Question 5 Financial statement analysis and ratios 1 The following ratios were provided for Laura Ltd: RATIOS 2019 2020 2020 Industry Average Quick Ratio 1.2:1 0.4:1 1.1:1 Current Ratio 1.8:1 0.9:1 1.8:1 Inventory Turnover 16 times 12 times 18 times Average Collection Period of Receivables 30 days 60 days 20 days Debt Ratio 40% 60% 30%

Question 5 Financial statement analysis and ratios 1 The following ratios were provided for Laura Ltd: RATIOS 2019 2020 2020 Industry Average Quick Ratio 1.2:1 0.4:1 1.1:1 Current Ratio 1.8:1 0.9:1 1.8:1 Inventory Turnover 16 times 12 times 18 times Average Collection Period of Receivables 30 days 60 days 20 days Debt Ratio 40% 60% 30%

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter4: Accounting For Retail Operations

Section: Chapter Questions

Problem 4.2MBA: Sales transactions Using transactions listed in P4-2, indicate the effects of each transaction on...

Related questions

Question

Please answer required 1,2,3

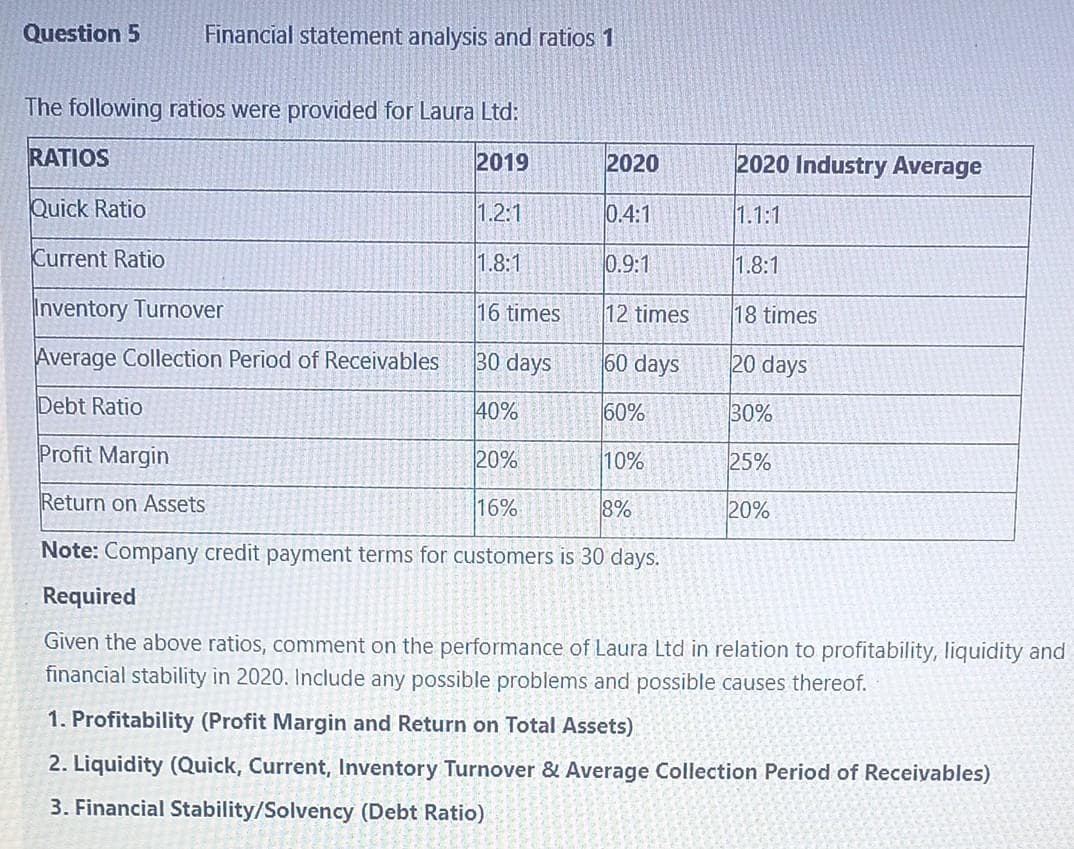

Transcribed Image Text:Question 5

Financial statement analysis and ratios 1

The following ratios were provided for Laura Ltd:

RATIOS

2019

2020

2020 Industry Average

Quick Ratio

1.2:1

0.4:1

1.1:1

Current Ratio

1.8:1

0.9:1

1.8:1

Inventory Turnover

16 times

12 times

18 times

Average Collection Period of Receivables

30 days

60 days

20 days

Debt Ratio

40%

60%

30%

Profit Margin

20%

10%

25%

Return on Assets

16%

8%

20%

Note: Company credit payment terms for customers is 30 days.

Required

Given the above ratios, comment on the performance of Laura Ltd in relation to profitability, liquidity and

financial stability in 2020. Include any possible problems and possible causes thereof.

1. Profitability (Profit Margin and Return on Total Assets)

2. Liquidity (Quick, Current, Inventory Turnover & Average Collection Period of Receivables)

3. Financial Stability/Solvency (Debt Ratio)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning