2. Using the indirect method of cash flow statement, what is the net cash provided by investing actiivities for the year 2020? * O A) Cash inflows of $91o B) Cash outflows of $910 O C) Cash inflows of $990

2. Using the indirect method of cash flow statement, what is the net cash provided by investing actiivities for the year 2020? * O A) Cash inflows of $91o B) Cash outflows of $910 O C) Cash inflows of $990

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5PA: The following selected accounts and their current balances appear in the ledger of Clairemont Co....

Related questions

Question

Transcribed Image Text:AlpQLSdhx7wkRBg-5ysLm-AeX919m2L5F4Jxzbwov4D68iWUmoFzSg/formResponse?pli=1

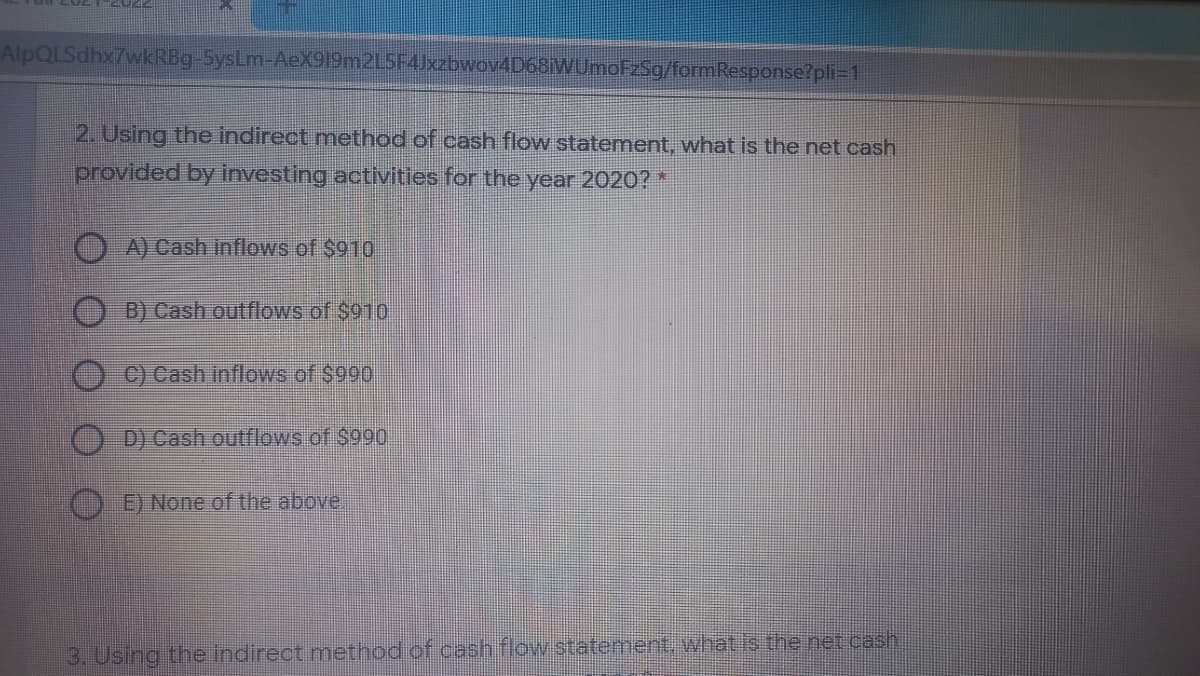

2. Using the indirect method of cash flow statement, what is the net cash

provided by investing activities for the year 2020? *

A) Cash inflows of $910

B) Cash outflows of $910

C) Cash inflows of $990

D) Cash outflows.of $990,

E) None of the above.

3. Using the indirect method of cash flow statenent, what is the net cash

Transcribed Image Text:Your email will be recorded when you submit this form

* Required

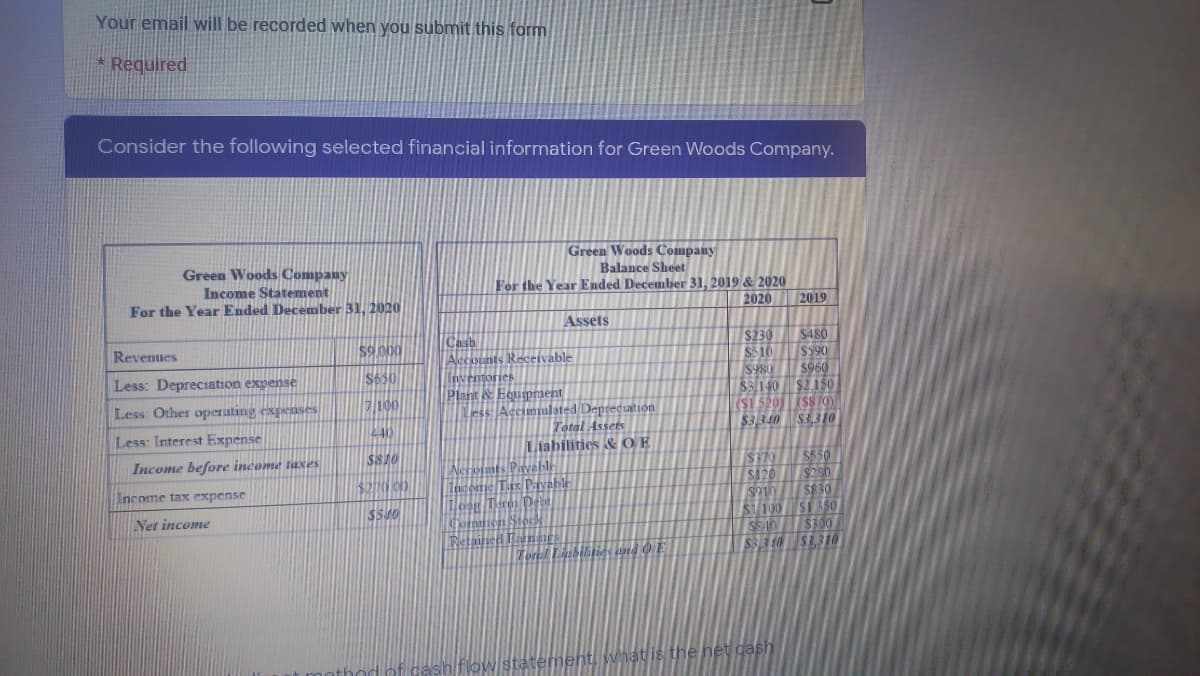

Consider the following selected financial information for Green Woods Company.

Green Woods Company

Income Statement

For the Year Ended December 31, 2020

Green Woods Company

Balance Sheet

For the Year Ended December 31, 2019 & 2020

2020

2019

Assets

|Cash

Accounts Receivable

Inventories

Plant & Equipment

Less: Accimiulated Depreciation

$480

$510 S$90

$960

Revenues

S650

7/100

S980

$3140 $2.150

(S1 520)S870)

$3.3.40 S3,310

Less: Depreciation expense

Less: Other operating expenses

Total Assets

Liabilities &OE

Less: Interest Expense

40

$810

Is17015550

T/S120/S2.80

Income before income taxes

INehornts Paable

Income Tax Payable

Income tax expense

$S40

S7100 / SĨ350

Net income

Retained FarnenE

What is the het dash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning