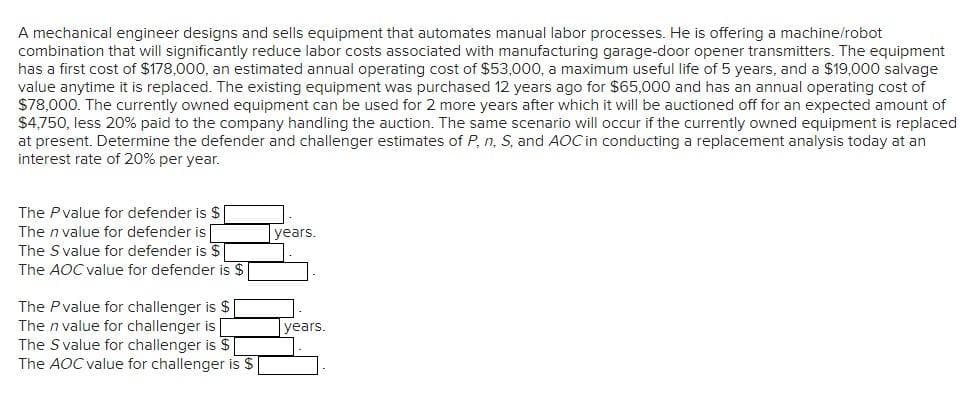

A mechanical engineer designs and sells equipment that automates manual labor processes. He is offering a machine/robot combination that will significantly reduce labor costs associated with manufacturing garage-door opener transmitters. The equipment has a first cost of $178,000, an estimated annual operating cost of $53,000, a maximum useful life of 5 years, and a $19,000 salvage value anytime it is replaced. The existing equipment was purchased 12 years ago for $65,000 and has an annual operating cost of $78,000. The currently owned equipment can be used for 2 more years after which it will be auctioned off for an expected amount of $4,750, less 20% paid to the company handling the auction. The same scenario will occur if the currently owned equipment is replaced at present. Determine the defender and challenger estimates of P, n, S, and AOC in conducting a replacement analysis today at an interest rate of 20% per year.

Q: Island Water Taxi has decided to lease another boat for four years rather than finance the purchase ...

A: Lease liability = $55000 n = 4 years = 48 months r = 8.7% per annum = 0.725% per month Let lease pay...

Q: 3. Although Mutual funds and Hedge funds are traded on exchanges regulated, they are not

A: Both hedge funds and mutual funds are made of pooled funds and have portfolios that need to be manag...

Q: 12. A company is planning to make a new investment worth 1200 USD, with projected income from year ...

A:

Q: NEED PARTS 4-8 You borrow money on a self liquidating installment loan (equal payments at the end o...

A: Question involves multiple subparts. We will answer 1st sub 3 parts as per prescribed guidelines. Yo...

Q: Question 3 What is the price of Thera Corpn's zero coupon bond with 10 years to maturity? The bond w...

A: Present Value can be calculated using PV function in excel PV (rate, nper, pmt, [Fv], [type]) Rat...

Q: 3. You have the option of investing money in a bond that will help to grow your money. Bond A offers...

A: Effective annual rate is the interest actually earned on the investment or paid on the loan, as a re...

Q: The VSE Corporation currently pays no dividend because of depressed earnings. A recent change in man...

A: It is assumed that the dividend will grow at 12% forever after 4 years Given D1 = $0.5D2 = $1.25 D3 ...

Q: You invest $900 in stock A and $900 in stock B. If you earn 10 percent on stock A and 5 percent on s...

A: Time value of money (TVM) is used to measure the value of money at different point of time in the fu...

Q: 9. TSE company reported a Net income of $150 million for year N. Depreciation expense was $141 milli...

A: Net income = $150 million Depreciation = $141 million Interest expenses = $60 million Tax rate = 30%

Q: How much should be placed in this account at the end of each week if the annual interest rate is 3.8...

A: Time value of money (TVM) is used to measure the value of money at different point of time in the fu...

Q: What is the Macaulay duration of a bond with a coupon of 5.8 percent, eleven years to maturity, and ...

A: Since, the number of compounding is not given, we will assume that the coupon is paid annually. Form...

Q: The VSE Corporation currently pays no dividend because of depressed earnings. A recent change in man...

A: The price of stock is equal to the present value of all future dividends and the future price of sto...

Q: a. How much interest did Jo pay the bank for the use of its money? b. How much did he receive from t...

A: Loan amortization refers to a schedule which is prepared to shows the periodic loan payments, amount...

Q: dymer increase by 2% for the next year. Find the present value of this annuity if the initial paymen...

A: The present value of annuity includes the value of annuities discounted at the rate of interest rate...

Q: Lloyd is a divorce attorney who practices law in Florida. He wants to join the American Divorce Lawy...

A: We need to apply the concept of time value of money. The concept states that money today has more wo...

Q: Ten years ago, Video Toys began manufacturing and selling coin-operated arcade games. Dividends are ...

A: The stock price which is the maximum price to be paid for share consists of dividends and terminal v...

Q: f you were asked to describe the terms of the Federal Reserve's Board of Governors, how would you ex...

A: Board of Governors The Board of Governors are also known as the Federal Reserve Board. They are the ...

Q: Bob Katz would like to save $250,000 over the next 25 years. If Bob knows today that he will be give...

A: Amount likely to be saved is $250,000 Interest rate is 4% Inheritance received in year -15 is $150,0...

Q: What are the holding period and the annualized compounded returns if you buy a stock for $40 and sel...

A: Holding period return is the total percentage return on an investment over a period of investment. T...

Q: The interest rate in Japan is 1%. The yen to dollar spot exchange rate is ¥100 per dollar and the f...

A: Covered Interest rate parity It provides relationships among interest rates and exchange rates (spo...

Q: Find the periodic payment R required to amortize a loan of P dollars over t years with interest char...

A: The periodic amount will be found using excel’s PMT function. It is the minimum amount that must be ...

Q: 1. Jefferson and Rio Morales are trying to decide on an account to help save for college for their n...

A: Since you have asked multiple questions, we will solve the first question for you. If you want any s...

Q: 15. Zoom has Quick ratio of 3x, sales of $120,000, in addition it has current assets of $170,000 and...

A: Since only Question 15 is clear and complete ly visible in the picture, so the following solution is...

Q: Determine the following: 1. Total present amount of the obligations. 2. Total future amount of the o...

A: Present value can be defined as the amount of money that have to be invested today to earn a require...

Q: Assume Highline Company has just paid an annual dividend of $0.98. Analysts are predicting an 11.2% ...

A: Answer - Computation of Value of Highline's stock - Year Dividend PV @ 9.2% Present Value ...

Q: Lakeside Inc. is considering replacing old production equipment with state-of-the-art technology tha...

A: Answer - Part 1 - Calculation of Payback Period = = Initial Investment / Annual Cash inflow Given, ...

Q: Harper Electronics is considering investing in manufacturing equipment expected to cost $250,000. Th...

A: Capital Budgeting methods: Managers use several capital budgeting methods while evaluating investmen...

Q: Kolby's Korndogs is looking at a new sausage system with an installed cost of $695,000. This cost wi...

A: Installed Cost is $695,000 Life of project is 5 years Initial Investment in net working capital is $...

Q: 6.7 Determine the rate of return per year for the cash flows shown below. Use (a) tabulated factors,...

A: Given Years =1,2,3, and 4 Cash flow in $ = -80000, 9000, 70000, 30000 We are required to prepare a r...

Q: 10. Sunny Corp. had a net income during 2018 of $200m, and after paying out dividends to shareholder...

A: Net income = $200m Opening retained earning = $700m Closing retained earning = $840m

Q: When adding a risky asset to a portfolio of may risky assets, which property of the asset has a grea...

A: Portfolios can consist of a variety of investments such as equities, bonds, commodities, cash and ca...

Q: Yield to maturity The bond shown in the following table pays interest annually. (Click on the icon h...

A: Bond is a debt-backed security which is used by investors to reduce risk and increase stable income ...

Q: Analyse the Assets-to-equity ratio of 1.87 in 2019 and 1.67 in 2020

A: As per Bartleby Honor Code, when multiple questions are asked, the expert is required only to solve ...

Q: Explore the amount $1 is discounted for different compound interest rates across time. The graph sho...

A: Given, PVN=1FVN=$11+iN

Q: 22. Alfa Corp's stock pr value per share was $37.50. What is its P/B ratio? * O a) 1.34 O b) 2.4 074...

A: Dupont ROE With profit margin, total asset turnover and equity multiplier, the Dupont ROE is calcula...

Q: sers of ratios into short-term lenders, long-term lenders, and stockholders, which ratios would each...

A: Step 1 Ratios may be quite useful when deciding whether or not to invest in a company. Retail inve...

Q: A project has the following cash flows. What is the internal rate of return? Years Cash flow -$46.80...

A: Solution:- Internal Rate of Return (IRR) is the rate of return which the bank is yielding. At IRR, N...

Q: 24. Alpha Co. has an equity book value per share $10 and its ROE = 20% %3D %3D What is its earnings ...

A: EPS is earning per share = Net Income / No of Share holders

Q: If that 55% return on investment (ROI) occurs over a decade, r = .55 and n = 10, so the annualized r...

A: Return on investment is defined as the return generated by investment as a percentage of investment....

Q: Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are t...

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts a...

Q: Assume you are the CIO (chief investment officer) for Dragon Industries, LLP (LLP stands for Limited...

A: Expected Return: The expected return is the minimum required rate of return which an investor requir...

Q: Bob has been investing $4,000 in stock at the end of every year for the past 8 years. If the account...

A: Future value of an annuity is calculated by multiplying the regular payment by Annuity factor which ...

Q: Not use of the excel Q)A car loan of $36601 is to be repaid by making payments each month for 3 yea...

A: Loans are paid by the monthly payment that carry the interest payment and payment for the principal ...

Q: XYZ inc. considers an investment project that requires $200,000 in new equipment and $30,000 in extr...

A: Cash flow for a project is calculated after adjusting all the operating expenses and adding back the...

Q: 3. Consider an EOY geometric gradient, which lasts for eight years, whose initial value at EOY one i...

A: A cash flow series is a series in which the cash flows in and out at certain period of time. However...

Q: Jana, now 23 years old, is a grade school teacher in Batangas City. She has been invited by her high...

A: A deposit or payment of equal amount of money at equal intervals of time is called annuity. Insuranc...

Q: You own a one-year European call option to buy one acre of Los Angeles real estate. The exercise pri...

A: Time period is 1 year Exercise price is $2.02million Market Value is $1.72million Interest rate is 1...

Q: Dorpac Corporation has a dividend yield of 1.2%. Its equity cost of capital is 7.5%, and its dividen...

A: Using Gordon’s growth model, the price of a share is calculated using the expected dividend, cost of...

Q: money right now. Find FV Annuity: If you deposit your annual payments into an account earning 2% per...

A: Payments = $10,000 Interest rate = 2% Time period = 10 years

Q: (a) Briefly explain why information asymmetry can widen the effective bid ask spread of a stock.

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one...

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

- Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)Newmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new design will eliminate the production of a toxic solid residue. The initial cost of the system is estimated at 860,000 and includes computerized equipment, software, and installation. There is no expected salvage value. The new system has a useful life of 8 years and is projected to produce cash operating savings of 225,000 per year over the old system (reducing labor costs and costs of processing and disposing of toxic waste). The cost of capital is 16%. Required: 1. Compute the NPV of the new system. 2. One year after implementation, the internal audit staff noted the following about the new system: (1) the cost of acquiring the system was 60,000 more than expected due to higher installation costs, and (2) the annual cost savings were 20,000 less than expected because more labor cost was needed than anticipated. Using the changes in expected costs and benefits, compute the NPV as if this information had been available one year ago. Did the company make the right decision? 3. CONCEPTUAL CONNECTION Upon reporting the results mentioned in the postaudit, the marketing manager responded in a memo to the internal audit department indicating that cash inflows also had increased by a net of 60,000 per year because of increased purchases by environmentally sensitive customers. Describe the effect that this has on the analysis in Requirement 2. 4. CONCEPTUAL CONNECTION Why is a postaudit beneficial to a firm?Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.

- St. Johns River Shipyards welding machine is 15 years old, fully depreciated, and has no salvage value. However, even though it is old, it is still functional as originally designed and can be used for quite a while longer. A new welder will cost 182,500 and have an estimated life of 8 years with no salvage value. The new welder will be much more efficient, however, and this enhanced efficiency will increase earnings before depreciation from 27,000 to 74,000 per year. The new machine will be depreciated over its 5-year MACRS recovery period, so the applicable depreciation rates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. The applicable corporate tax rate is 25%, and the project cost of capital is 12%. What is the NPV if the firm replaces the old welder with the new one?Basuras Waste Disposal Company has a long-term contract with several large cities to collect garbage and trash from residential customers. To facilitate the collection, Basuras places a large plastic container with each household. Because of wear and tear, growth, and other factors, Basuras places about 200,000 new containers each year (about 20% of the total households). Several years ago, Basuras decided to manufacture its own containers as a cost-saving measure. A strategically located plant involved in this type of manufacturing was acquired. To help ensure cost efficiency, a standard cost system was installed in the plant. The following standards have been established for the products variable inputs: During the first week in January, Basuras had the following actual results: The purchasing agent located a new source of slightly higher-quality plastic, and this material was used during the first week in January. Also, a new manufacturing process was implemented on a trial basis. The new process required a slightly higher level of skilled labor. The higher- quality material has no effect on labor utilization. However, the new manufacturing process was expected to reduce materials usage by 0.25 pound per container. Required: 1. CONCEPTUAL CONNECTION Compute the materials price and usage variances. Assume that the 0.25 pound per container reduction of materials occurred as expected and that the remaining effects are all attributable to the higher-quality material. Would you recommend that the purchasing agent continue to buy this quality, or should the usual quality be purchased? Assume that the quality of the end product is not affected significantly. 2. CONCEPTUAL CONNECTION Compute the labor rate and efficiency variances. Assuming that the labor variances are attributable to the new manufacturing process, should it be continued or discontinued? In answering, consider the new processs materials reduction effect as well. Explain. 3. CONCEPTUAL CONNECTION Refer to Requirement 2. Suppose that the industrial engineer argued that the new process should not be evaluated after only one week. His reasoning was that it would take at least a week for the workers to become efficient with the new approach. Suppose that the production is the same the second week and that the actual labor hours were 9,000 and the labor cost was 99,000. Should the new process be adopted? Assume the variances are attributable to the new process. Assuming production of 6,000 units per week, what would be the projected annual savings? (Include the materials reduction effect.)Self-Construction Olson Machine Company manufactures small and large milling machines. Selling prices of these machines range from 35,000 to 200,000. During the 5-month period from August 1, 2019, through December 31, 2019, Olson manufactured a milling machine for its own use. This machine was built as part of the regular production activities. The project required a large amount of time front planning and supervisory personnel, as well as that of some of the companys officers, because it was a more sophisticated type of machine than the regular production models. Throughout the 5-month period, Olson charged all costs directly associated with the construction of the machine to a special account entitled Asset Construction Account. An analysis of the charges to this account as of December 31, 2019, follows: Olson allocates factory overhead to normal production as a percent of direct labor dollars as follows: Olson uses a flat rate of 40% of direct labor dollars to allocate general and administrative overhead. During the machine testing period, a cutter head malfunctioned and did extensive damage to the machine table and one cutter housing. This damage was not anticipated and was the result of an error in the assembly operation. Although no additional raw materials were needed to make the machine operational after the accident, the following labor for rework was required: Olson has included all these labor charges in the asset construction account. In addition, it included in the account the repairs and maintenance charges of 1,340 that it incurred as a result of the malfunction. Required: 1. Compute, consistent with GAAP and common practice, the amount that Olson should capitalize for the milling machine as of December 31, 2019, when it declares the machine operational. 2. Next Level Identify the costs you included in Requirement 1 for which there are acceptable alternative procedures. Describe the alternative procedure(s) in each case.

- Keith Golding has decided to purchase a personal computer. He has narrowed his choices to two: Brand A and Brand B. Both brands have the same processing speed, hard disk capacity, RAM, graphics card memory, and basic software support package. Both come from companies with good reputations. The selling price for each is identical. After some review, Keith discovers that the cost of operating and maintaining Brand A over a three-year period is estimated to be 200. For Brand B, the operating and maintenance cost is 600. The sales agent for Brand A emphasized the lower operating and maintenance cost. She claimed that it was lower than any other PC brand. The sales agent for Brand B, however, emphasized the service reputation of the product. She provided Keith with a copy of an article appearing in a PC magazine that rated service performance of various PC brands. Brand B was rated number one. Based on all the information, Keith decided to buy Brand B. Required: 1. What is the total product purchased by Keith? 2. Is the Brand A company pursuing a cost leadership or differentiation strategy? The Brand B company? Explain. 3. When asked why he purchased Brand B, Keith replied, I think Brand B offered more value than Brand A. What are the possible sources of this greater value? If Keiths reaction represents the majority opinion, what suggestions could you offer to help improve the strategic position of Brand A?ZZOOM, Inc., has decided to discontinue manufacturing its Z Best model. Currently, the company has 4,600 partially completed Z Best models on hand. The government has put a recall on a particular part in the Z Best model, so each base model must now be reworked to accommodate the style of the new part. The company has spent $110 per unit to manufacture these Z Best models to their current state. Reworking each Z Best model will cost $22 for materials and $25 for direct labor. In addition, $9 of variable overhead and $34 of allocated fixed overhead (relating primarily to depreciation of plant and equipment) will be allocated per unit. If ZZOOM completes the Z Best models, it can sell them for $180 per unit. On the other hand, another manufacturer is interested in purchasing the partially completed units for $105 each and converting them into Z Plus models. Prepare a differential analysis per unit to determine if ZZOOM should complete the Z Best models or sell them in their current state.Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?

- Thaler Company bought 26,000 of raw materials a year ago in anticipation of producing 5,000 units of a deluxe version of its product to be priced at 75 each. Now the price of the deluxe version has dropped to 35 each, and Thaler is now deciding whether to produce 1,500 units of the deluxe version at a cost of 48,000 or to scrap the project. What is the opportunity cost of this decision? a. 175,000 b. 375,000 c. 48,000 d. 26,000Otero Fibers, Inc., specializes in the manufacture of synthetic fibers that the company uses in many products such as blankets, coats, and uniforms for police and firefighters. Otero has been in business since 1985 and has been profitable every year since 1993. The company uses a standard cost system and applies overhead on the basis of direct labor hours. Otero has recently received a request to bid on the manufacture of 800,000 blankets scheduled for delivery to several military bases. The bid must be stated at full cost per unit plus a return on full cost of no more than 10 percent after income taxes. Full cost has been defined as including all variable costs of manufacturing the product, a reasonable amount of fixed overhead, and reasonable incremental administrative costs associated with the manufacture and sale of the product. The contractor has indicated that bids in excess of 30 per blanket are not likely to be considered. In order to prepare the bid for the 800,000 blankets, Andrea Lightner, cost accountant, has gathered the following information about the costs associated with the production of the blankets. Direct machine costs consist of items such as special lubricants, replacement of needles used in stitching, and maintenance costs. These costs are not included in the normal overhead rates. Otero recently developed a new blanket fiber at a cost of 750,000. In an effort to recover this cost, Otero has instituted a policy of adding a 0.50 fee to the cost of each blanket using the new fiber. To date, the company has recovered 125,000. Lightner knows that this fee does not fit within the definition of full cost, as it is not a cost of manufacturing the product. Required: 1. Calculate the minimum price per blanket that Otero Fibers could bid without reducing the companys operating income. 2. Using the full-cost criteria and the maximum allowable return specified, calculate Otero Fibers bid price per blanket. 3. Without prejudice to your answer to Requirement 2, assume that the price per blanket that Otero Fibers calculated using the cost-plus criteria specified is greater than the maximum bid of 30 per blanket allowed. Discuss the factors that Otero Fibers should consider before deciding whether or not to submit a bid at the maximum acceptable price of 30 per blanket. (CMA adapted)Your family started a new manufacturing business making outdoor benches for use in parks and outdoor venues two years ago. The business has been very successful, and sales are soaring. Because of this success, your family realizes that the equipment purchased to start the business will not last as long as expected because the company has needed to run twenty-four-hour production shifts for most of the past year. There has been a lot of wear and tear on the equipment. The original useful lives and salvage values are not as accurate as your family had hoped. Your aunt, who is the production manager for the family business, has approached you because she is concerned about this issue, and she knows you have had an accounting class. What advice do you have for her? How should the company readjust given the realities of the last few years?