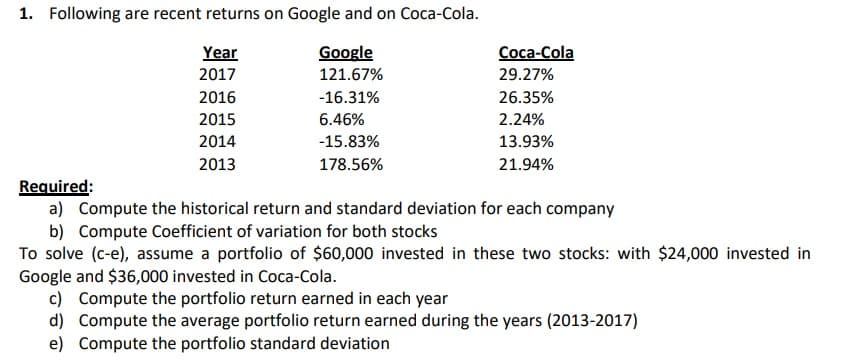

1. Following are recent returns on Google and on Coca-Cola. Year Google Coca-Cola 2017 121.67% 29.27% 2016 -16.31% 26.35% 2015 6.46% 2.24% 2014 -15.83% 13.93% 2013 178.56% 21.94% Required: a) Compute the historical return and standard deviation for each company b) Compute Coefficient of variation for both stocks To solve (c-e), assume a portfolio of $60,000 invested in these two stocks: with $24,000 invested in Google and $36,000 invested in Coca-Cola. c) Compute the portfolio return earned in each year

1. Following are recent returns on Google and on Coca-Cola. Year Google Coca-Cola 2017 121.67% 29.27% 2016 -16.31% 26.35% 2015 6.46% 2.24% 2014 -15.83% 13.93% 2013 178.56% 21.94% Required: a) Compute the historical return and standard deviation for each company b) Compute Coefficient of variation for both stocks To solve (c-e), assume a portfolio of $60,000 invested in these two stocks: with $24,000 invested in Google and $36,000 invested in Coca-Cola. c) Compute the portfolio return earned in each year

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter14: Valuation: Market-based Approach

Section: Chapter Questions

Problem 1KIC

Related questions

Question

Answered only b,c

Transcribed Image Text:1. Following are recent returns on Google and on Coca-Cola.

Year

Google

Coca-Cola

2017

121.67%

29.27%

2016

-16.31%

26.35%

2015

6.46%

2.24%

2014

-15.83%

13.93%

2013

178.56%

21.94%

Required:

a) Compute the historical return and standard deviation for each company

b) Compute Coefficient of variation for both stocks

To solve (c-e), assume a portfolio of $60,000 invested in these two stocks: with $24,000 invested in

Google and $36,000 invested in Coca-Cola.

c) Compute the portfolio return earned in each year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning