Concept explainers

Transactions; financial statements

D’Lite Dry Cleaners is owned and operated by Joel Palk. A building and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company at wholesale rates. The assets, liabilities, and common stock of the business on July 1, 2018, are as follows: Cash, $45,000; Accounts Receivable, $93,000; Supplies, $7,000; Land, $75,000; Accounts Payable, $40,000; Common Stock, $60,000. Business transactions during July are summarized as follows:

- A. Joel Palk invested additional cash in exchange for common stock with a deposit of $35,000 in the business bank account.

- B. Paid $50,000 for the purchase of land adjacent to land currently owned by D'Lite Dry Cleaners as a future building site.

C. Received cash from customers for dry cleaning revenue, $32,125.

- D. Paid rent for the month, $6,000.

- E. Purchased supplies on account, $2,500.

- F. Paid creditors on account, $22,800.

- G. Charged customers for dry cleaning revenue on account, $84,750.

- H. Received monthly invoice for dry cleaning expense for July (to be paid on August 10), $29,500.

- I. Paid the following: wages expense, $7,500; truck expense, $2,500; utilities expense, $ 1,300; miscellaneous expense, $2,700.

J. Received cash from customers on account $88,000.

K. Determined that the cost of supplies on hand was $5,900; therefore, the cost of supplies used during the month was $3,600.

L. Paid dividends, $ 12,000.

Instructions

1. Determine the amount of

2. State the assets, liabilities, and stockholders’ equity as of July 1 in equation form similar to that shown in this chapter. In tabular form below the equation, indicate increases and decreases resulting from each transaction and the new balances after each transaction.

3. Prepare an income statement for July, a retained earnings statement for July, and a balance sheet as of July 31.

4. (Optional) Prepare a statement of

a)

Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below:

Assets = Liabilities + Shareholders Equity

The retained earnings for DD Cleaners as on July 1, 2018.

Explanation of Solution

Calculate the retained earnings for DD Cleaners as on July 1, 2018.

The retained earnings, for DD Cleaners as on July 1, 2018 are $120,000.

b)

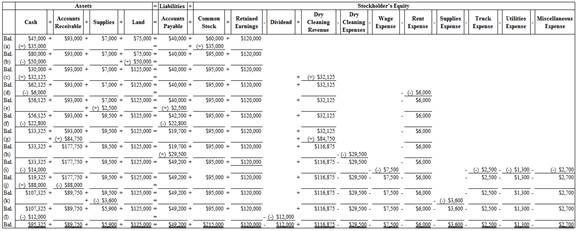

To Indicate: The effect of each given transaction of DD Cleaners on the accounting equation.

Explanation of Solution

Business transaction: Business transaction is a record of any economic activity, resulting in the change in the value of the assets, the liabilities, and the Shareholder’s equities, of a business. Business transaction is also referred to as financial transaction.

Indicate the effect of the given transactions of DD Cleaners.

(Figure – 1)

c)

To Prepare: The financial statements for DD Cleaners for the month ended July 31, 2018.

Explanation of Solution

Financial statements: Financial statements refer to those statements, which are prepared by the Company according to particular formats in accounting to show its financial position.

Financial statements include the following statements:

Income statement: Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues and vice versa.

Prepare the income statement of DD Cleaners for the month ended July 31, 2018.

| DD Cleaners | ||

| Income Statement | ||

| For the month ended July 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | ||

| Dry cleaning revenue | $116,875 | |

| Expenses | ||

| Dry Cleaning expense | $29,500 | |

| Wages expense | $7,500 | |

| Rent expense | $6,000 | |

| Supplies expense | $3,600 | |

| Truck expense | $2,500 | |

| Utilities expense | $1,300 | |

| Miscellaneous expense | $2,700 | |

| Total expenses | $53,100 | |

| Net income | $63,775 | |

Table (1)

Hence, the net income of DD Cleaners for the month ended July 31, 2018 is $63,775.

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare the statement of Retained earnings for DD Cleaners for the month ended July 31, 2018.

| DD Cleaners | ||

| Statement of Retained Earnings | ||

| For the month ended July 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, July 1, 2018 | $120,000 | |

| Net income for the year | $63,775 | |

| Deduct - Dividends | $12,000 | |

| Increase in Retained earnings | $51,775 | |

| Retained earnings, April 30, 2018 | $171,775 | |

Table (2)

Hence, the retained earnings of DD Cleaners for the month ended July 31, 2018 are $171,775.

Balance Sheet: Balance Sheet summarizes the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the balance sheet of DD Cleaners for the month ended July 31, 2018.

| DD Cleaners | ||

| Balance Sheet | ||

| July 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Current Assets | ||

| Cash | $95,325 | |

| Accounts receivable | $89,750 | |

| Supplies | $5,900 | |

| Land | $125,000 | |

| Total current assets | $315,975 | |

| Liabilities and Stockholders’ Equity | ||

| Liabilities | ||

| Accounts payable | $49,200 | |

| Owner's equity | ||

| Common Stock | $95,000 | |

| Retained earnings | $171,775 | |

| Total liabilities and stockholders’ equity | $315,975 | |

Table (3)

The balance sheet of DD Cleaners shows asset balance of $315,975 which is same as the balance of liabilities and owner's equity.

d)

To Prepare: The statement of cash flow for DD Cleaners for the month ended July 31, 2018.

Answer to Problem 1.5APR

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period.

Prepare the statement of cash flows for DD Cleaners for the month ended July 31, 2018.

| DD Cleaners | ||

| Statement of Cash Flows | ||

| For the month ended July 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Cash receipts from customers | $120,125 | |

| Cash payments for expenses (1) | $20,000 | |

| Payments to creditors | $22,800 | $42,800 |

| Net cash flow used for operating activities | $77,325 | |

| Cash flows from investing activities: | ||

| Cash payment for purchase of land | (-) $50,000 | |

| Cash flows from financing activities: | ||

| Cash receipt of owner’s investment | $35,000 | |

| Deduct - Withdrawals | (-) $12,000 | |

| Net cash flow from financing activities | $23,000 | |

| Net Increase in cash during July | $50,325 | |

| Cash Balance on July 1, 2018 | $45,000 | |

| Cash Balance on July 31, 2018 | $95,325 | |

Table (4)

The statement of cash flows for DD Cleaners for the month ended July 31, 2018, shows cash balance of $95,325 on July 31, 2018

Explanation of Solution

Working Note:

Calculate the expenses made through cash payments.

Want to see more full solutions like this?

Chapter 1 Solutions

Corporate Financial Accounting

- Income Statement and Balance Sheet Fort Worth Corporation began business in January 2016 as a commercial carpet-cleaning and drying service. Shares of stock were issued to the owners in exchange for cash. Equipment was purchased by making a down payment in cash and signing a note payable for the balance. Services are performed for local restaurants and office buildings on open account, and customers are given 15 days to pay their accounts. Rent for office and storage facilities is paid at the beginning of each month. Salaries and wages are paid at the end of the month. The following amounts are from the records of Fort Worth Corporation at the end of its first month of operations: Required Prepare an income statement for the month ended January 31, 2016. Prepare a balance sheet at January 31, 2016. What information would you need about Notes Payable to fully assess Fort Worths longterm viability? Explain your answer.arrow_forwardUsing the income statement for Adventure Travel Service shown in Practice Exercise 1-4A, prepare a statement of owners equity for the year ended April 30, 2019. Jerome Foley, the owner, invested an additional 60,000 in the business during the year and withdrew cash of 40,000 for personal use. Jerome Foley, capital as of May 1, 2018, was 1,020,000.arrow_forwardThe transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.arrow_forward

- The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.arrow_forwardThe transactions completed by PS Music during June 2018 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1. Peyton Smith made an additional investment in PS Musk in exchange for common stock by depositing 5,000 in PS Music s checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on lage 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2018. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2018. 31. Received 3,000 for serving as a disc jockey for a party. July 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 2018 (all normal balances), are as follows: 11 Cash 3,920 41 Fees Earned 6,200 12 Accounts Receivable 1,000 50 Wages Expense 400 14 Supplies 170 51 Office Rent Expense 800 15 Prepaid Insurance 52 Equipment Rent Expense 675 17 Office Equipment 53 Utilities Expense 300 21 Accounts Payable 250 54 Music Expense 1,590 23 Unearned Revenue 55 Advertising Expense 500 31 Common Stock 4,000 56 Supplies Expense 180 33 Dividends 500 59 Miscellaneous Expense 415 Instructions 1. Enter the July 1, 2018, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. {Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2018.arrow_forwardIncome Statement and Balance Sheet Green Bay Corporation began business in July 2016 as a commercial fishing operation and a passenger service between islands. Shares of stock were issued to the owners in exchange for cash. Boats were purchased by making a down payment in cash and signing a note payable for the balance. Fish are sold to local restaurants on open account, and customers are given 15 days to pay their account. Cash fares are collected for all passenger traffic. Rent for the dock facilities is paid at the beginning of each month. Salaries and wages are paid at the end of the month. The following amounts are from the records of Green Bay Corporation at the end of its first month of operations: Required Prepare an income statement for the month ended July 31, 2016. Prepare a balance sheet at July 31, 2016. What information would you need about Notes Payable to fully assess Green Bays long-term viability? Explain your answer.arrow_forward

- Transactions Interstate Delivery Service is owned and operated by Katie Wyer. The following selected transactions were completed by Interstate Delivery during May: 1. Received cash in exchange for common stock, 18,000. 2. Paid advertising expense, 4,850. 3. Purchased supplies on account, 2,100. 4. Billed customers for delivery services on account, 14,700. 5. Received cash from customers on account, 8,200. Indicate the effect of each transaction on the following accounting equation elements: Assets, Liabilities, Common Stock, Dividends, Revenue, and Expense. To illustrate, the answer to (1) follows: (1) Asset (Cash) increases by 18,000; Common Stock increases by 18,000.arrow_forwardAnalyzing Transactions. Using the analytical framework, indicate the effect of the following related transactions of a firm. a. January 1: Issued 10,000 shares of common stock for 50,000. b. January 1: Acquired a building costing 35,000, paying 5,000 in cash and borrowing the remainder from a bank. c. During the year: Acquired inventory costing 40,000 on account from various suppliers. d. During the year: Sold inventory costing 30,000 for 65,000 on account. e. During the year: Paid employees 15,000 as compensation for services rendered during the year. f. During the year: Collected 45,000 from customers related to sales on account. g. During the year: Paid merchandise suppliers 28,000 related to purchases on account. h. December 31: Recognized depreciation on the building of 7,000 for financial reporting. Depreciation expense for income tax purposes was 10,000. i. December 31: Recognized compensation for services rendered during the last week in December but not paid by year-end of 4,000. j. December 31: Recognized and paid interest on the bank loan in Part b of 2,400 for the year. k. Recognized income taxes on the net effect of the preceding transactions at an income tax rate of 40%. Assume that the firm pays cash immediately for any taxes currently due to the government.arrow_forwardJournal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.arrow_forward

- EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first month (March 20--), the following transactions occurred. Show the effect of each transaction on the accounting equation: Assets= Liabilities + Owners Equity. After each transaction, show the new account totals. (a) Invested cash in the business, 30,000. (b) Bought office equipment on account, 4,500. (c) Bought office equipment for cash, 1,600. (d) Paid cash on account to supplier in transaction (b), 2,000. EFFECTS OF TRANSACTIONS (REVENUE, EXPENSE, WITHDRAWALS) This exercise is an extension of Exercise 2-3B. Lets assume Jon Wallace completed the following additional transactions during March. Show the effect of each transaction on the basic elements of the expanded accounting equation: Assets = Liabilities + Owners Equity (Capital Drawing + Revenues Expenses). After transaction (k), report the totals for each element. Demonstrate that the accounting equation has remained in balance. (e) Performed services and received cash, 3,000. (f) Paid rent for March, 1,000. (g) Paid March phone bill, 68. (h) Jon Wallace withdrew cash for personal use, 800. (i) Performed services for clients on account, 900. (j) Paid wages to part-time employee, 500. (k) Received cash for services performed on account in transaction (i), 500.arrow_forwardThe transactions completed by PS Music during June 20Y5 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1. Peyton Smith made an additional investment in PS Music in exchange for common stock by depositing 5,000 in PS Musics checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 20Y5. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 20Y5. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 20Y5 (all normal balances), are as follows: Instructions 1. Enter the July 1, 20Y5, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 20Y5.arrow_forwardTransaction Analysis and Journal Entries Recorded Directly in T Accounts Four brothers organized Beverly Entertainment Enterprises on October 1. The following transactions occurred during the first month of operations: October 1: Received contributions of $10,000 from each of the four principal owners of the new business in exchange for shares of stock. October 2: Purchased the Ace Theater for $125,000. The seller agreed to accept a down payment of $12,500 and a seven-year promissory note for the balance. The Ace property consists of land valued at $35,000, and a building valued at $90,000. October 3: Purchased new seats for the theater at a cost of $5,000, paying $2,500 down and agreeing to pay the remainder in 60 days. October 12: Purchased candy, popcorn, cups, and napkins for $3,700 on an open account. The company has 30 days to pay for the concession supplies. October 13: Sold tickets for the opening-night movie for cash of $1,800 and took in $2,400 at the concession stand. October 17: Rented out the theater to a local community group for $1,500. The community group is to pay one-half of the bill within five working days and has 30 days to pay the remainder. October 23: Received 50% of the amount billed to the community group. October 24: Sold movie tickets for cash of $2,000 and took in $2,800 at the concession stand. October 26: The four brothers, acting on behalf of Beverly Entertainment, paid a dividend of $750 on the shares of stock owned by each of them, or $3,000 in total. October 27: Paid $500 for utilities. October 30: Paid wages and salaries of $2,400 total to the ushers, projectionist, concession stand workers, and maintenance crew. October 31: Sold movie tickets for cash of $1,800 and took in $2,500 at the concession stand. Required Prepare a table to summarize the preceding transactions as they affect the accounting equation. Use the format in Exhibit 3-1. Identify each transaction with a date. Record each transaction directly in T accounts using the dates preceding the transactions to identify them in the accounts. Each account involved in the problem needs a separate T account.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College