Concept explainers

Analyzing, Recording, and Summarizing Business Activities and Adjustments

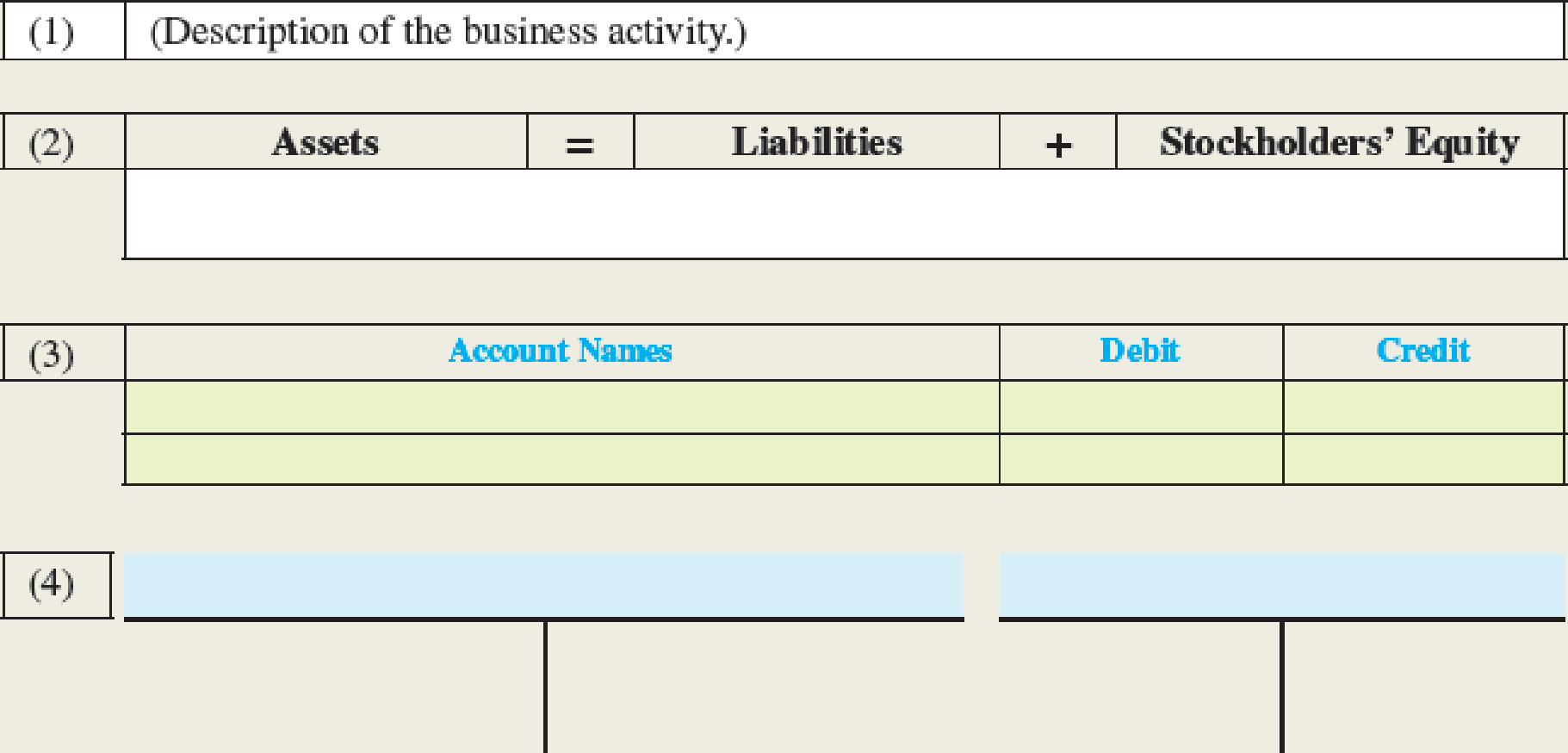

The following relates to a magazine company called My Style Mag (MSM). You will use your understanding of the relationships among (1) business activities, (2)

Required:

For each item (a)–(f) listed below, use the information provided to prepare and complete a four-part table similar to that shown above. Items (a)–(f) are independent of one another.

a.

Prepare a four part table by using the given information.

Explanation of Solution

Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by creating a relation between resources or assets of a business and claims on the resources by the creditors, and the owners.

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

T-account: The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

Prepare a four part table by using the given information as follows:

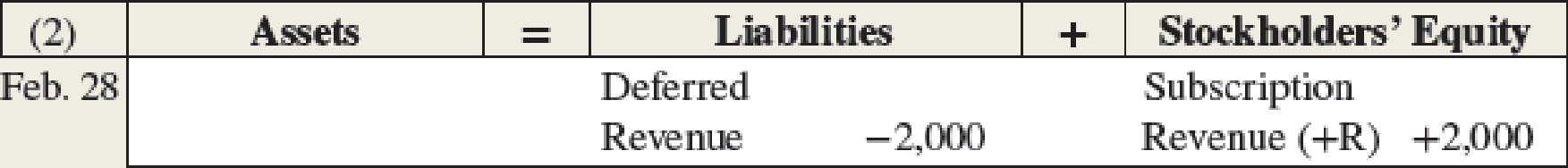

| (1) | On January 22, 2018, MSM received $24,000 cash from customers for one–year subscriptions to the magazine for February 2018 – January 2019. | ||||||||||

| (2) | Assets | = | Liabilities | + | Stockholders’ Equity | ||||||

| Cash +$24,000 |

Deferred Revenue +$24,000 | ||||||||||

| (3) | Account Names | Debit ($) | Credit ($) | ||||||||

| Cash (+A) | 24,000 | ||||||||||

| Deferred revenue (+R, +SE) | 24,000 | ||||||||||

| (To record the deferred revenue) | |||||||||||

| (4) | Cash account | Deferred revenue account | |||||||||

| $24,000 | $24,000 | ||||||||||

Table (1)

b.

Prepare a four part table by using the given information.

Explanation of Solution

Prepare a four part table by using the given information as follows:

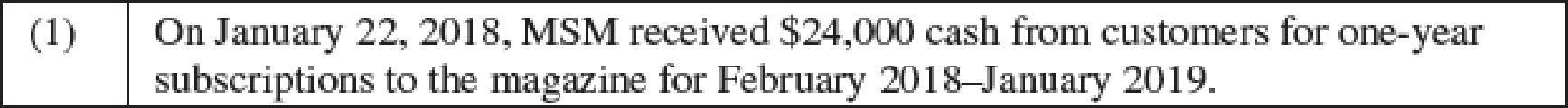

| (1) | Company MSM received utilities services on account at a cost of $3,000. | ||||||||||

| (2) | Assets | = | Liabilities | + | Stockholders’ Equity | ||||||

|

Accounts payable +$3,000 | Utilities expense (+E) -$3,000 | ||||||||||

| (3) | Account Names | Debit ($) | Credit ($) | ||||||||

| Utilities expense(+E, -SE) | 3,000 | ||||||||||

| Accounts payable (+L) | 3,000 | ||||||||||

| (To record the utilities expense) | |||||||||||

| (4) | Accounts payable account | Utilities expense account | |||||||||

| $3,000 | $3,000 | ||||||||||

Table (2)

c.

Prepare a four part table by using the given information.

Explanation of Solution

Prepare a four part table by using the given information as follows:

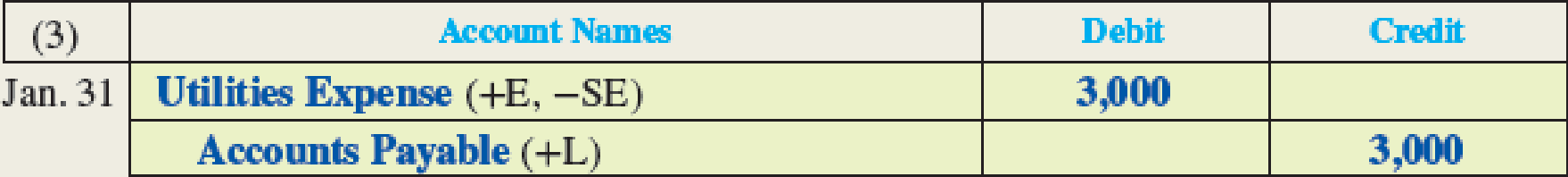

| (1) | Company MSM provided $2,000 of subscriptions for which it had been received the payment previously. | ||||||||||

| (2) | Assets | = | Liabilities | + | Stockholders’ Equity | ||||||

|

Deferred Revenue -$2,000 | Subscription revenue (+R) +$2,000 | ||||||||||

| (3) | Account Names | Debit ($) | Credit ($) | ||||||||

| Deferred revenue (-L) | 2,000 | ||||||||||

| Subscription Revenue (+R, +SE) | 2,000 | ||||||||||

| (To record the subscription revenue) | |||||||||||

| (4) | Deferred revenue account | Subscription revenue account | |||||||||

| $2,000 | $2,000 | ||||||||||

Table (3)

d.

Prepare a four part table by using the given information.

Explanation of Solution

Prepare a four part table by using the given information as follows:

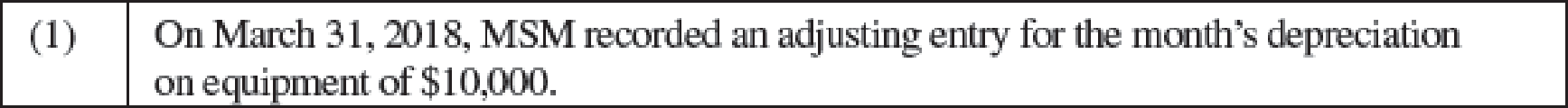

| (1) | On March 31, 2018, Company MSM recorded an adjusting entry for the month’s depreciation of $10,000. | ||||||||||||

| (2) | Assets | = | Liabilities | + | Stockholders’ Equity | ||||||||

| Accumulated | Depreciation | ||||||||||||

| Depreciation–Equipment (+xA) –$10,000 | Expense (+E) –$10,000 | ||||||||||||

| (3) | Account Names | Debit ($) | Credit ($) | ||||||||||

| Depreciation Expense (+E, –SE) | 10,000 | ||||||||||||

| Accumulated Depreciation–Equipment (+xA, –A) | 10,000 | ||||||||||||

| (To record accumulated depreciation) | |||||||||||||

| (4) | Accumulated Depreciation–Equipment account | Depreciation Expense account | |||||||||||

| $10,000 | $10,000 | ||||||||||||

Table (4)

e.

Prepare a four part table by using the given information.

Explanation of Solution

Prepare a four part table by using the given information as follows:

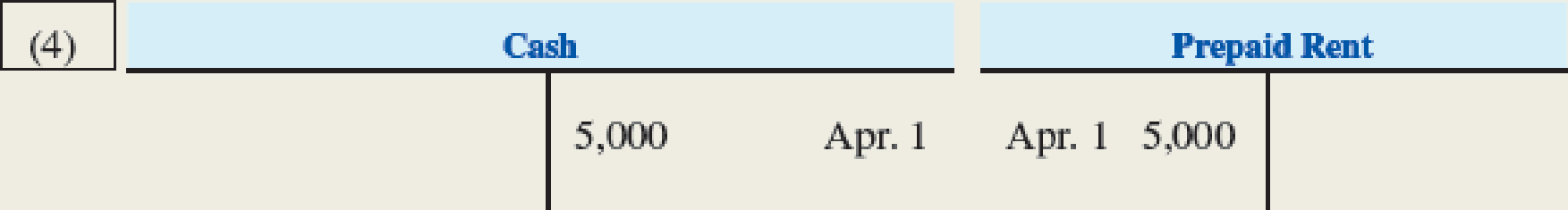

| (1) | On April 1, Company MSM paid $5,000 rent in advance of obtaining its benefits. | ||||||||||

| (2) | Assets | = | Liabilities | + | Stockholders’ Equity | ||||||

| Cash –$5,000 | |||||||||||

| Prepaid Rent +$5,000 | |||||||||||

| (3) | Account Names | Debit ($) | Credit($) | ||||||||

| Prepaid Rent (+A) | 5,000 | ||||||||||

| Cash (–A) | 5,000 | ||||||||||

| (To record prepaid rent) | |||||||||||

| (4) | Cash account | Prepaid Rent account | |||||||||

| $5,000 | $5,000 | ||||||||||

Table (5)

f.

Prepare a four part table by using the given information.

Explanation of Solution

Prepare a four part table by using the given information as follows:

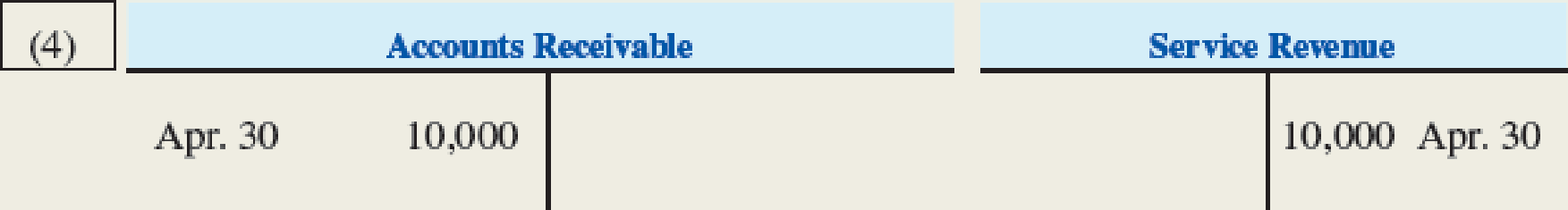

| (1) | On April 30, 2018, Company MSM billed customers for $10,000 of advertising services provided on account. | |||||||||

| (2) | Assets | = | Liabilities | + | Stockholders’ Equity | |||||

| Accounts | Service | |||||||||

| Receivable +$10,000 | Revenue (+R) +$10,000 | |||||||||

| (3) | Account Names | Debit ($) | Credit ($) | |||||||

| Accounts Receivable (+A) | 10,000 | |||||||||

| Service Revenue (+R, +SE) | 10,000 | |||||||||

| (To record service revenue recognized on account) | ||||||||||

| (4) | Accounts Receivable account | Service Revenue account | ||||||||

| $10,000 | $10,000 | |||||||||

Table (6)

Want to see more full solutions like this?

Chapter 4 Solutions

Fundamentals Of Financial Accounting

- The step-by-step process to record business activities and events to keep financial records up to date is ________. A. day-to-day cycle B. accounting cycle C. general ledger D. journalarrow_forwardACCOUNTING PROCESS Match the following steps of the accounting process with their definitions. Analyzinga. Telling the results Recordingb. Looking at events that have taken place and thinking about how they affect the business Classifying Summarizingc. Deciding the importance of the various reports Reportingd. Aggregating many similar events to provide information that is easy to understand Interpretinge. Sorting and grouping like items together f. Entering financial information into the accounting systemarrow_forwardRead each definition below and write the number of the definition in the blank beside the appropriate term. The quiz solutions appear at the end of the chapter. Event External event Internal event Transaction Source document Account Chart of accounts General ledger Debit Credit Double-entry system Journal Posting Journalizing General journal Trial balance A numerical list of all accounts used by a company. A list of each account and its balance; used to prove equality of debits and credits. A happening of consequence to an entity. An entry on the right side of an account. An event occurring entirely within an entity. A piece of paper that is used as evidence to record a transaction. The act of recording journal entries. An entry on the left side of an account. The process of transferring amounts from a journal to the ledger accounts. An event involving interaction between an entity and its environment. A record used to accumulate amounts for each individual asset, liability, revenue, expense, and component of stockholders equity. A book, a file, a hard drive, or another device containing all of the accounts. A chronological record of transactions. Any event that is recognized in a set of financial statements. The journal used in place of a specialized journal. A system of accounting in which every transaction is recorded with equal debits and credits and the accounting equation is kept in balance.arrow_forward

- This problem is designed to enable you to apply the knowledge you have acquired in the preceding chapters. In accounting, the ultimate test is being able to handle data in real life situations. This problem will give you valuable experience. CHART OF ACCOUNTS You are to record transactions in a two-column general journal. Assume that the fiscal period is one month. You will then be able to complete all of the steps in the accounting cycle. When you are analyzing the transactions, think them through by visualizing the T accounts or by writing them down on scratch paper. For unfamiliar types of transactions, specific instructions for recording them are included. However, reason them out for yourself as well. Check off each transaction as it is recorded. Required 1. Journalize the transactions. (Start on page 1 of the general journal if using Excel or Working Papers.) 2. Post the transactions to the ledger accounts. (Skip this step if using CLGL.) 3. Prepare a trial balance. (If using a work sheet, use the first two columns.) 4. Data for the adjustments are as follows: a. Insurance expired during the month, 1,000. b. Depreciation of pool structure for the month, 715. c. Depreciation of fan system for the month, 260. d. Depreciation of sailboats for the month, 900. e. Wages accrued at June 30, 810. Your instructor may want you to use a work sheet for these adjustments. 5. Journalize adjusting entries. 6. Post adjusting entries to the ledger accounts. (Skip this step if using CLGL.) 7. Prepare an adjusted trial balance 8. Prepare the income statement 9. Prepare the statement of owners equity. 10. Prepare the balance sheet. 11. Journalize closing entries. 12. Post closing entries to the ledger accounts. (Skip this step if using CLGL.) 13. Prepare a post-dosing trial balance. Check Figure Trial balance total, 281,858; net income, 7,143; post-dosing trial balance total, 263,341arrow_forwardPURPOSE OF ACCOUNTING Match the following users with the information needed. 1. Ownersa. Whether the firm can pay its bills on time 2. Managersb. Detailed, up-to-date information to measure business performance (and plan for future operations) 3. Creditorsc. To determine taxes to be paid and whether other regulations are met 4. Government agenciesd. The firms current financial conditionarrow_forwardThe following information pertains to Crossroads Consulting, Inc. Match each of the following parts of Crossroads accounting information system in the left-hand column with the appropriate item(s) from the right-hand column. You may use items in the right-hand column more than once or not at all. There may be several answers for each item in the left-hand column. You may choose items in the right-hand column more than once.arrow_forward

- This problem is designed to enable you to apply the knowledge you have acquired in the preceding chapters. In accounting, the ultimate test is being able to handle data in real-life situations. This problem will give you valuable experience. CHART OF ACCOUNTS You are to record transactions in a two-column general journal. Assume that the fiscal period is one month. You will then be able to complete all of the steps in the accounting cycle. When you are analyzing the transactions, think them through by visualizing the T accounts or by writing them down on scratch paper. For unfamiliar types of transactions, specific instructions for recording them are included. However, reason them out for yourself as well. Check off each transaction as it is recorded. Required 1. Journalize the transactions. (Start on page 1 of the general journal if using Excel or Working Papers.) 2. Post the transactions to the ledger accounts. (Skip this step if using CLGL.) 3. Prepare a trial balance. (If using a work sheet, use the first two columns.) 4. Data for the adjustments are as follows: a. Insurance expired during the month, 1,020. b. Depreciation of building for the month, 480. c. Depreciation of pool/slide facility for the month, 675. d. Depreciation of pool furniture for the month, 220. e. Wages accrued at July 31, 920. Your instructor may want you to use a work sheet for these adjustments. 5. Journalize adjusting entries. 6. Post adjusting entries to the ledger accounts. (Skip this step if using CLGL.) 7. Prepare an adjusted trial balance. 8. Prepare the income statement. 9. Prepare the statement of owners equity. 10. Prepare the balance sheet. 11. Journalize closing entries. 12. Post closing entries to the ledger accounts. (Skip this step if using CLGL.) 13. Prepare a post-closing trial balance. Check Figure Trial balance total, 601,941; net income, 16,293; post-closing trial balance total, 569,614arrow_forwardMonet Paints Co. is a newly organized business with a list of accounts arranged in alphabetical order, as follows: Construct a chart of accounts, assigning account numbers and arranging the accounts in balance sheet and income statement order, as illustrated in Exhibit 2. Each account number is three digits: the first digit is to indicate the major classification (1 for assets, for example); the second digit is to indicate the subclassification (11 for current assets, for example); and the third digit is to identify the specific account (110 for Cash, 112 for Accounts Receivable, 114 for Merchandise Inventory, etc.).arrow_forwardMonet Paints Co. is a newly organized business with a list of accounts arranged in alphabetical order, as follows: Construct a chart of accounts, assigning account numbers and arranging the accounts in balance sheet and income statement order, as illustrated in Exhibit 9. Each account number is three digits: the first digit is to indicate the major classification (1 for assets, and so on); the second digit is to indicate the subclassification (11 for current assets, and so on); and the third digit is to identify the specific account (110 for Cash, 112 for Accounts Receivable, 114 for Merchandise Inventory, 115 for Store Supplies, and so on).arrow_forward

- The __________ is a working paper used by accountants to record necessary adjustments and provide up-to-date account balances needed to prepare the financial statements. a. journal b. balance sheet c. accounting cycle d. work sheetarrow_forwardEnter the letter A through H for the principle or assumption in the blank space next to each numbered description that it best reflects. A. General accounting principle B. Measurement (cost) principle C. Business entity assumption D. Revenue recognition principle E. Specific accounting principle F. Expense recognition (matching) principle G. Going-concern assumption H. Full disclosure principle 1. A company reports details behind financial statements that would impact users’ decisions. 2. Financial statements reflect the assumption that the business continues operating. 3. A company records the expenses incurred to generate the revenues reported. 4. Concepts, assumptions, and guidelines for preparing financial statements. 5. Each business is accounted for separately from its owner or owners. 6. Revenue is recorded when products and services are delivered. 7. Detailed rules used in reporting events and transactions. 8. Information is based on actual costs incurred in transactions.arrow_forwardJanis Engle has prepared the following list of statements about the accounting cycle. 1. “Journalize the transactions” is the first step in the accounting cycle. 2. Reversing entries are a required step in the accounting cycle. 3. Correcting entries do not have to be part of the accounting cycle. 4. If a worksheet is prepared, some steps of the accounting cycle are incorporated into the worksheet. 5. The accounting cycle begins with the analysis of business transactions and ends with the preparation of a post-closing trial balance. 6. All steps of the accounting cycle occur daily during the accounting period. 7. The step of “post to the ledger accounts” occurs before the step of “journalize the transactions.” 8. Closing entries must be prepared before financial statements can be prepared. Instructions Identify each statement as true or false. If false, indicate how to correct the statement. Please answer it with proper explanationarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning