A person's "safe debt load" is often defined as of a person's after-tax income les expenses. If Devon's after-tax income is $23,930, and his expenses are $4,800 fon ousing, $4,900 for food, $1,280 for transportation, and $950 for clothes, what is Devon's safe debt load? A $3,000

A person's "safe debt load" is often defined as of a person's after-tax income les expenses. If Devon's after-tax income is $23,930, and his expenses are $4,800 fon ousing, $4,900 for food, $1,280 for transportation, and $950 for clothes, what is Devon's safe debt load? A $3,000

Chapter4: Income Tax Withholding

Section: Chapter Questions

Problem 3SSQ

Related questions

Question

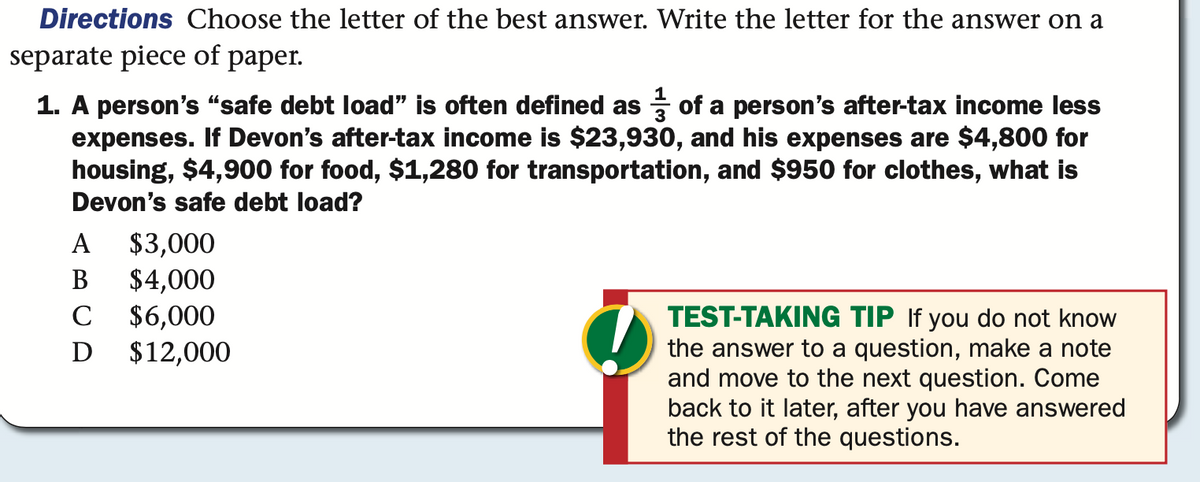

Transcribed Image Text:Directions Choose the letter of the best answer. Write the letter for the answer on a

separate piece of paper.

1. A person's "safe debt load" is often defined as of a person's after-tax income less

expenses. If Devon's after-tax income is $23,930, and his expenses are $4,800 for

housing, $4,900 for food, $1,280 for transportation, and $950 for clothes, what is

Devon's safe debt load?

$3,000

$4,000

$6,000

$12,000

А

В

TEST-TAKING TIP If you do not know

the answer to a question, make a note

and move to the next question. Come

back to it later, after you have answered

the rest of the questions.

C

D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you