Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3.A, Problem A.1P

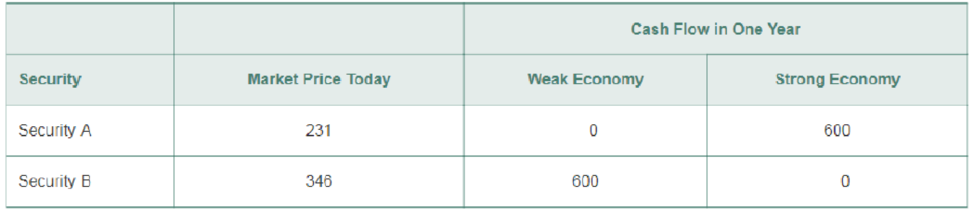

The table here shows the no-arbitrage prices of securities A and B that we calculated.

- a. What are the payoffs of a portfolio of one share of security A and one share of security B?

- b. What is the market price of this portfolio? What expected return will you earn from holding this portfolio?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Given the information in the table below, which of the following statements is correct, assuming that either security will be held in a portfolio with other investments?

Stock

Expected Return

Required Return

Beta

Standard Deviation

A

10%

12%

0.9

25%

B

8%

5%

0.3

35%

Question 26 options:

The investor should purchase both stocks because their beta is less than that of the market.

The investor should purchase A since its risk, as measured by standard deviation, is the lowest.

The investor should purchase A because it requires the highest rate of return.

The investor should purchase B since its expected return exceeds its required return.

how to find the current market price of your market portfolio according to No Arbitrage condition? With weights (-0.6906057,1.21794211, 047266359) and expected returns (0.31%,2.1859%,1.4475%), where 0.31% is the risk free rate

Given that the formula for CAPM is Expected return= risk free rate + Beta*(Return on market - risk free rate), Security A has a beta of 1.16 and an expected return of .1137 and Security B has a beta of .92 and expected return of .0984. If these securities are assumed to be correctly priced, what is their risk free rate? Based on CAPM, what is the return on the market?

Chapter 3 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 3.1 - Prob. 1CCCh. 3.1 - If crude oil trades in a competitive market, would...Ch. 3.2 - How do you compare costs at different points in...Ch. 3.2 - Prob. 2CCCh. 3.3 - What is the NPV decision rule?Ch. 3.3 - Why doesnt the NPV decision rule depend on the...Ch. 3.4 - Prob. 1CCCh. 3.4 - Prob. 2CCCh. 3.5 - If a firm makes an investment that has a positive...Ch. 3.5 - Prob. 2CC

Ch. 3.5 - Prob. 3CCCh. 3.A - The table here shows the no-arbitrage prices of...Ch. 3.A - Suppose security Chas a payoff of 600 when the...Ch. 3.A - Prob. A.3PCh. 3.A - Prob. A.4PCh. 3.A - Prob. A.5PCh. 3.A - Consider a portfolio of two securities: one share...Ch. 3.A2 - Why does the expected return of a risky security...Ch. 3.A2 - Prob. 2CCCh. 3.A3 - Prob. 1CCCh. 3.A3 - Prob. 2CCCh. 3 - Honda Motor Company is considering offering a 2000...Ch. 3 - You are an international shrimp trader. A food...Ch. 3 - Prob. 3PCh. 3 - Prob. 4PCh. 3 - You have decided to take your daughter skiing in...Ch. 3 - Suppose the risk-free interest rate is 4%. a....Ch. 3 - You have an investment opportunity in Japan. It...Ch. 3 - Your firm has a risk-free investment opportunity...Ch. 3 - You run a construction firm. You have just won a...Ch. 3 - Your firm has identified three potential...Ch. 3 - Your computer manufacturing firm must purchase...Ch. 3 - Prob. 12PCh. 3 - Prob. 13PCh. 3 - An American Depositary Receipt (ADR) is security...Ch. 3 - Prob. 15PCh. 3 - An Exchange-Traded Fund (ETF) is a security that...Ch. 3 - Consider two securities that pay risk-free cash...Ch. 3 - Prob. 18P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose you observe the following situation on two securities:Security Beta Expected Return Pete Corp. 0.8 0.12 Repete Corp. 1.1 0.16 Assume these two securities are correctly priced. Based on the CAPM, what is the return on the market?arrow_forwardThe security market line (SML) is an equation that shows the relationship between risk as measured by beta and the required rates of return on individual securities. The SML equation is given below: If a stock's expected return plots on or above the SML, then the stock's return is sufficient to compensate the investor for risk. If a stock's expected return plots below the SML, the stock's return is insufficient to compensate the investor for risk.The SML line can change due to expected inflation and risk aversion. If inflation changes, then the SML plotted on a graph will shift up or down parallel to the old SML. If risk aversion changes, then the SML plotted on a graph will rotate up or down becoming more or less steep if investors become more or less risk averse. A firm can influence market risk (hence its beta coefficient) through changes in the composition of its assets and through changes in the amount of debt it uses. Quantitative Problem: You are given the following…arrow_forwardAssume you own a portfolio of diverse securities each of which is correctly priced. Given this, the reward-to-risk ratio: of each security must equal the slope of the security market line. for the portfolio must equal 1.0. for the portfolio must be less than the market risk premium.arrow_forward

- You have also decided that you have a risk-aversion (A) of 4.(a) What is the expected return for each of the securities?(b) What is the volatility of each security return?(c) What is the covariance between stock and bond returns?(d) If you combine stocks and bills as an investment, what is your optimal combination? What is your expected return? What is yourportfolio’s volatility?(e) If you combine bonds and bills, what is your optimal combination?What is your expected return? What is your portfolio’s volatility?(f) If you combine stocks and bonds, what is your optimal combination?What is your expected return? What is your portfolio’s volatility?(g) If you combine all three assets in your portfolio, what is your optimal combination? What is your expected return? What is yourportfolio’s volatility?arrow_forwardShow detailed steps to solve the following question. Consider a portfolio comprised of three securities in the following proportions and with the indicated security beta. a.) What is the portfolios beta? b.) Wht is the portfolios expected return?arrow_forwardWhich of the following is TRUE? To construct a capital market line, we use expected return as y-axis and beta as x-axis On the capital market line debt securities are located to the right of the market portfolio To construct a security market line, we use expected return as y-axis and beta as x-axis Market portfolio lays at an intersection of the average indifference curve of a risk-averse investor and the efficient portfolioarrow_forward

- Consider a portfolio consisting of the below securities with the below characteristics: Security Amount Invested($) Beta Expected Return A 1,5 MIL 1.0 12.0%B 1.0 MIL 1.5 13.5%C 2.0 MIL 0.8 9.0% Required:a) Calculate the portfolio’s Beta. b) Calculate the portfolio’s expected return. c) Discuss the Capital Asset Pricing Model (CAPM) explaining what it is used forand which are its limitations.arrow_forwardThe portfolio weights for a portfolio consisting of multiple securities given multiple states of the economy are based on the: a. expected rates of return of each security given a normal economic state. b. market value of the investment in each individual security. c. beta of each individual security. d. amount of the original investment in each security.arrow_forwardThe following below are the expected return and betas of the given set of securities. Given that the risk free rate is 7% and the market return is 13%. Security N O P Return 20 21 23 Beta 1.2 1.8 0.82 Calculate the market risk premium, and the expected return of each asset using CAPM.arrow_forward

- If markets are in equilibrium, which of the following conditions will exist? a. Each stock's expected return should equal its required return as seen by the marginal investor. b. All stocks should have the same expected return as seen by the marginal investor. c. The expected and required returns on stocks and bonds should be equal. d. All stocks should have the same realized return during the coming year. e. Each stock's expected return should equal its realized return as seen by the marginal investor.arrow_forwardWhat is the equation for the Security Market Line? Define each term. If an asset has a beta of 2.0, what type of return should it realize compared to the market portfolio?arrow_forwardConsider the stocks in the table with their respective beta coefficients to answer the following questions:a. Which of the assets represents the most sensitive to fluctuations or changes in market returns and why? What impact in terms of risk and return would this asset have if you add it to an investment portfolio in a higher proportion than all other assets? b. Which of the assets represents the least sensitive to fluctuations or changes in market returns and why? What impact in terms of risk and return would this asset have, if you add it to an investment portfolio in a greater proportion than all other assets? Stock Beta SKT 0.65 COST 0.90 SU 1.42 AMZN 1.57 V 0.94arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Chapter 8 Risk and Return; Author: Michael Nugent;https://www.youtube.com/watch?v=7n0ciQ54VAI;License: Standard Youtube License