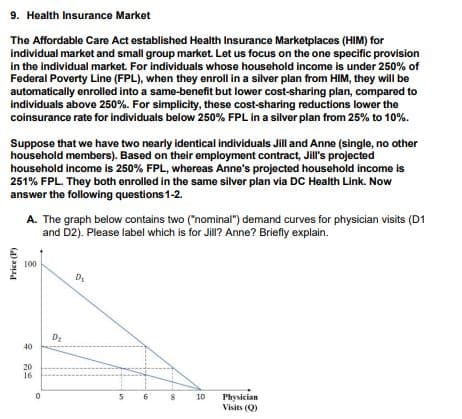

9. Health Insurance Market The Affordable Care Act established Health Insurance Marketplaces (HIM) for individual market and small group market. Let us focus on the one specific provision in the individual market. For individuals whose household income is under 250% of Federal Poverty Line (FPL), when they enroll in a silver plan from HIM, they will be automatically enrolled into a same-benefit but lower cost-sharing plan, compared to individuals above 250%. For simplicity, these cost-sharing reductions lower the coinsurance rate for individuals below 250% FPL in a silver plan from 25% to 10%. Suppose that we have two nearly identical individuals Jill and Anne (single, no other household members). Based on their employment contract, Jill's projected household income is 250% FPL, whereas Anne's projected household income is 251% FPL. They both enrolled in the same silver plan via DC Health Link. Now answer the following questions 1-2. A. The graph below contains two ("nominal") demand curves for physician visits (D1 and D2). Please label which is for Jill? Anne? Briefly explain. 100 D₂ 10 Physician Visits (Q) Price (P) 40 20 16 D₂ an

9. Health Insurance Market The Affordable Care Act established Health Insurance Marketplaces (HIM) for individual market and small group market. Let us focus on the one specific provision in the individual market. For individuals whose household income is under 250% of Federal Poverty Line (FPL), when they enroll in a silver plan from HIM, they will be automatically enrolled into a same-benefit but lower cost-sharing plan, compared to individuals above 250%. For simplicity, these cost-sharing reductions lower the coinsurance rate for individuals below 250% FPL in a silver plan from 25% to 10%. Suppose that we have two nearly identical individuals Jill and Anne (single, no other household members). Based on their employment contract, Jill's projected household income is 250% FPL, whereas Anne's projected household income is 251% FPL. They both enrolled in the same silver plan via DC Health Link. Now answer the following questions 1-2. A. The graph below contains two ("nominal") demand curves for physician visits (D1 and D2). Please label which is for Jill? Anne? Briefly explain. 100 D₂ 10 Physician Visits (Q) Price (P) 40 20 16 D₂ an

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

ChapterST7: The Economics Of Health Care

Section: Chapter Questions

Problem 1CQ

Related questions

Question

Transcribed Image Text:9. Health Insurance Market

The Affordable Care Act established Health Insurance Marketplaces (HIM) for

individual market and small group market. Let us focus on the one specific provision

in the individual market. For individuals whose household income is under 250% of

Federal Poverty Line (FPL), when they enroll in a silver plan from HIM, they will be

automatically enrolled into a same-benefit but lower cost-sharing plan, compared to

individuals above 250%. For simplicity, these cost-sharing reductions lower the

coinsurance rate for individuals below 250% FPL in a silver plan from 25% to 10%.

Suppose that we have two nearly identical individuals Jill and Anne (single, no other

household members). Based on their employment contract, Jill's projected

household income is 250% FPL, whereas Anne's projected household income is

251% FPL. They both enrolled in the same silver plan via DC Health Link. Now

answer the following questions 1-2.

A. The graph below contains two ("nominal") demand curves for physician visits (D1

and D2). Please label which is for Jill? Anne? Briefly explain.

100

D₂

8

10 Physician

Visits (Q)

Price (P)

40

20

16

D₂

5

10

00

Transcribed Image Text:B. If the nominal price per physician visit changes from $40 to $20 per physician

visit, what are the coinsurance for Jill and Anne, at $40 per visit and $20

respectively? And explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc