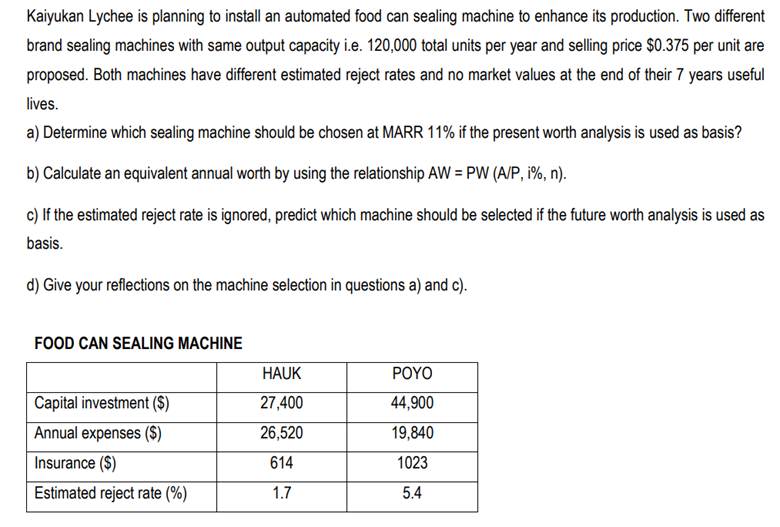

a) Determine which sealing machine should be chosen at MARR 11% if the present worth analysis is used as basis? b) Calculate an equivalent annual worth by using the relationship AW = PW (A/P, i%, n). c) If the estimated reject rate is ignored, predict which machine should be selected if the future worth analysis is used as basis. d) Give your reflections on the machine selection in questions a) and c).

Q: What is the IRR of the project? % (Round to two decimal places.) At what adjusted WACCS will the…

A: To find the IRR, we need to solve the following equation: $0 = -9847216 + $2814000 / (1+IRR) +…

Q: COST-BENEFIT ANALYSIS Listed in the diagram for Problem 7 are some probability estimates of the…

A: Cost-Benefit Analysis a). NPV: NPV is calculated for the recurring cost according to the probability…

Q: Which of the following statements are correct in the context of Annual Worth Value Calculations?…

A: a) If the period of need is greater or equal to the LCM of the lives of all alternatives, we need to…

Q: 1. What is sensitivity analysis?

A: A sensitivity analysis is a technique or study that investigate how multiple values of an…

Q: any is thinking in investing in one of two potential new products for sale. The projections are as…

A: IRR is the internal rate of return at which present value of cash flow is equal to initial…

Q: What is the amount to use as the annual sales figure when evaluating this project? Note: Do not…

A: Sales revenue refers to the amount received by the company from selling goods and services to the…

Q: Use the following alternatives to develop an incremental analysis choice table and answer the…

A: Internal rate of return: It is the rate where the net present value of a project becomes zero and…

Q: Evaluate the two alternatives A and B and decide the economic justified alternative using: Present…

A: Comment- Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: The following data have been estimated for two feasible investments, A and B, for which revenues as…

A:

Q: Home Innovations is evaluating a new product design. The estimated receipts and disbursements…

A: Net Present Value is the difference between present value of inflows and present value of outflows.…

Q: You have been tasked to conduct a conventional B/C analysis for a security system upgrade at your…

A: The cost-benefit analysis is used to find out if the project being undertaken is justified by…

Q: Plot a sensitivity graph for annual worth versus initial cost, annual revenue, and salvage value for…

A: Sensitivity analysis is performed to assess the impact of change in any variable, on the overall…

Q: d. From your answers to parts a-c, which project would be selected? -Select- If the WACC was 18%,…

A: Capital budgeting methods: There are several techniques that can be used to evaluate prospective…

Q: a rational investor would choose:

A: Standard Deviation: It measures the variation for a set of values. It also indicates the risk of…

Q: NPV (TL) A Project B Project 750 1000 1250 1500 1750 0.1 0.15 0.2 0.25 0.3 0.15 0.25 0.3 0.1 0.2

A: The question is based on the concept of calculation of expected value ,standard deviation and…

Q: Based on a present worth measure of worth, complete a multi-parameter sensitivity analysis that…

A: Here since the lives have probability ranges from 8 to 12, we need to do the Annual Worth…

Q: 2. Based on an approximation with the beta distribution, which has been used in project management…

A: To find the mean of the annual benefit under each situation simple add the annual benefit and divide…

Q: A firm evaluates all of its projects by applying the IRR rule. a. What is the project's IRR? (Do…

A: Required return is 15% To Find: IRR of the project Acceptance of project

Q: Suppose that, for an engineering project, the optimistic, most likely, and pessimistic estimates are…

A: Annual worth refers to the power of a project to generate cash during the period of a single year.…

Q: Suppose the MARR is 10% with probability 0.25, 12% with probability 0.50, and 15% with probability…

A:

Q: Consider the following 2 alternatives. The cost and benefit information for the 2 alternatives is in…

A: The question is based on the concept of net present worth calculation for two mutually exclusive…

Q: Ziege Systems is considering the following independent projects for the coming year: Project…

A: When the WACC is above the rate of return then the project would be rejected and if WACC is below…

Q: Laramie Labs uses a risk-adjustment when evaluating projects of different risk. Its overall…

A: The project whose expected return is more than the required rate of return that project will…

Q: Given the data in the table below, choose the better alternative using net present value (NPV)…

A: The question is related to Capital Budgeting. The Net Present Value is calculated with the help of…

Q: ou have been asked to compute the cash equivalent price of a machine assuming the cost (including…

A: The correct answer in the given question is: A)Present value of a single amount.

Q: Generro Company is considering the purchase of equipment that would cost $36,000 and offer annual…

A: Given that, Present value of cash outflows = $36000 Cash inflows = $10500 for 5 years Required…

Q: Compute the net present value for each project. (Round answers to 0 decimal places, e.g. 125. If the…

A: Net Present Value=Sum of the present value of cash inflows-Present value of cash outflows Project…

Q: COST-BENEFIT ANALYSIS Listed in the diagram for Problem 7 are some probability estimates of the…

A: Net Present Value (NPV) is a capital budgeting method and investment planning support to estimate…

Q: 1. What is the IRR for each of these projects? (Do not round intermediate calculations and enter…

A: Introduction: Net present value & IRR are the capital budgeting techniques used by the…

Q: Which alternative is the most economical among the three alternatives shown their details in Table…

A: Future Worth refers to the value of current assets at a specified growth rate in the future for a…

Q: You have been assigned to perform a project selection based on profitability index. You have…

A: Profitability Index: It is a capital budgeting technique in which projects are ranked according to…

Q: Which one of the following is the proper dollar value of existing equipment to use in replacement…

A: An equipment is replaced when the revenue earned from this equipment is lower than the new equipment…

Q: The table below shows internal rate of return for three investment projects A, B and C and there…

A: Solution- Internal rate of return (IRR)- This is the rate at which the present price/value of future…

Q: Assume a project has three variables: life, first cost, and annual cost. Assume there is no salvage…

A: The net present worth also known as the net present value calculated the difference between the…

Q: The table below shows internal rate of return for three investment projects A, B and C and there…

A: The question is multiple choice question Required Choose the Correct Option.

Q: Suppose a firm is considering two mutually exclusive projects. One has alife of 6 years and the…

A: Yes, bias exists in NPV analysis. If firm is considering two mutually exclusive projects and a firm…

Q: Alternatives A B Cost x P3,200 Salvage Value 900 600 Annual Benefit 1150 720 Life (years) 18

A: The benefit-cost ratio is an indicator that shows the relationship between the relative costs and…

Q: To illustrate how a sensitivity analysis might be performed, we consider once more the SMP…

A: AW (Annual Worth) analysis is done using the sensitivity analysis by estimation of all the receipts…

Q: Use the information provided below to answer the following questions. Where applicable, use the…

A: Payback period Payback period is the span of time required to recover the original initial…

Q: Data for 2 alternatives are given below, determine the cost of alternative B so that the two…

A: The benefit-to-cost ratio analysis measures the profitability of a project. It uses the relation…

Q: Machine A Machine B Which machine should be selected using the Net present value, (cost of capital…

A: Given information : Period Machine A Machine B 0 -750000 -750000 1 100000 250000 2 200000…

Q: Given the financial data for four mutually exclusive alternatives in the table below, determine the…

A: The rate of return from the incremental analysis will be calculated using the IRR method and then…

Q: What is the NPV of the systems? (Enter negative amounts using negative sign, e.g. -45.25. Do not…

A: Calculation of NPV: System 100 Time Cash Flows Present Value Factor (11.50%) Present…

Step by step

Solved in 2 steps with 2 images

- Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.Den-Tex Company is evaluating a proposal to replace its HID (high intensity discharge) lighting with LED (light emitting diode) lighting throughout its warehouse. LED lighting consumes less power and lasts longer than HID lighting for similar performance. The following information was developed: a. Determine the investment cost for replacing the 700 fixtures. b. Determine the annual utility cost savings from employing the new energy solution. c. Should the proposal be accepted? Evaluate the proposal using net present value, assuming a 15-year life and 8% minimum rate of return. (Present value factors are available in Appendix A.)Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)

- Boxer Production, Inc., is in the process of considering a flexible manufacturing system that will help the company react more swiftly to customer needs. The controller, Mick Morrell, estimated that the system will have a 10-year life and a required return of 10% with a net present value of negative $500,000. Nevertheless, he acknowledges that he did not quantify the potential sales increases that might result from this improvement on the issue of on-time delivery, because it was too difficult to quantify. If there is a general agreement that qualitative factors may offer an additional net cash flow of $150,000 per year, how should Boxer proceed with this Investment?Nico Parts, Inc., produces electronic products with short life cycles (of less than two years). Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics costs low. Recently, management has also decided that post-purchase costs are important in design decisions. Last month, a proposal for a new product was presented to management. The total market was projected at 200,000 units (for the two-year period). The proposed selling price was 130 per unit. At this price, market share was expected to be 25 percent. The manufacturing and logistics costs were estimated to be 120 per unit. Upon reviewing the projected figures, Brian Metcalf, president of Nico, called in his chief design engineer, Mark Williams, and his marketing manager, Cathy McCourt. The following conversation was recorded: BRIAN: Mark, as you know, we agreed that a profit of 15 per unit is needed for this new product. Also, as I look at the projected market share, 25 percent isnt acceptable. Total profits need to be increased. Cathy, what suggestions do you have? CATHY: Simple. Decrease the selling price to 125 and we expand our market share to 35 percent. To increase total profits, however, we need some cost reductions as well. BRIAN: Youre right. However, keep in mind that I do not want to earn a profit that is less than 15 per unit. MARK: Does that 15 per unit factor in preproduction costs? You know we have already spent 100,000 on developing this product. To lower costs will require more expenditure on development. BRIAN: Good point. No, the projected cost of 120 does not include the 100,000 we have already spent. I do want a design that will provide a 15-per-unit profit, including consideration of preproduction costs. CATHY: I might mention that post-purchase costs are important as well. The current design will impose about 10 per unit for using, maintaining, and disposing our product. Thats about the same as our competitors. If we can reduce that cost to about 5 per unit by designing a better product, we could probably capture about 50 percent of the market. I have just completed a marketing survey at Marks request and have found out that the current design has two features not valued by potential customers. These two features have a projected cost of 6 per unit. However, the price consumers are willing to pay for the product is the same with or without the features. Required: 1. Calculate the target cost associated with the initial 25 percent market share. Does the initial design meet this target? Now calculate the total life-cycle profit that the current (initial) design offers (including preproduction costs). 2. Assume that the two features that are apparently not valued by consumers will be eliminated. Also assume that the selling price is lowered to 125. a. Calculate the target cost for the 125 price and 35 percent market share. b. How much more cost reduction is needed? c. What are the total life-cycle profits now projected for the new product? d. Describe the three general approaches that Nico can take to reduce the projected cost to this new target. Of the three approaches, which is likely to produce the most reduction? 3. Suppose that the Engineering Department has two new designs: Design A and Design B. Both designs eliminate the two nonvalued features. Both designs also reduce production and logistics costs by an additional 8 per unit. Design A, however, leaves post-purchase costs at 10 per unit, while Design B reduces post-purchase costs to 4 per unit. Developing and testing Design A costs an additional 150,000, while Design B costs an additional 300,000. Assuming a price of 125, calculate the total life-cycle profits under each design. Which would you choose? Explain. What if the design you chose cost an additional 500,000 instead of 150,000 or 300,000? Would this have changed your decision? 4. Refer to Requirement 3. For every extra dollar spent on preproduction activities, how much benefit was generated? What does this say about the importance of knowing the linkages between preproduction activities and later activities?Oberweis Dairy switched from delivery trucks with regular gasoline engines to ones with diesel engines. The diesel trucks cost $6,000 more than the ordinary gasoline trucks but costs $1,800 per year less to operate. Assume that Oberweis saves the operating costs at the end of each month. If Oberweis uses a discount rate of 1% per month, approximately how many months, at a minimum, must the diesel trucks remain in service for the switch to be sensible?

- Thaler Company bought 26,000 of raw materials a year ago in anticipation of producing 5,000 units of a deluxe version of its product to be priced at 75 each. Now the price of the deluxe version has dropped to 35 each, and Thaler is now deciding whether to produce 1,500 units of the deluxe version at a cost of 48,000 or to scrap the project. What is the opportunity cost of this decision? a. 175,000 b. 375,000 c. 48,000 d. 26,000Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?Newmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new design will eliminate the production of a toxic solid residue. The initial cost of the system is estimated at 860,000 and includes computerized equipment, software, and installation. There is no expected salvage value. The new system has a useful life of 8 years and is projected to produce cash operating savings of 225,000 per year over the old system (reducing labor costs and costs of processing and disposing of toxic waste). The cost of capital is 16%. Required: 1. Compute the NPV of the new system. 2. One year after implementation, the internal audit staff noted the following about the new system: (1) the cost of acquiring the system was 60,000 more than expected due to higher installation costs, and (2) the annual cost savings were 20,000 less than expected because more labor cost was needed than anticipated. Using the changes in expected costs and benefits, compute the NPV as if this information had been available one year ago. Did the company make the right decision? 3. CONCEPTUAL CONNECTION Upon reporting the results mentioned in the postaudit, the marketing manager responded in a memo to the internal audit department indicating that cash inflows also had increased by a net of 60,000 per year because of increased purchases by environmentally sensitive customers. Describe the effect that this has on the analysis in Requirement 2. 4. CONCEPTUAL CONNECTION Why is a postaudit beneficial to a firm?

- At Stardust Gems, a faux gem and jewelry company, the setting department is a bottleneck. The company is considering hiring an extra worker, whose salary will be $67,000 per year, to ease the problem. Using the extra worker, the company will be able to produce and sell 9,000 more units per year. The selling price per unit is $20. The cost per unit currently is $15.85 as shown: What is the annual financial impact of hiring the extra worker for the bottleneck process?Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.15. The machine will increase fixed costs by $18,250 per year. The information they will use to consider these changes is shown here.The J.R. Ryland Computer Company is considering a plant expansion to enable the company to begin production of a new computer product. The companys president must determine whether to make the expansion a medium- or large-scale project. Demand for the new product is uncertain, which for planning purposes may be low demand, medium demand, or high demand. The probability estimates for demand are 0.20, 0.50, and 0.30, respectively. Letting x and y indicate the annual profit in thousands of dollars, the firms planners developed the following profit forecasts for the medium-and large-scale expansion projects. a. Compute the expected value for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of maximizing the expected profit? b. Compute the variance for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of minimizing the risk or uncertainty?