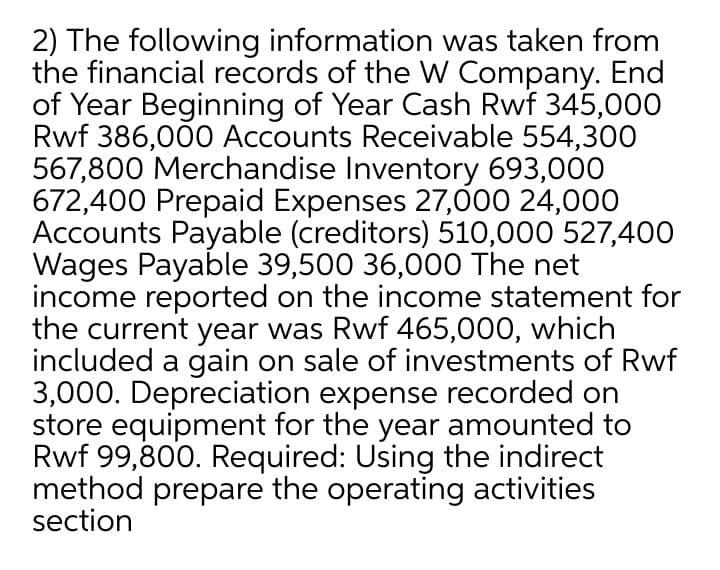

2) The following information was taken from the financial records of the W Company. End of Year Beginning of Year Cash Rwf 345,000 Rwf 386,000 Accounts Receivable 554,300 567,800 Merchandise Inventory 693,000 672,400 Prepaid Expenses 27,000 24,000 Accounts Payable (creditors) 510,000 527,400 Wages Payable 39,500 36,00O The net income reported on the income statement for the current year was Rwf 465,000, which included a gain on sale of investments of Rwf 3,000. Depreciation expense recorded on store equipment for the year amounted to Rwf 99,800. Required: Using the indirect method prepare the operating activities section

2) The following information was taken from the financial records of the W Company. End of Year Beginning of Year Cash Rwf 345,000 Rwf 386,000 Accounts Receivable 554,300 567,800 Merchandise Inventory 693,000 672,400 Prepaid Expenses 27,000 24,000 Accounts Payable (creditors) 510,000 527,400 Wages Payable 39,500 36,00O The net income reported on the income statement for the current year was Rwf 465,000, which included a gain on sale of investments of Rwf 3,000. Depreciation expense recorded on store equipment for the year amounted to Rwf 99,800. Required: Using the indirect method prepare the operating activities section

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 35E: Jarem Company showed 189,000 in prepaid rent on December 31, 20X1. On December 31, 20X2, the balance...

Related questions

Question

Transcribed Image Text:2) The following information was taken from

the financial records of the W Company. End

of Year Beginning of Year Cash Rwf 345,000

Rwf 386,000 Accounts Receivable 554,30O

567,800 Merchandise Inventory 693,000

672,400 Prepaid Expenses 27,000 24,000

Accounts Payable (creditors) 510,000 527,400

Wages Payable 39,500 36,000 The net

income reported on the income statement for

the current year was Rwf 465,000, which

included a gain on sale of investments of Rwf

3,000. Depreciation expense recorded on

store equipment for the year amounted to

Rwf 99,800. Required: Using the indirect

method prepare the operating activities

section

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning