Concept explainers

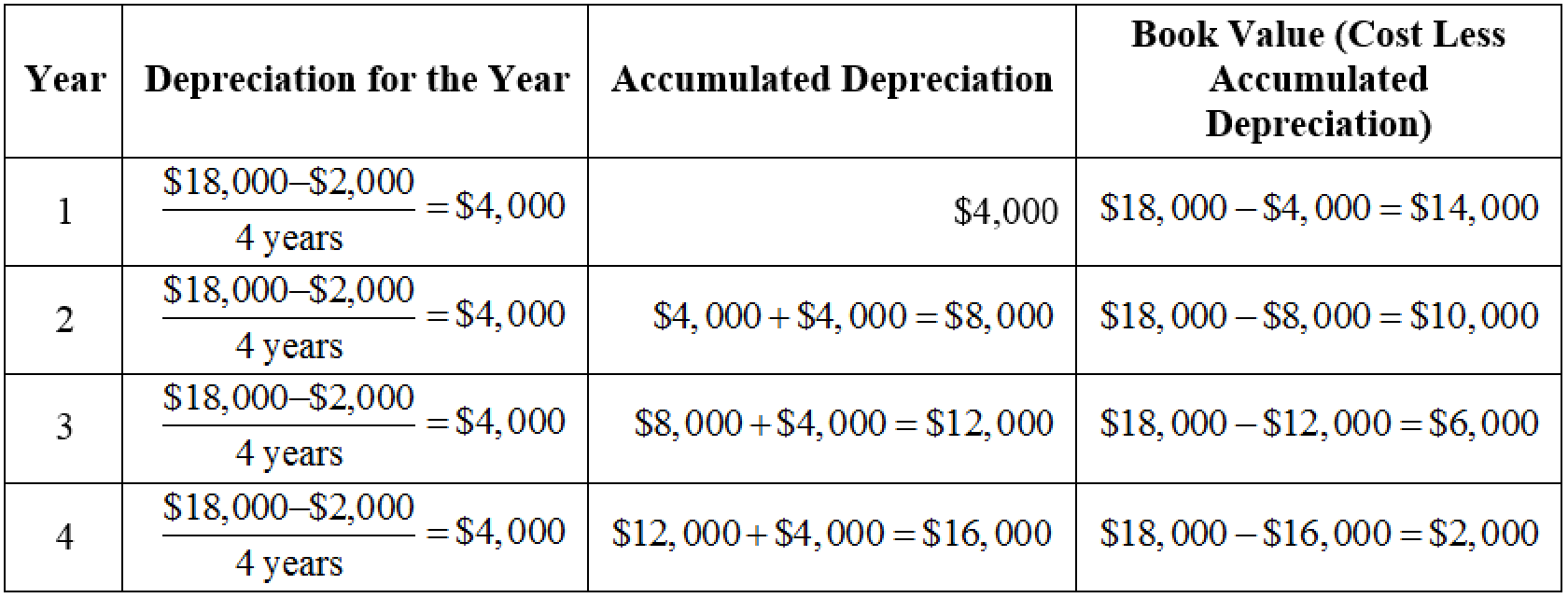

A delivery van was bought for $18,000. The estimated life of the van is four years. The trade-in value at the end of four years is estimated to be $2,000.

Required

Prepare a

Check Figure

Year 1 depreciation, $4,000

Prepare depreciation schedule for the four year estimated useful life of the delivery van under straight-line depreciation method.

Explanation of Solution

Straight-line method: The depreciation method which assumes that the consumption of economic benefits of long-term asset could be distributed equally throughout the useful life of the asset, is referred to as straight-line method.

Formula for straight-line depreciation method:

Prepare depreciation schedule for the four year estimated useful life of the delivery van under straight-line depreciation method, if cost of the asset is $18,000 and trade-in value is $2,000.

Table (1)

Want to see more full solutions like this?

Chapter A Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Principles of Accounting Volume 1

Principles Of Taxation For Business And Investment Planning 2020 Edition

Cost Accounting (15th Edition)

Intermediate Accounting

Managerial Accounting: Tools for Business Decision Making

- Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.arrow_forwardMontezuma Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montezuma uses the straight-line depreciation method. Calculate the annual depreciation expense. After three years of recording depreciation, Montezuma determines that the delivery truck will only be useful for another three years and that the salvage value will increase to $4,000. Determine the depreciation expense for the final three years of the assets life, and create the journal entry for year four.arrow_forwardA machine costing 350,000 has a salvage value of 15,000 and an estimated life of three years. Prepare depreciation schedules reporting the depreciation expense, accumulated depreciation, and book value of the machine for each year under the double-declining-balance and sum-of-the-years-digits methods. For the double-declining-balance method, round the depreciation rate to two decimal places.arrow_forward

- Colquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value at the time of purchase was $15,000, and it is expected to be used for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determines that the warehouse will be useful for only another fifteen years. Calculate annual depreciation expense for the first four years. Determine the depreciation expense for the final fifteen years of the assets life, and create the journal entry for year five.arrow_forwardLoban Company purchased four cars for 9,000 each and expects that they will be sold in 3 years for 1,500 each. The company uses group depreciation on a straight-line basis. Required: 1. Prepare journal entries to record the acquisition and the first years depreciation expense. 2. If one of the cars is sold at the beginning of the second year for 7,000, what journal entry is required?arrow_forwardMontello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for 120,000 miles. Montello uses the units-of-production depreciation method and in year one it expects to use the truck for 23,000 miles. Calculate the annual depreciation expense.arrow_forward

- Montezuma Inc. purchases a delivery truck for $20,000. The truck has a salvage value of $8,000 and is expected to be driven for ten years. Montezuma uses the straight-line depreciation method. Calculate the annual depreciation expense. After five years of recording depreciation, Montezuma determines that the delivery truck will be useful for another five years (ten years in total, as originally expected) and that the salvage value will increase to $10,000. Determine the depreciation expense for the final five years of the assets life, and create the journal entry for years 6–10 (the entry will be the same for each of the five years).arrow_forwardGrandorf Company replaced the engine in a truck for 8,000 and expects the new engine will extend the life of the truck two years beyond the original estimated life. Related information is provided below. Cost of truck 65,000 Salvage value 5,000 Original estimated life 6 years The truck was purchased on January 1, 20-1. The engine was replaced on January 1, 20-6. Using straight-line depreciation, compute depreciation expense for 20-6.arrow_forwardWhen depreciation is recorded each period, what account is debited? a. Depreciation Expense b. Cash c. Accumulated Depreciation d. The fixed asset account involved Use the following information for Multiple-Choice Questions 7-4 through 7-6: Cox Inc. acquired a machine for on January 1, 2019. The machine has a salvage value of $20,000 and a 5-year useful life. Cox expects the machine to run for 15,000 machine hours. The machine was actually used for 4,200 hours in 2019 and 3,450 hours in 2020.arrow_forward

- A machine with a 4-year estimated useful life and an estimated 15% residual value was acquired on January 1. Would depreciation expense using the sum-of-the-years-digits method be higher or lower than depreciation expense using the double-declining balance method in the first and second years:arrow_forwardA truck was recently purchased for 75,000 with a salvage value of 5,000 and an estimated useful life of eight years or 150,000 miles (24,000 miles per year for the first five years and 10,000 miles per year after that). Enter the new information in the Data Section of the worksheet. Again, make sure the totals for all three methods are in agreement. Print the worksheet. Save this new data as DEPREC5.arrow_forwardUse the information in Problem A-1 to solve this problem. Assume that the van is five-year property for tax purposes. Required Prepare a schedule of depreciation under MACRS. Round figures to the nearest whole dollar. PROBLEM A-1 A delivery van was bought for 18,000. The estimated life of the van is four years. The trade-in value at the end of four years is estimated to be 2,000. Check Figure Year 3 depreciation, 3,456arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning