Rosle Dry Cleaning was started on January 1, Year 1. It experlenced the following events during its first two years of operation. Events Affecting Year 1 1. Provided $29,360 of cleaning services on account. 2. Collected $23,488 cash from accounts recelvable. 3. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Events Affecting Year 2 1. Wrote off a $220 account recelvable that was determined to be uncollectible. 2. Provided $34,263 of cleaning services on account. 3. Collected $30,323 cash from accounts recelvable. 4. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account.

Rosle Dry Cleaning was started on January 1, Year 1. It experlenced the following events during its first two years of operation. Events Affecting Year 1 1. Provided $29,360 of cleaning services on account. 2. Collected $23,488 cash from accounts recelvable. 3. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Events Affecting Year 2 1. Wrote off a $220 account recelvable that was determined to be uncollectible. 2. Provided $34,263 of cleaning services on account. 3. Collected $30,323 cash from accounts recelvable. 4. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.12MCE: Determining an Ending Account Balance Jessies Accounting Services was organized on June 1. The...

Related questions

Question

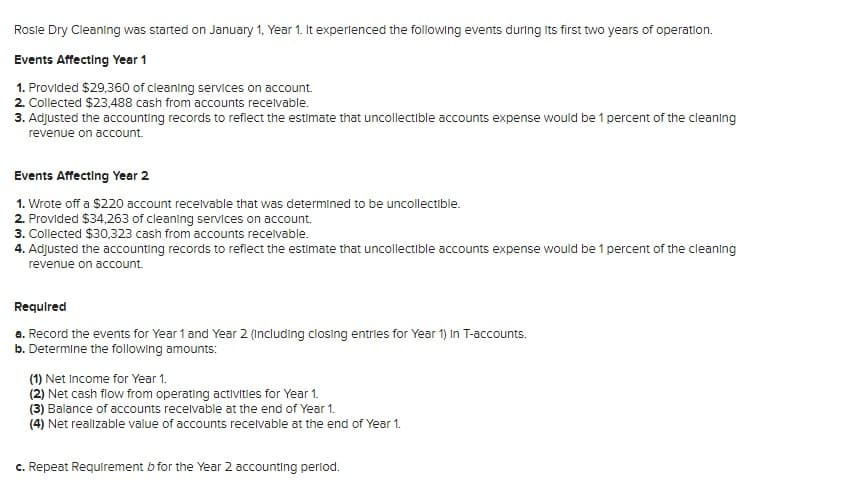

Transcribed Image Text:Rosle Dry Cleaning was started on January 1, Year 1. It experlenced the following events during Its first two years of operation.

Events Affecting Year 1

1. Provided $29,360 of cleaning services on account.

2. Collected $23,488 cash from accounts recelvable.

3. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning

revenue on account.

Events Affecting Year 2

1. Wrote off a $220 account recelvable that was determined to be uncollectible.

2. Provided $34,263 of cleaning services on account.

3. Collected $30,323 cash from accounts receivable.

4. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning

revenue on account.

Requlred

a. Record the events for Year 1 and Year 2 (Including closing entries for Year 1) In T-accounts.

b. Determine the following amounts:

(1) Net Income for Year 1.

(2) Net cash flow from operating activities for Year 1.

(3) Balance of accounts recelvable at the end of Year 1.

(4) Net realizable value of accounts recelvable at the end of Year 1.

c. Repeat Requirement b for the Year 2 accounting perlod.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning