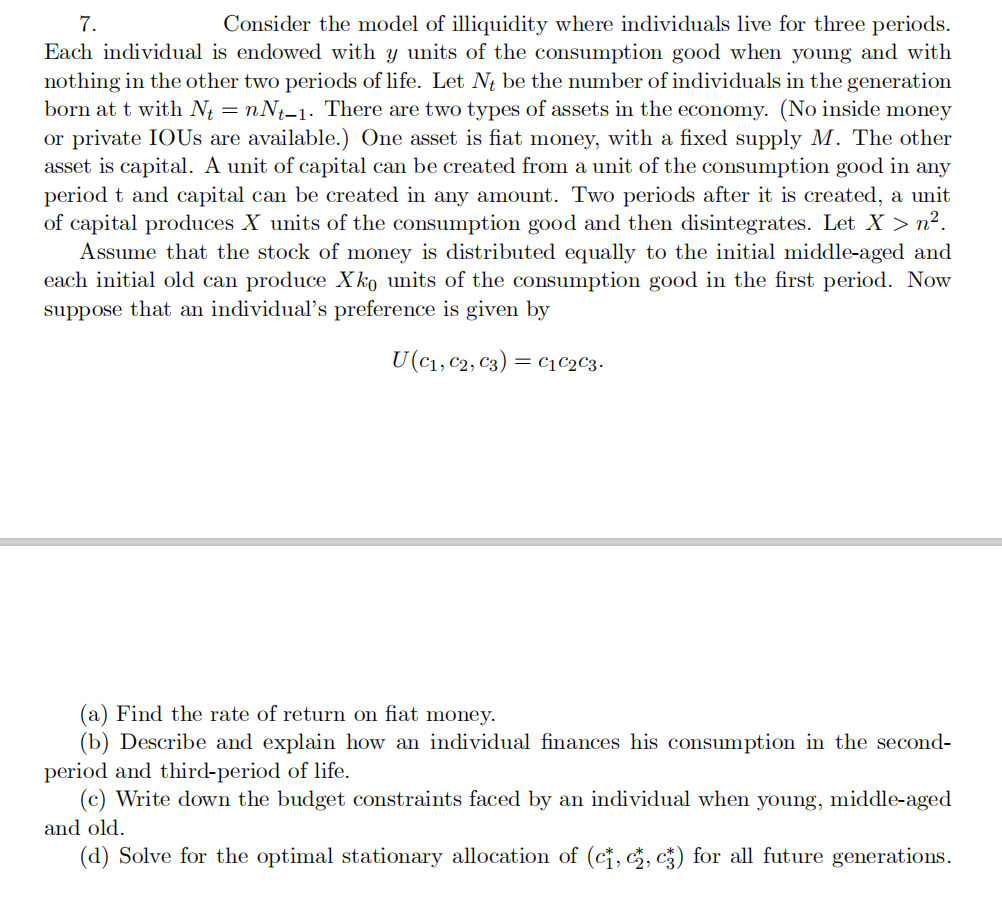

7. Consider the model of illiquidity where individuals live for three periods. Each individual is endowed with y units of the consumption good when young and with nothing in the other two periods of life. Let Nt be the number of individuals in the generation born at t with Nt = nNt-1. There are two types of assets in the economy. (No inside money or private IOUS are available.) One asset is fiat money, with a fixed supply M. The other asset is capital. A unit of capital can be created from a unit of the consumption good in any period t and capital can be created in any amount. Two periods after it is created, a unit of capital produces X units of the consumption good and then disintegrates. Let X > n². Assume that the stock of money is distributed equally to the initial middle-aged and each initial old can produce Xko units of the consumption good in the first period. Now suppose that an individual's preference is given by U(C₁, C2, C3) = C1 C₂ C3. (a) Find the rate of return on fiat money. (b) Describe and explain how an individual finances his consumption in the second- period and third-period of life. (c) Write down the budget constraints faced by an individual when young, middle-aged and old. (d) Solve for the optimal stationary allocation of (c1, c₂, c) for all future generations.

7. Consider the model of illiquidity where individuals live for three periods. Each individual is endowed with y units of the consumption good when young and with nothing in the other two periods of life. Let Nt be the number of individuals in the generation born at t with Nt = nNt-1. There are two types of assets in the economy. (No inside money or private IOUS are available.) One asset is fiat money, with a fixed supply M. The other asset is capital. A unit of capital can be created from a unit of the consumption good in any period t and capital can be created in any amount. Two periods after it is created, a unit of capital produces X units of the consumption good and then disintegrates. Let X > n². Assume that the stock of money is distributed equally to the initial middle-aged and each initial old can produce Xko units of the consumption good in the first period. Now suppose that an individual's preference is given by U(C₁, C2, C3) = C1 C₂ C3. (a) Find the rate of return on fiat money. (b) Describe and explain how an individual finances his consumption in the second- period and third-period of life. (c) Write down the budget constraints faced by an individual when young, middle-aged and old. (d) Solve for the optimal stationary allocation of (c1, c₂, c) for all future generations.

Chapter17: Capital And Time

Section: Chapter Questions

Problem 17.1P

Related questions

Question

Transcribed Image Text:7.

Consider the model of illiquidity where individuals live for three periods.

Each individual is endowed with y units of the consumption good when young and with

nothing in the other two periods of life. Let Nt be the number of individuals in the generation

born at t with N₁ = nNt-1. There are two types of assets in the economy. (No inside money

or private IOUS are available.) One asset is fiat money, with a fixed supply M. The other

asset is capital. A unit of capital can be created from a unit of the consumption good in any

period t and capital can be created in any amount. Two periods after it is created, a unit

of capital produces X units of the consumption good and then disintegrates. Let X > n².

Assume that the stock of money is distributed equally to the initial middle-aged and

each initial old can produce Xko units of the consumption good in the first period. Now

suppose that an individual's preference is given by

U(C₁, C2, C3) = C₁ C2 C3.

(a) Find the rate of return on fiat money.

(b) Describe and explain how an individual finances his consumption in the second-

period and third-period of life.

(c) Write down the budget constraints faced by an individual when young, middle-aged

and old.

(d) Solve for the optimal stationary allocation of (c1, c₂, c) for all future generations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax