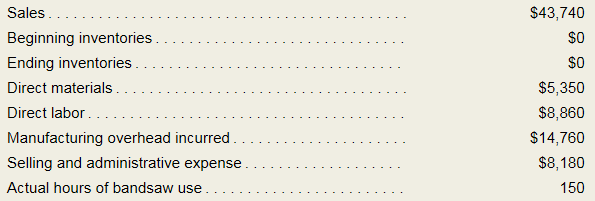

Wixis Cabinets makes custom wooden cabinets for high-end stereo systems from specialty woods. The company uses a

The results of a recent month’s operations appear below:

Required:

- Prepare an income statement following the example in Exhibit 3B—1 that records the cost of unused capacity on the income statement as a period expense.

- Why do unused capacity costs arise when the predetermined overhead rate is based on capacity?

1.

Introduction: Job costing is a technique of determine the cost of a manufacturing job rather than the process of the job. Manufacturing overhead is applied to product or job order is determined as predetermined overhead. Absorption costing is used to calculate the cost of product while taking indirect and direct expense into account. Activity based costing assign the cost of all the activity of the organization according to their actual consumption

To prepare: The income statement that record the cost of unused capacity.

Answer to Problem 4B.1E

Income statement given shown below:

Explanation of Solution

Cost of goods manufactured and under applied overhead

| Particular | Amount $ |

| Direct material | 5,350 |

| Direct labor | 8,860 |

| Manufacturing overhead applied | 12,300 |

| Total manufacturing cost charged to jobs | 26,510 |

| Add: Beginning work in process inventory | 0 |

| 26,510 | |

| Deduct: Ending work in process inventory | 0 |

| Cost of goods manufactured | 26,510 |

The manufacturing overhead incurred was $14200 and the applied manufacturing overhead was $12,300. Thus, under applied overhead is:

Income statement:

| Particular | Amount $ | Amount $ |

| Sales | 43,740 | |

| Cost of goods | 26,510 | |

| Gross margin | 17,230 | |

| Under applied manufacturing overhead | 1920 | |

| Selling and manufacturing expense | 8180 | 10,100 |

| Net operating income | 7,130 |

2.

Introduction: Job costing is a technique of determine the cost of a manufacturing job rather than the process of the job. Manufacturing overhead is applied to product or job order is determined as predetermined overhead. Absorption costing is used to calculate the cost of product while taking indirect and direct expense into account. Activity based costing assign the cost of all the activity of the organization according to their actual consumption

The reason for unused capacity cost arises when the predetermined overhead rate is based on capacity.

Answer to Problem 4B.1E

Manufacturing overhead typically includes a significant amount of fixed cost that results in overhead being under applied when the predetermined overhead rate is based on capacity.

Explanation of Solution

Manufacturing overhead typically includes a significant amount of fixed cost that results in overhead being under applied when the predetermined overhead rate is based on capacity. If the plant never operates at full capacity, an amount less than the total fixed cost will actually be applied to each job. However, since fixed costs remain fixed the amount overhead applied to each job will typically be underapplied.

Want to see more full solutions like this?

Chapter 4B Solutions

Managerial Accounting for Managers

- LO.1 & LO.3 (Plant vs. departmental OH rates) Red River Farm Machine makes a wide variety' of products, all of which must be processed in the Cutting and Assembly departments. For the year 2013, Red River budgeted total overhead of $993,000, of which $385,500 will be incurred in Cutting and the remainder will be incurred in Assembly. Budgeted direct labor and machine hours are as follows: Cutting Assembly Budgeted direct labor hours 27,000 3,000 Budgeted machine hours 2,100 65,800 Two products made by Red River are the RW22SKI and the SD45ROW. The following cost and production time information on these items has been gathered: RW22SKI SD45ROW Direct material $34.85 $19.57 Direct labor rate in Cutting $20.00 $20.00 Direct labor rate in Assembly $8.00 $8.00 Direct labor hours in Cutting 6.00 4.80 Direct labor hours in Assembly 0.03 0.05 Machine hours in Cutting 0.06 0.15 Machine hours in Assembly 5.90 9.30 a. What is the plantwide predetermined…arrow_forwardLO.1 & LO.3 (Plant vs. departmental OH rates) Red River Farm Machine makes a wide variety' of products, all of which must be processed in the Cutting and Assembly departments. For the year 2013, Red River budgeted total overhead of $993,000, of which $385,500 will be incurred in Cutting and the remainder will be incurred in Assembly. Budgeted direct labor and machine hours are as follows: Cutting Assembly Budgeted direct labor hours 27,000 3,000 Budgeted machine hours 2,100 65,800 Two products made by Red River are the RW22SKI and the SD45ROW. The following cost and production time information on these items has been gathered: RW22SKI SD45ROW Direct material $34.85 $19.57 Direct labor rate in Cutting $20.00 $20.00 Direct labor rate in Assembly $8.00 $8.00 Direct labor hours in Cutting 6.00 4.80 Direct labor hours in Assembly 0.03 0.05 Machine hours in Cutting 0.06 0.15 Machine hours in Assembly 5.90 9.30 d. A competitor manufactures a product…arrow_forwardNelly Technology manufactures a particular computer component. Currently, the costs per unit are asfollows:Direct material P 50Direct labor 500Variable overhead 250Fixed overhead 400Fur Inc. has obtained Nelly with a offer to sell 10,000 units of the component for P1,100 per unit. IfNelly accepts the proposal, P2,500,000 of the fixed overhead will be eliminated. Should Nelly makeor buy the component?arrow_forward

- Company XYZ uses machine hours to allocate its manufacturing overhead. The company estimates that total machine hours to be operated next year are 190,000 hours. The estimated variable overhead is $10 per hour and the estimated fixed overhead costs are $152,000. Calculate the predetermined overhead rate. Select one O a. $10.80 b. None of the answers given c S0.00 O d. $11.80 e s0.09arrow_forwardY2 Part 1 Clean−It−Up, Inc., is a manufacturer of vacuums and uses standard costing. Manufacturing overhead (both variable and fixed) is allocated to products on the basis of budgeted machine-hours. In 2020, budgeted fixed manufacturing overhead cost was$18,000,000. Budgeted variable manufacturing overhead was $8 per machine-hour. The denominator level was 1,000,000 machine-hours.arrow_forwardQ: The KIA Motor Company estimated its factory overhead for the next period at Rs. 1,600,000. It is estimated that 80, 000 units will be produced at a normal material cost of Rs. 400, 000. Production will require 20,000 man hours at an estimated wage cost of Rs.800, 000. The machine will run about 40, 000 hours. Compute Applied FOH rate on the following basis. Material Cost Direct Labor Cost Direct Labor Hours Machine hours Units of production Prime costarrow_forward

- problem 5 Marites Company employs standard absorption system for product costing. The standard cost of this product is as follows: Raw Materials – P14.50; Direct Labor for 2 hours @ P8/hr is P16; Manufacturing overhead for 2 hours @ P11/hr is P22. The total cost/unit (14.50+16+22) = P52.50. The manufacturing overhead rate is based upon normal annual activity level of 600,000 direct labor hours. The company planned to produce 25,000 units each month during 2020. Budgeted factory overhead for 2020 is composed of P3,600,000 variable and P3,000,000 fixed. During April 2021, 26,000 units of product were produced using 53,500 direct labor hours at a cost of P433,350. Actual manufacturing overhead for the month was P260,000 fixed and P315,000 variable. The total manufacturing overhead applied during April was P572,000. The variable overhead spending variance must be:arrow_forwardAy 1. Downtown Manufacturers makes and sells Iron box stands. Each unit sells for $220. The following cost data per stand are based on a full capacity of 10,000 stands each period: Direct materials $100 Direct labor $50 Variable manufacturing overhead $18 Unavoidable fixed overhead $12 Downtown is considering a special order for a sale of 2,500 computers to an overseas customer. The only selling costs that would be incurred for the order would be shipping charges of $10 per computer. Downtown is currently selling 7,500 units through its regular orders. The company has enough capacity to accept this order. What should be the minimum selling price per stand in negotiating a price for the special order. Group of answer choices $180, $190, $220, $202, $178.arrow_forwardPROBLEM 1: MAKE or BUY Limos Mfg. has been manufacturing furniture sets and is considering whether tomake or outsource its own seat cushions needed for its chairs. The expected priceof the cushions is P50 per unit. If it continue to produce the company would incur the following unit cost: Directmaterials P13, Direct Labor P15, Variable overhead 5, Fixed overhead (based onthe average production requirement of 10,000 units) P20 for a total of P53. Let us assume that materials and labor costs are expected to increase by 20% nextperiod. Factory overhead costs will remain the same, except that 40% of the fixedoverhead will be eliminated in case the company decides to buy the seat cushionsfrom other suppliers. Moreover, the facilities presently being used in the manufactureof seat cushions can be utilized to manufacture another part of the main product incase such facilities become vacant when the company decides to stop producing theseat cushions. The alternative use of resources would…arrow_forward

- QUESTION 4 An organisation manufactures a single product. The following information with regard to the raw material needed in the production process is supplied to you: Normal delivery time: 2.5 weeksMaximum delivery time: 3.5 weeksNormal usage: 52 000 units per yearPurchase price per unit: R8.50Cost of placing an order: R18.00Interest rate: 2% per yearStoring cost per unit: R2.50 Required: Calculate the EOQ. Calculate the re-order point if the organisation does not keep safety stock.arrow_forwardBrick lane Co. produces two products: Camden and Chelsea. Camden Chelsea Direct Materials 2 3 Direct labor (2 per hour) 8 2 Variable overhead 1 1 11 6 The sale price per unit is $ 13 per Camden and 11 $ per Chelsea. In August 2022, the available direct labor is limited to 7,000 hours. Salas demand in July is expected to be 4,000 for Camden and 6,000 united for Chelsea. Required: Determine the profit product mix for Brick lance Co. assuming that Monthly fixed costs are $15,000 and that opening inventory of finished goods and work in progress are nil.arrow_forwardQ1 Direct Apex Corporation manufactures two products, Product DAC and Product DIB. Product DIB requires two hours of direct labour time per unit to manufacture compared to one hour of direct labour time for Product DAC. Overhead is currently assigned to the products on the basis of direct-labour-hours. The company estimated it would incur $450,000 in manufacturing overhead costs and produce 30,000 units of Product DAC and 7,500 units of Product DIB during the current year. Unit costs for materials and direct labour are: Product DAC Product DIB Direct material $24 $35 Direct labour $10 $20 If the company allocates all of its overhead based on direct labour-hours, the unit product cost of Product DAC would be closest to: Question 14 options: 1) $60.00 2) $34.00 3) $44.00 4) $54.00 Q2 Delight Business Ltd (DIB) manufactures two products, Product L11 and Product L12. The company is…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education