1. In the short run, when prices are partially sticky, the observed general equilibrium relationship between the output gap and prices is best described as: A. There is no relationship between output gap and prices. B. The relationship between output gap and prices depends on the type of shocks affecting the economy. C. A positive output gap will always be associated with an increase in prices. D. None of the above is correct.

1. In the short run, when prices are partially sticky, the observed general equilibrium relationship between the output gap and prices is best described as: A. There is no relationship between output gap and prices. B. The relationship between output gap and prices depends on the type of shocks affecting the economy. C. A positive output gap will always be associated with an increase in prices. D. None of the above is correct.

Chapter16: Monetary Policy

Section16.A: Policy Disputes Using The Self Correcting Aggregate Demand And Supply Model

Problem 4SQP

Related questions

Question

multiple choice questions

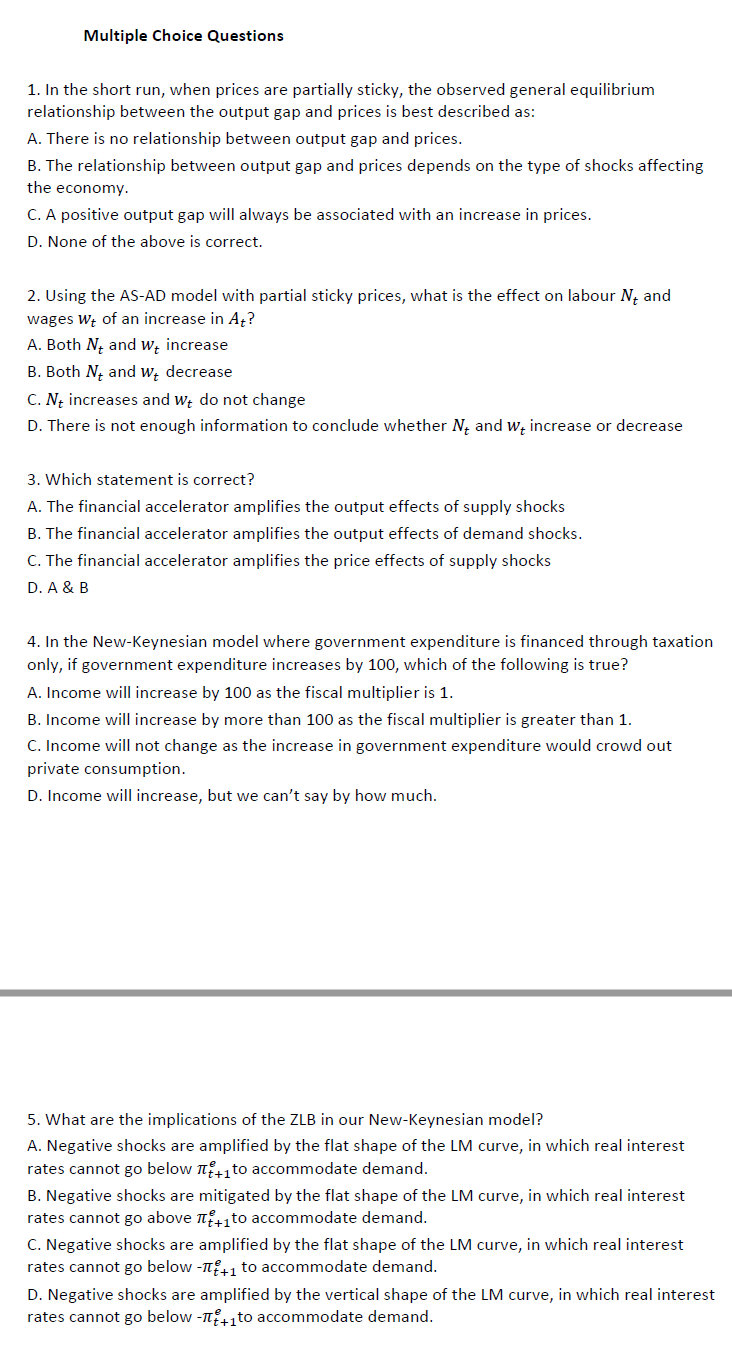

Transcribed Image Text:Multiple Choice Questions

1. In the short run, when prices are partially sticky, the observed general equilibrium

relationship between the output gap and prices is best described as:

A. There is no relationship between output gap and prices.

B. The relationship between output gap and prices depends on the type of shocks affecting

the economy.

C. A positive output gap will always be associated with an increase in prices.

D. None of the above is correct.

2. Using the AS-AD model with partial sticky prices, what is the effect on labour N₁ and

wages Wt of an increase in At?

A. Both N, and we increase

B. Both N and Wt decrease

C. Nt increases and we do not change

D. There is not enough information to conclude whether N and we increase or decrease

3. Which statement is correct?

A. The financial accelerator amplifies the output effects of supply shocks

B. The financial accelerator amplifies the output effects of demand shocks.

C. The financial accelerator amplifies the price effects of supply shocks

D. A & B

4. In the New-Keynesian model where government expenditure is financed through taxation

only, if government expenditure increases by 100, which of the following is true?

A. Income will increase by 100 as the fiscal multiplier is 1.

B. Income will increase by more than 100 as the fiscal multiplier is greater than 1.

C. Income will not change as the increase in government expenditure would crowd out

private consumption.

D. Income will increase, but we can't say by how much.

5. What are the implications of the ZLB in our New-Keynesian model?

A. Negative shocks are amplified by the flat shape of the LM curve, in which real interest

rates cannot go below to accommodate demand.

B. Negative shocks are mitigated by the flat shape of the LM curve, in which real interest

rates cannot go above π+1to accommodate demand.

C. Negative shocks are amplified by the flat shape of the LM curve, in which real interest

rates cannot go below -π+1 to accommodate demand.

D. Negative shocks are amplified by the vertical shape of the LM curve, in which real interest

rates cannot go below -+₁to accommodate demand.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 7 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning