To determine: The bond’s price at different periods

Introduction:

A bond refers to the debt securities issued by the governments or corporations for raising capital. The borrower does not return the face value until maturity. However, the investor receives the coupons every year until the date of maturity.

Bond price or bond value refers to the present value of the future cash inflows of the bond after discounting at the required rate of return.

Answer to Problem 18QP

The price of the bond at different periods is as follows:

| Time to maturity (Years) | Bond X | Bond Y |

| 13 | $1,126.6776 | $883.3285 |

| 12 | $1,120.4378 | $888.5195 |

| 10 | $1,106.5930 | $900.2923 |

| 5 | $1,062.3745 | $939.9184 |

| 1 | $1,014.2477 | $985.9048 |

| 0 | $1,000.0000 | $1,000.0000 |

Explanation of Solution

Given information:

Bond X is selling at a premium. The coupon rate of Bond X is 8.5 percent and its yield to maturity is 7 percent. The bond will mature in 13 years. Bond Y is selling at a discount. The coupon rate of Bond Y is 7 percent and its yield to maturity is 8.5 percent. The bond will mature in 13 years. Both the bonds make semiannual coupon payments. Assume that the face value of bonds is $1,000.

The formula to calculate annual coupon payment:

The formula to calculate the current price of the bond:

Where,

“C” refers to the coupon paid per period

“F” refers to the face value paid at maturity

“r” refers to the yield to maturity

“t” refers to the periods to maturity

Compute the bond price of Bond X at different maturities:

Compute the annual coupon payment of Bond X:

Hence, the annual coupon payment of Bond X is $85.

The bond value or the price of Bond X at present:

The bond pays the coupons semiannually. The annual coupon payment is $85. However, the bondholder will receive the same is two equal installments. Hence, semiannual coupon payment or the 6-month coupon payment is $42.50

Secondly, the remaining time to maturity is 13 years. As the coupon payment is semiannual, the semiannual periods to maturity are 26

Thirdly, the yield to maturity is 7 percent per year. As the calculations are semiannual, the yield to maturity must also be semiannual. Hence, the semiannual or 6-month yield to maturity is 3.50 percent

Hence, the current price of the bond is $1,126.6776.

The bond value or the price of Bond X after one year:

The bond pays the coupons semiannually. The annual coupon payment is $85. However, the bondholder will receive the same is two equal installments. Hence, semiannual coupon payment or the 6-month coupon payment is $42.50

Secondly, the remaining time to maturity is 12 years after one year from now. As the coupon payment is semiannual, the semiannual periods to maturity are 24

Thirdly, the yield to maturity is 7 percent per year. As the calculations are semiannual, the yield to maturity must also be semiannual. Hence, the semiannual or 6-month yield to maturity is 3.50 percent

Hence, the price of the bond will be $1,120.4378 after one year.

The bond value or the price of Bond X after 3 years:

The bond pays the coupons semiannually. The annual coupon payment is $85. However, the bondholder will receive the same is two equal installments. Hence, semiannual coupon payment or the 6-month coupon payment is $42.50

Secondly, the remaining time to maturity is 10 years after three years from now. As the coupon payment is semiannual, the semiannual periods to maturity are 20

Thirdly, the yield to maturity is 7 percent per year. As the calculations are semiannual, the yield to maturity must also be semiannual. Hence, the semiannual or 6-month yield to maturity is 3.50 percent

Hence, the price of the bond will be $1,106.5930 after three years.

The bond value or the price of Bond X after eight years:

The bond pays the coupons semiannually. The annual coupon payment is $85. However, the bondholder will receive the same is two equal installments. Hence, semiannual coupon payment or the 6-month coupon payment is $42.50

Secondly, the remaining time to maturity is 5 years after eight years from now. As the coupon payment is semiannual, the semiannual periods to maturity are 10

Thirdly, the yield to maturity is 7 percent per year. As the calculations are semiannual, the yield to maturity must also be semiannual. Hence, the semiannual or 6-month yield to maturity is 3.50 percent

Hence, the price of the bond will be $1,062.3745 after eight years.

The bond value or the price of Bond X after twelve years:

The bond pays the coupons semiannually. The annual coupon payment is $85. However, the bondholder will receive the same is two equal installments. Hence, semiannual coupon payment or the 6-month coupon payment is $42.50

Secondly, the remaining time to maturity is one year after twelve years from now. As the coupon payment is semiannual, the semiannual periods to maturity are two

Thirdly, the yield to maturity is 7 percent per year. As the calculations are semiannual, the yield to maturity must also be semiannual. Hence, the semiannual or 6-month yield to maturity is 3.50 percent

Hence, the price of the bond will be $1,014.2477 after twelve years.

The bond value or the price of Bond X after thirteen years:

The thirteenth year is the year of maturity for Bond X. In this year, the bondholder will receive the bond’s face value. Hence, the price of the bond will be $1,000 after thirteen years.

Compute the bond price of Bond Y at different maturities:

Compute the annual coupon payment of Bond Y:

Hence, the annual coupon payment of Bond Y is $70.

The bond value or the price of Bond Y at present:

The bond pays the coupons semiannually. The annual coupon payment is $70. However, the bondholder will receive the same is two equal installments. Hence, semiannual coupon payment or the 6-month coupon payment is $35

Secondly, the remaining time to maturity is 13 years. As the coupon payment is semiannual, the semiannual periods to maturity are 26

Thirdly, the yield to maturity is 8.5 percent per year. As the calculations are semiannual, the yield to maturity must also be semiannual. Hence, the semiannual or 6-month yield to maturity is 4.25 percent

Hence, the current price of the bond is $883.3285.

The bond value or the price of Bond Y after one year:

The bond pays the coupons semiannually. The annual coupon payment is $70. However, the bondholder will receive the same is two equal installments. Hence, semiannual coupon payment or the 6-month coupon payment is $35

Secondly, the remaining time to maturity is 12 years after one year from now. As the coupon payment is semiannual, the semiannual periods to maturity are 24

Thirdly, the yield to maturity is 8.5 percent per year. As the calculations are semiannual, the yield to maturity must also be semiannual. Hence, the semiannual or 6-month yield to maturity is 4.25 percent

Hence, the price of the bond is $888.5195 after one year.

The bond value or the price of Bond Y after three years:

The bond pays the coupons semiannually. The annual coupon payment is $70. However, the bondholder will receive the same is two equal installments. Hence, semiannual coupon payment or the 6-month coupon payment is $35

Secondly, the remaining time to maturity is 10 years after three years from now. As the coupon payment is semiannual, the semiannual periods to maturity are 20

Thirdly, the yield to maturity is 8.5 percent per year. As the calculations are semiannual, the yield to maturity must also be semiannual. Hence, the semiannual or 6-month yield to maturity is 4.25 percent

Hence, the price of the bond is $900.2923 after three years.

The bond value or the price of Bond Y after eight years:

The bond pays the coupons semiannually. The annual coupon payment is $70. However, the bondholder will receive the same is two equal installments. Hence, semiannual coupon payment or the 6-month coupon payment is $35

Secondly, the remaining time to maturity is 5 years after three years from now. As the coupon payment is semiannual, the semiannual periods to maturity are 10

Thirdly, the yield to maturity is 8.5 percent per year. As the calculations are semiannual, the yield to maturity must also be semiannual. Hence, the semiannual or 6-month yield to maturity is 4.25 percent

Hence, the price of the bond is $939.9184 after eight years.

The bond value or the price of Bond Y after twelve years:

The bond pays the coupons semiannually. The annual coupon payment is $70. However, the bondholder will receive the same is two equal installments. Hence, semiannual coupon payment or the 6-month coupon payment is $35

Secondly, the remaining time to maturity is one year after twelve years from now. As the coupon payment is semiannual, the semiannual periods to maturity are two

Thirdly, the yield to maturity is 8.5 percent per year. As the calculations are semiannual, the yield to maturity must also be semiannual. Hence, the semiannual or 6-month yield to maturity is 4.25 percent

Hence, the price of the bond is $985.9048 after twelve years.

The bond value or the price of Bond Y after thirteen years:

The thirteenth year is the year of maturity for Bond Y. In this year, the bondholder will receive the bond’s face value. Hence, the price of the bond will be $1,000 after thirteen years.

Table indicating the bond prices of Bond X and Bond Y at different maturities:

| Time to maturity (Years) | Bond X | Bond Y |

| 13 | $1,126.6776 | $883.3285 |

| 12 | $1,120.4378 | $888.5195 |

| 10 | $1,106.5930 | $900.2923 |

| 5 | $1,062.3745 | $939.9184 |

| 1 | $1,014.2477 | $985.9048 |

| 0 | $1,000.0000 | $1,000.0000 |

Table 1

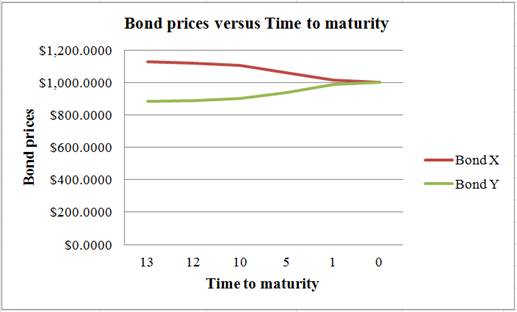

Graphical representation of the bond prices of Bond X and Bond Y from Table 1:

Explanation of the graph:

The graph indicates a “pull to par” effect on the prices of the bonds. The face value of both the bonds is $1,000. Although Bond X is at a premium and Bond Y is at a discount, both the bonds will reach their par values at the time of maturity. The effect of reaching the face value or par value from a discount or premium is known as “pull to par”.

Want to see more full solutions like this?

Chapter 7 Solutions

Fundamentals of Corporate Finance

- D3) Currently, the market interest rate on a bond is 10%. Yield-to-Maturity is a return you can reliaze when you are investing in a bond until its maturity. If you decide to sell the bond before the maturity, what would be your realized return like? and why?arrow_forward37 Which of the following observations is the most accurate? 37. a. If the required return on a bond with equivalent risk is 8%, a bond with a coupon rate of 10% may sell at a disadvantage if all other factors are identical.b. Assuming that the bond's yield to maturity stays stable over time, the price of a discount bond would rise.c. A bond's net return for a specified year is made up entirely of coupon interest payments.d. Both b and c are valid statements.e. All of the above claims are true.arrow_forwardHW#3 Consider a coupon bond that has a $1,000 par value and a coupon rate of 10%. The bond is currently selling for $1,150 and has 8 years to maturity. What is the bond’s yield to maturity? A 10-year, 7% coupon bond with a face value of $1,000 is currently selling for $871.65. Compute your rate of return if you sell the bond next year for $880.10. Consider the decision to purchase either a 5-year corporate bond or a 5-year municipal bond. The corporate bond is a 12% annual coupon bond with a par value of $1,000. It is currently yielding 5%. The municipal bond has an 8.5% annual coupon and a par value of $1,000. It is currently yielding 7%. Which of the two bonds would be more beneficial to you? Assume that your marginal tax rate is 35%. Calculate the duration of a $1,000 6% coupon bond with three years to maturity. Assume that all market interest rates are 7%. Consider the bond in the previous question. Calculate the expected price change if interest rates drop to 6.75% using the…arrow_forward

- Question 8 (i) A Treasury bond with £100 maturity face value has a £9 annual coupon and 15 years left to maturity. What price will the bond sell for assuming that the 15 year yield to maturity in the market is 4%, 9% and 14% respectively? (ii) Without using any further calculations, comment on whether the price movements would have been greater or smaller if instead of using a 15 year bond a 10 year bond had been used.arrow_forwardQUESTION 7 Consider the market for a bond which has a face value of $2,000, pays a coupon of $100, and matures in 1 year (that is, you will get the face value and one coupon payment next year). Suppose the demand for such bonds is given by P=4,000-2Q, and that the supply of such bonds is given by P=1,000+Q. What is the yield to maturity if one were to purchase the bond at the equilibrium price? 5% .05% 10% .10%arrow_forward3. Asea Brown Boveri (ABB Group) Bond has a coupon rate of 14%. Caterpillar Bond has a coupon rate of 6%. Both bonds have 20 years to maturity, a par value of $1,000 and a YTM of 10% and both make semiannual payments. If interest rates suddenly rise by 2%, what is the percentage change in the price of these bonds? Instead, if rates suddenly fall by 2%, what is the percentage change in the price of these bonds? As interest rates fall by 2%, which of the two bonds would you prefer to own. Explain briefly, why?arrow_forward

- 43. One of the above is the most accurate statement?a. In general, distant cash flows are riskier than near-term cash flows.Additionally, a 20-year bond that is callable after five years would have a shorter projected duration, if not none at all, than an otherwise comparable noncallable 20-year bond. Assuming all other features are comparable, investors can demand a lower rate of return on the callable bond than on the noncallable bond.b. The average period of a noncallable 20-year bond is usually equivalent to or greater than the expected life of an otherwise similar callable 20-year bond. Additionally, the interest rate danger that borrowers experience increases with the maturity of a bond. Thus, where all other factors remain stable, callable bonds subject borrowers to fewer interest rate danger than noncallable bonds.c. Both a and b are true.d. None of the above claims are true.arrow_forward6. Pure expectations theory The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future short-term interest rates. A. Based on the pure expectations theory, is the following statement true or false? The pure expectations theory assumes that a one-year bond purchased today will have the same return as a one-year bond purchased five years from now. False True B. The yield on a one-year Treasury security is 5.8400%, and the two-year Treasury security has a 8.7600% yield. Assuming that the pure expectations theory is correct, what is the market’s estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) 14.936% 13.4071% 11.7606% 9.9965% C. Recall that on a one-year Treasury security the yield is 5.8400% and 8.7600% on a two-year Treasury security. Suppose the one-year security does not have a…arrow_forward3. Bond Prices (LO2) Malahat Inc. has 7.5% coupon bonds on the market that have ten years left to maturity. the bond make annual payments. If the YTM on these bonds is 8.75%, what is the current bond price?arrow_forward

- 5. Suppose the yield to maturity on a one-year zero-coupon bond is 5%.The yield to maturity on a two-year zero-coupon bond is 3%.(a) According to the Expectations Hypothesis, what is the expected one-year rate inthe marketplace for year 2?(b) Consider an investor who is absolutely convinced that interest rates will notchange so that the yield on a one-year bond will still be 5% this time next year.Which of these two bonds, the one-year zero coupon bond, or the two-year zerocoupon bond, should this investor buy to maximize their one year return (undertheir strongly-held belief about future rates)?arrow_forwardQ4: Consider a bond paying a coupon rate of 10% per year semi-annually when the market interest rate is only 4% per half-year. The bond has three years until maturity. This initial payment is $1000. A: What is find the bond’s price today and 6 months time after the next coupon is paid?arrow_forwardProblem 4: Suppose that the US Treasury bonds paying an 8% coupon rate with semiannual payments are currently trading at par value. What coupon rate would they have to pay in order to sell at par if they paid their coupons annually?arrow_forward