Concept explainers

Extensions of the CVP Model—Multiple Products and Taxes

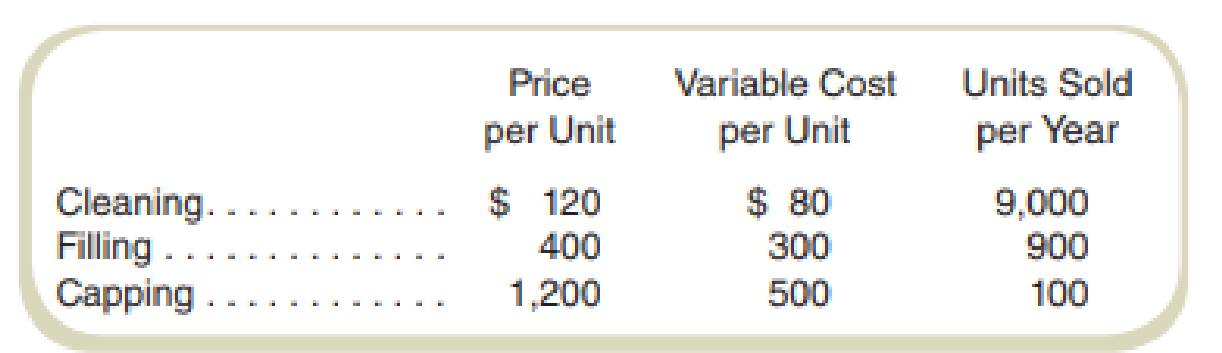

Assume that Painless Dental Clinics, Inc., offers three basic dental services. Here are its prices and costs:

Variable costs include the labor costs of the dental hygienists and dentists. Fixed costs of $400,000 per year include building and equipment costs, marketing costs, and the costs of administration. Painless Dental Clinics is subject to a 30 percent tax rate on income. A cleaning “unit” is a routine teeth cleaning that takes about 45 minutes. A filling “unit” is the work done to fill one or more cavities in one session. A capping “unit” is the work done to put a crown on one tooth. If more than one tooth is crowned in a session, then the clinic counts one unit per tooth (e.g., putting crowns on two teeth counts as two units).

Required

- a. Given the above information, how much will Painless Dental Clinics, Inc., earn each year after taxes?

- b. Assuming the above sales mix is the same at the break-even point, at what sales revenue does Painless Dental Clinics, Inc., break even?

- c. Assuming the above sales mix, at what sales revenue will the company earn $140,000 per year after taxes?

- d. Painless Dental Clinics, Inc., is considering becoming more specialized in cleanings and fillings. What would be the company’s revenues per year if the number of cleanings increased to 12,000 per year, the number of fillings increased to 1,000 per year, while the number of cappings dropped to zero? With this change in product mix, the company would increase its fixed costs to $450,000 per year. What would be the effect of this change in product mix on the clinic’s earnings after taxes per year? If the clinic’s managers seek to maximize the clinic’s after-tax earnings, would this change be a good idea?

a.

Calculate the profit after tax for Company P.

Answer to Problem 69P

Company P earns $84,000 of profit after tax.

Explanation of Solution

Operating profit: The operating profit is the excess of total revenues over total expenses after adjusting for depreciation and taxes.

Contribution margin:

| Particulars | Cleaning | Filling | Capping |

| Sales price (unit) | $120 | $400 | $1,200 |

| Less: variable cost (unit) | $80 | $300 | $500 |

| Contribution margin (unit) | $40 | $100 | $700 |

| Units sold per year | 9,000 | 900 | 100 |

| Fixed cost | $400,000 | ||

| Tax rate | 30% | ||

Table: (1)

Compute the profit after tax of Company P:

| Particulars | Amount |

| Sales revenue | |

| Cleaning | $1,080,000 |

| Filling | $360,000 |

| Capping | $120,000 |

| Total sales revenue (a) | $1,560,000 |

| Less: | |

| Variable cost | |

| Cleaning | $720,000 |

| Filling | $270,000 |

| Capping | $50,000 |

| Total variable cost (b) | $1,040,000 |

| Contribution: | $520,000 |

| Less: | |

| Fixed cost (d) | $400,000 |

| Profit before tax: | $120,000 |

| Tax rate | 30% |

| Tax (f) | $36,000 |

| Profit after tax: | $84,000 |

Table: (2)

Thus, Company P earns $84,000 of profit after tax.

b.

Calculate the sales revenue for cleaning, filling and capping at the break-even point.

Answer to Problem 69P

The sales revenue for cleaning, filling, and capping is $830,760, $276,800 and $91,200 respectively.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Compute the total sales revenue of each product:

| Particulars | Sales mix | Break-even point |

Sales Price (b) |

Total sales revenue |

| Cleaning | 90% | 6,923 | $120 | $830,760 |

| Filling | 9% | 692 | $400 | $276,800 |

| Capping | 1% | 76 | $1,200 | $91,200 |

Table: (3)

Thus, the sales revenue for cleaning, filling, and capping is $830,760, $276,800 and $91,200 respectively.

Working note 1:

Compute the break-even point:

Working note 2:

Compute the total weighted average contribution margin:

| Particulars | Sales price (a) | Variable cost (b) |

Contribution margin | Sales mix (d) |

Weighted average contribution margin |

| Cleaning | $120 | $80 | $40 | 90% | $36 |

| Filling | $400 | $300 | $100 | 9% | $9 |

| Capping | $1,200 | $500 | $700 | 1% | $7 |

| Total weighted average contribution margin | $52 | ||||

Table: (4)

c.

Calculate the dollar sales required to earn the profit after tax of $140,000.

Answer to Problem 69P

To earn the profit after tax of $140,000, Company P must make the sales revenue of $1,246,104, $415,200 and $138,000 for cleaning, filling and capping for respectively.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Compute the dollar sales required to earn the profit after tax of $140,000:

The total target volume is 11,538, so it will be distributed among the products in their sales mix ratio.

| Particulars | Sales mix |

Sales units | Sales price | Sales revenue |

| Cleaning | 90% | 10,384 | $120 | $1,246,104 |

| Filling | 9% | 1,038 | $400 | $415,200 |

| Capping | 1% | 115 | $1,200 | $138,000 |

| Total sales revenue | $1,799,304 | |||

Table: (5)

Thus, to earn the profit after tax of $140,000, Company P must make the sales revenue of $1,246,104, $415,200 and $138,000 for cleaning, filling and capping respectively.

Working note 3:

Compute the volume of sales required to earn the profit after tax of $140,000:

d.

- I. Calculate the revenue of Company P if the number of cleanings increased to 12,000 per year, the number of fillings increased to 1,000 per year, while the number of capping dropped to zero.

- II. Calculate the effect on the profit after tax if the company increases its fixed cost to $450,000 with the given product mix.

- III. Suggest that the given change is a good idea or not.

Answer to Problem 69P

- I. The revenue of Company P would be $1,840,000 if the number of cleanings increased to 12,000 per year, the number of fillings increased to 1,000 per year, while the number of capping dropped to zero.

- II. The profit after tax increases by $7,000 if the company increases its fixed cost to $450,000 with the given product mix.

- III. Yes, the change of sales mix and an increase in fixed cost is a good idea for Company P.

Explanation of Solution

I.

Compute the revenue of Company P if the number of cleanings increased to 12,000 per year, the number of fillings increased to 1,000 per year, while the number of capping dropped to zero:

| Particulars | Amount |

| Sales revenue | |

| Cleaning | $1,440,000 |

| Filling | $400,000 |

| Capping | $0 |

| Total sales revenue (a) | $1,840,000 |

Table: (6)

Thus, the revenue of Company P is $1,840,000 if the number of cleanings increased to 12,000 per year, the number of fillings increased to 1,000 per year, while the number of capping dropped to zero.

II.

Compute the effect on the profit after tax if the company increases its fixed cost to $450,000 with the given product mix:

Thus, the profit after tax increases by $7,000 if the company increases fixed cost to $450,000 with the given product mix.

Working note 4:

Compute the profit after tax of Company P:

| Particulars | Amount |

| Sales revenue | |

| Cleaning | $1,440,000 |

| Filling | $400,000 |

| Capping | $0 |

| Total sales revenue (a) | $1,840,000 |

| Less: | |

| Variable cost | |

| Cleaning | $960,000 |

| Filling | $300,000 |

| Capping | $0 |

| Total variable cost (b) | $1,260,000 |

| Contribution: | $580,000 |

| Less: | |

| Fixed cost (d) | $450,000 |

| Profit before tax: | $130,000 |

| Tax rate | 30% |

| Tax (f) | $39,000 |

| Profit after tax: | $91,000 |

Table: (7)

III.

If the clinic’s managers seek to maximize the clinic’s after-tax earnings, this is a good idea as the profit has increased by 7,000 with the change in sales mix and an increase in fixed cost.

Thus, the change in sales mix and an increase in fixed cost is a good idea for Company P.

Want to see more full solutions like this?

Chapter 3 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Brahma Industries sells vinyl replacement windows to home improvement retailers nationwide. The national sales manager believes that if they invest an additional $25,000 in advertising, they would increase sales volume by 10,000 units. Prepare a forecasted contribution margin income statement for Brahma if they incur the additional advertising costs, using this information:arrow_forwardCampbell Company manufactures and sells adjustable canopies that attach to motor homes and trailers. The market covers both new unit purchases as well as replacement canopies. Campbell developed its business plan for the year based on the assumption that canopies would sell at a price of $400 each. The variable costs for each canopy were projected at $200, and the annual fixed costs were budgeted at $100,000. Campbell’s after-tax profit objective was $243,000; the company’s effective tax rate is 40 percent. While Campbell’s sales usually rise during the second quarter, the May financial statements reported that sales were not meeting expectations. For the first five months of the year, only 350 units had been sold at the established price, with variable costs as planned, and it was clear that the after-tax profit projection for the year would not be reached unless some actions were taken. Campbell’s president assigned a management committee to analyze the situation and develop several…arrow_forwardCruse Cleaning offers residential and small office cleaning services. An average cleaning service has the following price and costs. Sales price $ 128.00 per service Variable costs 90.00 per service Fixed costs 124,982 per year Cruse Cleaning is subject to an income tax rate of 22 percent. Required: How many cleaning services must Cruse Cleaning sell in a year to break even? How many cleaning services must Cruse Cleaning sell in a year to earn an annual operating profit of $34,086 after taxes?arrow_forward

- The Windshield division of Fast Car Co. makes windshields for use in Fast Car’s Assembly division. The Windshield division incurs variable costs of $200 per windshield and has capacity to make 500,000 windshields per year. The market price is $450 per windshield. The Windshield division incurs total fixed costs of $3,000,000 per year. If the Windshield division is operating at full capacity, what transfer price should be used on transfers between the Windshield and Assembly divisions?arrow_forwardLucid Images Ltd manufactures premium high definition televisions. The firm’s fixed costs are$4,000,000 per year. The variable cost of each TV is $2,000, and the TVs are sold for $3,000 each. Thecompany sold 5,000 TVs during the previous year. (In the following requirements, ignore income taxes)Required:Treat each of the requirements as independent situations:a) Calculate the break-even point in units. b) What will the new break-even point be if fixed costs increase?c) What was the company’s net profit for the previous year? d) The sales manager believes that a reduction in the sales price to $2,500 will result in orders for1,200 more TVs each year. What will the break-even point be if the price is changed?arrow_forwardThe Windshield division of Fast Car Co. makes windshields for use in Fast Car’s Assembly division. The Windshield division incurs variable costs of $240 per windshield and has capacity to make 630,000 windshields per year. The market price is $475 per windshield. The Windshield division incurs total fixed costs of $3,050,000 per year. If the Windshield division is operating at full capacity, what transfer price should be used on transfers between the Windshield and Assembly divisions? he Windshield division of Fast Car Co. makes windshields for use in Fast Car’s Assembly division. The Windshield division incurs variable costs of $240 per windshield and has capacity to make 630,000 windshields per year. The market price is $475 per windshield. The Windshield division incurs total fixed costs of $3,050,000 per year.If the Windshield division is operating at full capacity, what transfer price should be used on transfers between the Windshield and Assembly divisions?…arrow_forward

- Quest Motors, Inc., operates as a decentralized multidivision company. The Vivo division of Quest Motors purchases most of its airbags from the airbag division. The airbag division’s incremental cost for manufacturing the airbags is $90 per unit. The airbag division is currently working at 80% of capacity. The current market price of the airbags is $125 per unit. Q. Using the general guideline presented in the chapter, what is the minimum price at which the airbag division would sell airbags to the Vivo division?arrow_forwardLetang Industrial Systems Company (LISC) is trying to decide between two different conveyor belt systems. System A costs $320,000, has a four-year life, and requires $117,000 in pretax annual operating costs. System B costs $400,000, has a six-year life, and requires $111,000 in pretax annual operating costs. Suppose the company always needs a conveyor belt system; when one wears out, it must be replaced. Assume the tax rate is 21 percent and the discount rate is 10 percent. Calculate the EAC for both conveyor belt systems. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardThe Windshield division of Fast Car Co. makes windshields for use in Fast Car’s Assembly division. The Windshield division incurs variable costs of $200 per windshield and has capacity to make 500,000 windshields per year. The market price is $450 per windshield. The Windshield division incurs total fixed costs of $3,000,000 per year. If the Windshield division has excess capacity, what is the range of possible transfer prices that could be used on transfers between the Windshield and Assembly divisions?arrow_forward

- College Pizza delivers pizzas to the dormitories and apartments near a major state university. The company’s annual fixed expenses are $40,000. The sales price of a pizza is $10, and it costs the company $5 to make and deliver each pizza. (In the following requirements, ignore income taxes.)Required:1. Using the contribution-margin approach, compute the company’s break-even point in units (pizzas).2. What is the contribution-margin ratio?3. Compute the break-even sales revenue. Use the contribution-margin ratio in your calculation.4. How many pizzas must the company sell to earn a target profit of $65,000? Use the equation method.arrow_forwardThe Lombard Company produces and sells office-space dehumidifiers to companies that own or rent office space. (a) Lombard’s materials and labor costs for producing the dehumidifiers are $3,000 per unit and the fixed costs of its dehumidifier production plant are $1.85 million. If Lombard sells a dehumidifier for $5,000 per unit, what is its percent contribution margin? Show your work. (b) If Lombard used revenue-based compensation to pay its sales force, what would be a salesperson’s sales credit for selling 20 dehumidifiers at a price of $4,500? Show your work. (c) If Lombard used the profit-based compensation method described in the course to pay its sales force and sets the dehumidifier’s target price at $5,000 per unit, what would be a salesperson’s sales credit for selling 20 dehumidifiers at a price of $4,500? Show your work. (d) Explain the benefit to Lombard’s management of using the profit-based compensation method of Part (c) over revenue-based compensation for…arrow_forwardCVP; taxesHamlet House makes portable garden sheds that sell for $1,800 each. The tax rate for the company is 35 percent. Costs are as follows: Per Unit Total Direct material $800 Direct labor 90 Variable production overhead 60 Variable selling and administrative cost 50 Fixed production overhead $200,000 Fixed selling and administrative 60,000 a. If Hamlet House wants to earn an after-tax profit of $182,000, how many garden sheds must be sold? b. How many garden sheds must be sold to yield an after-tax profit of 8 percent of revenue?Note: Do not round until your final answer.Note: Round your final answer up to the nearest whole unit (for example, round 5.1 to 6 units). garden shedsc. How much revenue is generated from selling units calculated in part (b)? $Answerarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College