Chapter 11 Reorganization

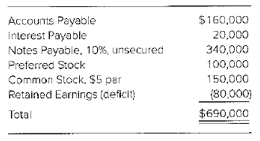

During the recent recession, Polydorous Inc. accumulated a deficit in

A plan of reorganization is filed with the court, which approves it after review and obtaining creditor and investor votes. The plan of reorganization includes the following actions:

1. The prepetition accounts payable will be restructured according to the following: (a) $40,000 will be paid in cash, (b) $20,000 will be eliminated, and (c) the remaining $100,000 will be exchanged for a five-year, secured note payable paying 12 percent interest.

2. The interest payable will be restructured as follows: elimination of $10,000 of the interest and payment of the remaining $10,000 in cash.

3. The 10 percent, unsecured notes payable will be restructured as follows: (a) $60,000 of them will be eliminated, (b) $10,000 of them will be paid in cash, (c) $240,000 of them will be exchanges for a five-year, 12 percent secured note, and (d) the remaining $30,000 will be exchanged for 3,000 shares of newly issued common stock having a par value of $10.

4. The preferred shareholder will exchange their stock for 5,000 shares of newly issued $10 par common stock.

5. The common shareholder will exchange their stock for 2,000 shares of newly issued $10 common stock.

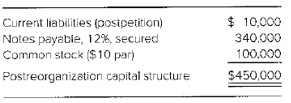

After extensive analysis, the company's reorganization value is determined to be $510,000 prior to any payments of cash required by the reorganization plan. An additional $10,000 in current liabilities have been incurred since the petition was filed. After the reorganization is completed, the capital structure of the company will be as follows:

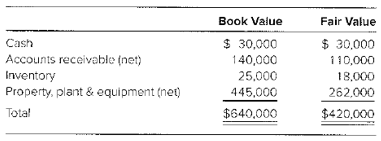

An evaluation of the assets' fair values was made after the company completed its reorganization, immediately prior to the point the company emerged from the proceedings. The following information is available:

Required

a. Prepare a plan of reorganization recovery analysis for the stockholders' equity accounts of Polydorous Inc. on the day plan of reorganization is approved. (Hint: The liabilities on the plan's approval are $530,000, which is $520,000 from prepetition payables plus $10,000 in additional accounts incurred postpetition.)

b. Prepare an analysis showing whether the company qualifies for fresh start accounting as it emerges from the reorganization.

c. Prepare

d. Prepare the balance sheet for the company on completion of the plan of reorganization.

a

Reorganization: Chapter 11 of bankruptcy involves a reorganization of a debtor’s business affairs. It allows legal protection from creditors’ during the time needed to reorganize and return to a profitable level. A company in financial distress files for bankruptcy may receive protection from creditors, the company continues to operate while it prepares a plan for reorganization.

A plan of reorganization recovery analysis for the liabilities and stockholders’ equity

Answer to Problem 20.6P

Pre-petition liabilities $520,000 and equity $700,000

Explanation of Solution

| Recovery | |||||||||

| Pre-confirmation ($) | Elimination of debt & equity ($) | Surviving debt ($) | Cash ($) | 12%Secured Notes ($) | Common% | Stock value ($) | Total($) | Recovery % | |

| Post − petition liabilities | (10,000) | (10,000) | (10,000) | 100 | |||||

| Claims/ Interest: | |||||||||

| Accounts payable | (160,000) | 20,000 | (40,000) | (100,000) | (140,000) | 88 | |||

| Interest payable | (20,000) | 10,000 | (10,000) | (10,000) | 50 | ||||

| Notes payable 10% | (340,000) | 60,000 | (10,000) | (240,000) | 30 | (30,000) | (280,000) | 82 | |

| Total | (520,000) | 90,000 | |||||||

| Preferred shareholders | (100,000) | 50,000 | 50 | (50,000) | (50,000) | ||||

| Common shareholders | (150,000) | 130,000 | 20 | (20,000) | (20,000) | ||||

| Retained earnings deficit | 80,000 | (80,000) | |||||||

| Total | (700,000) | 190,000 | (10,000) | (60,000) | (340,000) | 100% | (100,000) | (510,000) | |

b

Reorganization: Chapter 11 of bankruptcy involves a reorganization of a debtor’s business affairs. It allows legal protection from creditors’ during the time needed to reorganize and return to a profitable level. A company in financial distress files for bankruptcy may receive protection from creditors, the company continues to operate while it prepares a plan for reorganization.

The analysis showing whether the company qualifies for fresh start accounting as it emerges from the reorganization.

Answer to Problem 20.6P

The analysis shows that company qualifies for the fresh start accounting as it emerges from reorganization.

Explanation of Solution

First condition for fresh start:

| Post-petition liabilities | $10,000 |

| Liabilities deferred pursuant to chapter 11 | 520,000 |

| Total post-petition liabilities and claims | $530,000 |

| Reorganization value | (520,000) |

| Excess of liabilities over reorganization value | $20,000 |

Second condition:

Holders of existing voting shares immediately before confirmation receive 20% of voting shares of emerging entity.

Therefore, both conditions for a fresh start occur, and fresh start accounting is used to account for the company.

c

Reorganization: Chapter 11 of bankruptcy involves a reorganization of a debtor’s business affairs, it allows legal protection from creditors’ during the time needed to reorganize and return to a profitable level. A company in financial distress files for bankruptcy may receive protection from creditors, the company continues to operate while it prepares a plan for reorganization.

The entries for execution of the plan of reorganization with its general restructuring of debt and capital.

Explanation of Solution

| Particulars | Debit $ | Credit $ |

| Liabilities subjected to compromise | 520,000 | |

| Cash | 60,000 | |

| Notes payable | 340,000 | |

| Common stock | 30,000 | |

| Gain on debt discharge | 90,000 | |

| (Recognition of debt discharge) | ||

| Preferred stock | 100,000 | |

| Common stock old | 150,000 | |

| Common stock new | 70,000 | |

| Additional paid-in capital | 180,000 | |

| (Recording of exchange of stock) | ||

| Reorganization value in excess of amounts | ||

| Allocation to identifiable assets | 30,000 | |

| Gain on debt discharge | 90,000 | |

| Additional paid-in capital | 180,000 | |

| Accounts receivable | 30,000 | |

| Inventory | 7,000 | |

| Property, plant, and equipment | 183,000 | |

| Retained earnings deficit | 80,000 | |

| (Record fresh start accounting and elimination of deficit) |

Schedule to support allocation of reorganization value:

| Book value | Fair value | difference | |

| Cash | $30,000 | $30,000 | 0 |

| Accounts receivable | 140,000 | 110,000 | (30,000) |

| Inventory | 25,000 | 18,000 | (7,000) |

| Property, plant and equipment | 445,000 | 262,000 | (183,000) |

| Reorganization value in excess of amounts allocable to identifiable assets | 0 | 30,000 | 30,000 |

| Total | $640,000 | $450,000 | $(190,000) |

d

Reorganization: Chapter 11 of bankruptcy involves a reorganization of a debtor’s business affairs, it allows legal protection from creditors’ during the time needed to reorganize and return to a profitable level. A company in financial distress files for bankruptcy may receive protection from creditors, the company continues to operate while it prepares a plan for reorganization.

The balance sheet for the company on completion of the plan of reorganization.

Answer to Problem 20.6P

Balance sheet total as per balance sheet $450,000

Explanation of Solution

Note showing effect of plan of reorganization balance sheet:

| Pre-confirmation $ | Adjustments | Re-organized balance sheet $ | |||

| DebtDischarge $ | Exchange of Stock $ | FreshStart $ | |||

| Assets: | |||||

| Cash | 90,000 | (60,000) | 30,000 | ||

| Accounts receivable | 140,000 | (30,000) | 110,000 | ||

| Inventory | 25,000 | (7,000) | 18,000 | ||

| 255,000 | (60,000) | 0 | (37,000) | 158,000 | |

| Property, plant & equipment | 445,000 | (183,000) | 262,000 | ||

| Reorganization value in Excess amount allocated to identifiable assets | 30,000 | 30,000 | |||

| Total assets | 700,000 | (60,000) | 0 | (190,000) | 450,000 |

| Liabilities: | |||||

| Not subjected to compromise: | |||||

| Current liabilities | (10,000) | (10,000) | |||

| Subjected to compromise | (520,000) | 520,000 | |||

| Notes payable | (340,000) | (340,000) | |||

| Total liabilities | (530,000) | 180,000 | 0 | 0 | (350,000) |

| Shareholders’ equity | |||||

| Preferred stock | (100,000) | 100,000 | |||

| Common stock old | (150,000) | 150,000 | |||

| Common stock new | (30,000) | (70,000) | (100,000) | ||

| Additional paid-in capital | (180,000) | 180,000 | |||

| Retained earnings | 80,000 | (90,000) | 90,000 | ||

| (80,000) | 0 | ||||

| Total Liabilities and Equity | (700,000) | 60,000 | 190,000 | (450,000) | |

P Company

Balance sheet

| $ | |

| Assets: | |

| Cash | 30,000 |

| Accounts receivable | 110,000 |

| Inventory | 18,000 |

| Total current assets | 158,000 |

| Property, plant and equipment | 262,000 |

| Reorganization value | 30,000 |

| Total assets | 450,000 |

| Liabilities: | |

| Accounts payable | 10,000 |

| Notes payable | 340,000 |

| Total liabilities | 350,000 |

| Shareholders’ equity: | |

| Common stock | 100,000 |

| Total liabilities and shareholders’ equity | 450,000 |

Want to see more full solutions like this?

Chapter 20 Solutions

Advanced Financial Accounting

Additional Business Textbook Solutions

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

INTERMEDIATE ACCOUNTING

Cost Accounting (15th Edition)

Managerial Accounting: Tools for Business Decision Making

Managerial Accounting (5th Edition)

Financial Accounting (12th Edition) (What's New in Accounting)

- 4. Which statement is false concerning a Chapter 11 reorganization? a. b. C. d. The firm is allowed to remain in possession of its assets. Proceedings begin when the debtor firm files a petition with the bankruptcy court. Once confirmed, the plan of reorganization binds all parties. Creditors may agree to a longer payment period but do not settle for partial payment. a. answer a b. answer b c. answer c O d. answer darrow_forwardFinancial Difficulty: The “Going-Concern” Problem. Pitts Company has experienced significant financial difficulty. Current liabilities exceed current assets by $1 million, cash has decreased to $10,000, the interest on the long-term debt has not been paid, and a customer has brought a lawsuit against Pitts for $500,000 on a product liability claim. Significantquestions concerning the going-concern status of the company exist. The lawsuit and information about the going-concern status have been appropriately described in footnote 3 to the financial statements.Required:a. Draft AOW’s report, assuming that the auditors decide that an unmodified opinion instead of a disclaimer of opinion is appropriate in the circumstances.b. Draft AOW’s report, assuming that the auditors decide the uncertainties are so serious that they do not wish to express an opinion on Pitts’ financial statementsarrow_forwardFrankton Corporation has experienced difficult financial times for the past five years resulting in serious cash flow problems, negative earnings, and increasing deficits in retained earnings. The negative cash flows from operations have been managed in part by debt financing, particularly from a major shareholder making loans to the corporation. The level of debt financing is not sustainable and the corporation has decided to engage in a quasi-reorganization. Key elements of the reorganization are as follows: After the reorganization, retained earnings should have a zero balance. The current balance is a deficit of $300,000. Interest bearing debt in the amount of $300,000, held by the major shareholder, will be extinguished in exchange for $250,000 of consideration represented by preferred stock with a par value of $50,000. Treasurystockwithacostof$150,000wasretirednotingthatthe10,000commonsharesof $10 par value were originally sold for $13 per share. Inventory with a book…arrow_forward

- 5-92. General Motors FRAUD In March 2006, General Motors (GM) announced that it needed to restate its previous year’s financial statements. Excerpts from the Wall Street Journal describing the restatements include the following: GM, which already faces an SEC probe into its accounting practices, also disclosed that its 10-K report, when filed, will outline a series of accounting mistakes that will force the car maker to restate its earnings from 2000 to the first quarter of 2005. GM also said it was widening by $2 billion the loss it reported for 2005. Many of the other GM problems relate to rebates, or credits, from suppliers. Typically, suppliers offer an upfront payment in exchange for a promise by the customer to buy certain quantities of products over time. Under accounting rules, such rebates cannot be recorded until after the promised purchases are made. GM said it concluded it had mistakenly recorded some of these payments prematurely. The biggest impact was in 2001, when the…arrow_forwardBarber Technologies designs and develops software to be used for the management of inventory by both retailers and manufacturing firms. Over the past three years, the company has experienced significant competition and a declining market resulting in a significant deficit in retained earnings. In response to this condition, you have suggested that management consider the following: a. Recognize all asset impairments.b. Restructure the long-term debt by committing to make future payments that are less than the basis of the original debt.c. Adjust the par value of common stock to eliminate the deficit in retained earnings. Discuss how the above actions will likely affect: 1. The current ratio, debt-to-equity ratio, and return on equity. 2. The determination of net income in subsequent periods.arrow_forward(Earnings Management) Charlie Brown, controller for Kelly Corporation, is preparing the company’s income statement at year-end. He notes that the company lost a considerable sum on the sale of some equipment it had decided to replace. Since the company has sold equipment routinely in the past, Brown knows the losses cannot be reported as an unusual item. Healso does not want to highlight it as a material loss since he feels that will reflect poorly on him and the company. He reasons that if the company had recorded more depreciation during the assets’ lives, the losses would not be so great. Since depreciation is included among the company’s operating expenses, he wants to report the losses along with the company’s expenses, where he hopes it will not be noticed. Instructions(a) What are the ethical issues involved?(b) What should Brown do?arrow_forward

- 7. Obior plc operates in a high technology industry where the external environment is dynamic and uncertain. Obior plc made a loss in the reporting period just ended and is now in the process of charging its strategy completely. The finance director has indicated to the board that, in consequence, Obior plc’s financial statements for the last reporting period will lack both predictive and confirmatory value for users In terms of the IFRS Framework, Obior plc will be reporting financial information which lacks the qualitative characteristic of Faithful representation Understandability Timeliness Relevance 8. Which of the following is identified by Mintzberg as a co-ordinating mechanism which integrates organisational building blocks ? Centralisation Standardisation of work Division of work Span of workarrow_forwardCase study 1: While auditing the financial statements of Petty Corporation, the certified public accounting firm of Trueblue and Smith discovered that its client’s legal expense account was abnormally high. Further investigation of the records indicated the following: • Since the beginning of the year, several disbursements totaling $15,000 had been made to the law firm of Swindle, Fox, and Kreip. • Swindle, Fox, and Kreip were not Petty Corporation attorneys. • A review of the canceled checks showed that they had been written and approved by Mary Boghas, the cash disbursements clerk. • Boghas’s other duties included performing the end-of-month bank reconciliation. • Subsequent investigation revealed that Swindle, Fox, and Kreip are representing Mary Boghas in an unrelated embezzlement case in which she is the defendant. The checks had been written in payment of her personal legal fees. Required: a. What control procedures could Petty Corporation have employed to prevent this…arrow_forwardLong-Term Debt and Ethics You arc the CFO of Diversified Industries. Diversified has suffered through 4 or 5 tough years. This has deteriorated its financial condition to the point that Diversified is in danger of violating two loan covenants related to its largest loan, which is not due for 12 more years. The loan contract states that if Diversified violates any of these covenants, the loan principal becomes immediately due and payable. Diversified would be unable to make this payment, and any additional loans taken to repay this loan would likely be at higher rates, forcing Diversified into bankruptcy. An investment banker suggests forming another entity (called special purpose entities or SPE) and transferring some debt to this SPE. Structuring the SPE very carefully will have the effect of moving enough debt off Diversifier's balance sheet to keep the company in compliance with all its loan covenants. The investment banker assures you that accounting rules permit such accounting treatment. Required: How do you react to the investment banker?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning