Inc. acquires 30 percent of the...Ch. 1 - Prob. 28PCh. 1 - Prob. 29PCh. 1 - On July 1, 2016, Killearn Company acquired 88,000...Ch. 1 - Prob. 31PCh. 1 - On January 1, 2017, Stream Company acquired 30...Ch. 1 - EXCEL CASE 1 On January 1, 2018, Acme Co. is...Ch. 1 - Access The Coca-Cola Companys SEC 10-K filing at...Ch. 1 - Prob. 4DYSCh. 1 - Prob. 5DYS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Parkette, Inc., acquired a 60 percent interest in Skybox Company several years ago. During 2020, Skybox sold inventory costing $90,200 to Parkette for $110,000. A total of 12 percent of this inventory was not sold to outsiders until 2021. During 2021, Skybox sold inventory costing $294,800 to Parkette for $335,000. A total of 29 percent of this inventory was not sold to outsiders until 2022. In 2021, Parkette reported cost of goods sold of $527,500 while Skybox reported $422,500. What is the consolidated cost of goods sold in 2021? Multiple Choice a $605,718. b $959,282. c $635,400. d $624,282.arrow_forwardAlex, Incorporated, buys 30 percent of Steinbart Company on January 1, 2023, for $599,000. The equity method of accounting is to be used. Steinbart’s net assets on that date were $1.65 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart immediately begins supplying inventory to Alex as follows: Year Cost to Steinbart Transfer Price Amount Held by Alex at Year-End (at transfer price) 2023 $ 171,760 $ 226,000 $ 56,500 2024 118,320 174,000 53,000 The inventory held at the end of one year by Alex is sold at the beginning of the next. Steinbart reports net income of $104,500 in 2023 and $139,300 in 2024 and declares $20,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2024?arrow_forwardParkette, Inc., acquired a 60 percent interest in Skybox Company several years ago. During 2017, Skybox sold inventory costing $160,000 to Parkette for $200,000. A total of 18 percent of this inventory was not sold to outsiders until 2018. During 2018, Skybox sold inventory costing $297,500 to Parkette for $350,000. A total of 30 percent of this inventory was not sold to outsiders until 2019. In 2018, Parkette reported cost of goods sold of $607,500 while Skybox reported $450,000. What is the consolidated cost of goods sold in 2018?a. $698,950b. $720,000c. $1,066,050d. $716,050arrow_forward

- Panner, Inc., owns 30 percent of Watkins and applies the equity method. During the current year, Panner buys inventory costing $54,000 and then sells it to Watkins for $90,000. At the end of the year, Watkins still holds only $20,000 of merchandise. What amount of gross profit must Panner defer in reporting this investment using the equity method?a. $2,400b. $4,800c. $8,000d. $10,800arrow_forwardOn January 1, 2015, P Company acquired a 90% interest in S Company. During 2016, S Company sold merchandise to P Company at 25% above cost in the amount (selling price) of $203,700. At the end of the year, P Company had in its inventory one-third of the amount of goods purchased from S Company.On January 1, 2016, P Company sold equipment that had a book value of $83,600 to S Company for $118,100. The equipment had an estimated remaining life of four years.S Company reported net income of $116,100, and P Company reported net income of $293,000 from their independent operations (including sales to affiliates) for the year ended December 31, 2016.Calculate controlling interest in consolidated net income for the year ended December 31, 2016.arrow_forwardAlex, Inc., buys 40 percent of Steinbart Company on January 1, 2020, for $530,000. The equity method of accounting is to be used. Steinbart’s net assets on that date were $1.2 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart immediately begins supplying inventory to Alex as follows: Year Cost to Steinbart Transfer Price Amount Held by Alex at Year-End (at transfer price) 2020 70,000 100,00 25,000 2021 96,000 150,000 45,000 Inventory held at the end of one year by Alex is sold at the beginning of the next. Steinbart reports net income of $80,000 in 2020 and $110,000 in 2021 and declares $30,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2021? How do you get the answer and how do you get trade name price? a. $34,050 b. $38,020 c. $46,230 d. $51,450arrow_forward

- . Paulee Corporation paid $24,800 for an 80% interest in Sergio Corporation on January 1, 2013, at which time Sergio's stockholders' equity consisted of $15,000 of Common Stock and $6,000 of Retained Earnings. The fair values of Sergio Corporation's assets and liabilities were identical to recorded book values when Paulee acquired its 80% interest. Sergio Corporation reported net income of $4,000 and paid dividends of $2,000 during 2013. Paulee Corporation sold inventory items to Sergio during 2013 and 2014 as follows: 2013 2014 Paulee's sales to Sergio $5,000 $6,000 Paulee's cost of sales to Sergio 3,000 3,500 Unrealized profit at year-end 1,000 1,500 At December 31, 2014, the accounts payable of Sergio include $1,500 owed to Paulee for inventory…arrow_forwardRommel, Inc. acquired a 60% interest in Mikee Company several years ago. During 2020, Mikee sold inventory costing P75,000 to Rommel for P100,000. A total of 16% of this inventory was not sold to outsider until 2021. During 2021, Mikee sold inventory costing P96,000 to Rommel for P120,000. A total of 35% of this inventory was not sold to outsiders until 2022. In 2021, Rommel reported cost of sales of P380,000 while Mikee reported P210,000. What is the consolidated cost of sales?a. 522,400b. 474,400c. 473,400d. 594,400arrow_forwardHuge owns 25% of Small and at January 1, 2020 has a balance in its Investment in Small of $400,000. Huge has significant influence. In 2020 Huge sells inventory (cost $60,000) to Small for $80,000. At the end of 2020, 30% of the inventory remains unsold. Small sells all the remaining inventory to third parties in 2021. During 2021, Huge sells inventory (cost $80,000) to Small for $100,000, with 60% of this inventory being sold by Small to third parties in 2021. Small sells all the remaining inventory to third parties in 2022. In 2021 Small reported $90,000 of net income and paid dividends of $20,000. What is the amount of Equity Income recognized in 2021 ?arrow_forward

- Pop acquired a 60 percent interest in Son on January 1, 2016, for $360,000, when Son’s net assets had a book value and fair value of $600,000. During 2016, Pop sold inventory items that cost $600,000 to Son for $800,000, and Son’s inventory at December 31, 2016, included one-fourth of this merchandise. Pop reported separate income from its own operations (excludes investment income) of $300,000, and Son reported a net loss of $150,000 for 2016. Controlling share of consolidated net income for Pop Corporation and Subsidiary for 2016 is: $260,000 $180,000 $160,000 $100,000arrow_forwardPerke Corporation purchased 80% of the stock of Superstition Company for $1,970,000 on January 1, 2012. On this date, the fair value of the assets and liabilities of Superstition Company was equal to their book value except for the inventory and equipment accounts. The inventory had a fair value of $725,000 and a book value of $600,000. Sixty percent of Superstition Company's inventory was sold in 2012; the remainder was sold in 2013. The equipment had a book value of $900,000 and a fair value of $1,075,000. The remaining useful life of the equipment is seven years. The balances in Superstition Company's capital stock and retained earnings accounts on the date of acquisition were $1,200,000 and $600,000, respectively. Perke uses the complete equity method to account for its investment in Superstition. The following financial data are from Superstition Company's records. Net income: (2012) $750,000; (2013) $900,000 Dividends declared: (2012) $150,000; (2013) $225,000 Required: c.…arrow_forwardAlex, Inc., buys 30 percent of Steinbart Company on January 1, 2020, for $762,000. The equity method of accounting is to be used. Steinbart’s net assets on that date were $2.30 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart immediately begins supplying inventory to Alex as follows: Year Cost to Steinbart Transfer Price Amount Held by Alexat Year-End(at transfer price) 2020 $202,160 $266,000 $66,500 2021 117,990 171,000 52,000 Inventory held at the end of one year by Alex is sold at the beginning of the next. Steinbart reports net income of $95,500 in 2020 and $130,300 in 2021 and declares $30,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2021?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License