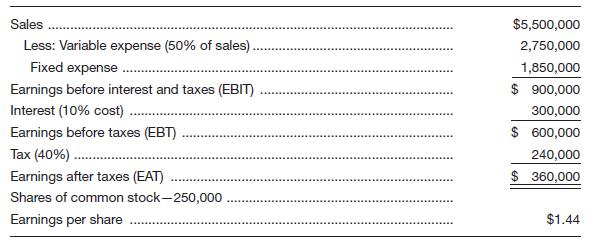

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as follows:

The company is currently financed with 50 percent debt and 50 percent equity (common stock, par value of $10). In order to expand the facilities, Mr. Delsing estimates a need for $2.5 million in additional financing. His investment banker has laid out three plans for him to consider:

Variable costs are expected to stay at 50 percent of sales, while fixed expenses will increase to

Delsing is interested in a thorough analysis of his expansion plans and methods of financing. He would like you to analyze the following:

a. The break-even point for operating expenses before and after expansion (in sales dollars).

b. The degree of operating leverage before and after expansion. Assume sales of

c. The degree of financial leverage before expansion and for all three methods of financing after expansion. Assume sales of

d. Compute EPS under all three methods of financing the expansion at

e. What can we learn from the answer to part d about the advisability of the three methods of financing the expansion?

a.

To calculate: The BEP (in dollars) for the operating expenses of Delsing Canning Company prior to and post expansion.

Introduction:

Break-even point (BEP):

It refers to the production level at which the revenue of the product is equal to the cost of the product. It is calculated by dividing the total fixed cost with the difference between the revenue per unit and variable cost per unit.

Answer to Problem 27P

The BEP of sales prior to the expansion of Delsing Canning Company is $3,700,000 and that post expansion is $4,700,000.

Explanation of Solution

Calculation of BEP before expansion:

Calculation of BEP after expansion:

Working Notes:

Calculation of the contribution margin ratio prior to expansion:

Calculation of the contribution margin ratio post expansion:

b.

To calculate: The DOL before and after expansion for Delsing Canning Company.

Introduction:

Degree of Operating Leverage (DOL):

It refers to the ratio that measures the change in the operating income of the company with the change in sales volume.

Answer to Problem 27P

The DOL of Delsing Canning Company before expansion is 3.06 times and that after expansion is 3.61 times.

Explanation of Solution

Calculation of DOL before expansion with sales of $5,500,000:

Calculation of DOL after expansion with sales of $6,500,000:

c.

To calculate: The DFL before and after expansion for Delsing Canning Company.

Introduction:

Degree of financial leverage (DFL):

It refers to the leverage ratio that evaluates the EPS of the company with respect to variations in its operating income. This ratio indicates that a higher DFL leads to higher earnings for the firm.

Answer to Problem 27P

The DFL before expansion for Delsing Canning Company is 1.50 times and that after expansion for plan 1 is 3.27 times, that for plan 2 is 1.50 times, and that for plan 3 is 2 times.

Explanation of Solution

Calculation of DFL before expansion:

Calculation of DFL after expansion for plan 1:

Calculation of DFL after expansion for plan 2:

Calculation of DFL after expansion for plan 3:

Working Notes:

Calculation of EBIT for plan 1 with 100% debt:

Calculation of EBIT for plan 2 with 100% equity:

Calculation of EBIT for plan 3 with 50% debt and 50% equity:

Calculation of interest for plan 1 with 100% debt:

Calculation of interest for plan 2 with 100% equity:

Calculation of interest for plan 3 with 50% debt and 50% equity:

d.

To calculate: The EPS, given that the sales in the first year were $6,500,000 and that in the last year were $10,000,000, using the three methods of financing after the expansion of Delsing Canning Company.

Introduction:

Earnings per share (EPS):

It is the profit per outstanding share of a public company. A higher EPS indicates a higher value of the company because investors are ready to pay a higher price for one share of the company.

Answer to Problem 27P

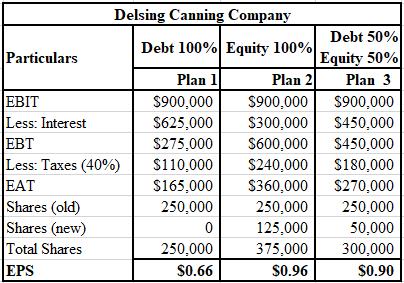

The calculation of EPS with sales of $6,500,000 for Delsing Canning Company is shown below.

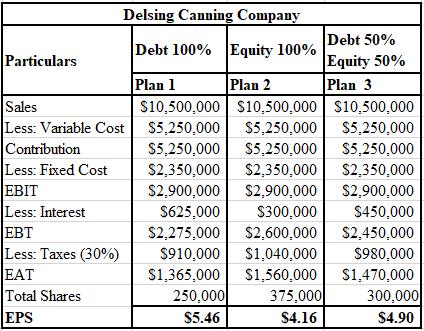

The calculation of EPS with sales of $10,500,000 for Delsing Canning Company is shown below.

Explanation of Solution

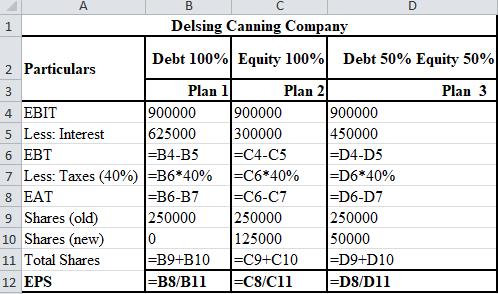

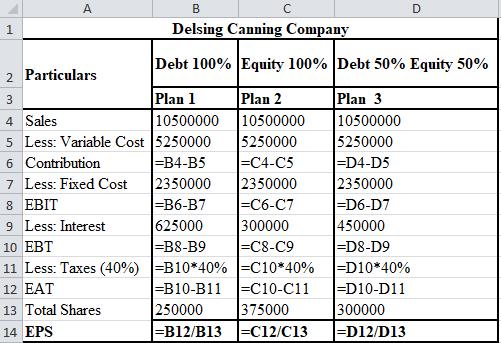

The formulae used for the calculation of EPS with sales of $6,500,000 are shown below.

The formulae used for the calculation of EPS with sales of $10,500,000 are shown below.

e.

To determine: The outcome of the calculation of part (d) using the three methods of financing the expansion for the Delsing Canning Company.

Introduction:

Earnings Before Interest and Tax (EBIT):

It is the profit of a firm that includes all operating and non-operating expenses. It is calculated by subtracting the cost of goods sold and operating expenses from the revenue of the corporation.

Answer to Problem 27P

When sales and profits are comparatively low, plan 2, that is, the plan with 100% equity, seems to be the best alternative in the first year. However, after expansion, when sales and profits are high, plan 1, that is, the one with 100% debt, seems to be the best one on the basis of higher yield.

Explanation of Solution

Plan 2 with 100% equity is comparatively the best alternative for the first year when there are low profits as well as sales. Moreover, with the increase in the level of sales of approximately $10.5 million, it is clear that the financial leverage has started producing results as it increased the EBIT in plan 1, which has 100% debt.

Want to see more full solutions like this?

Chapter 5 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT