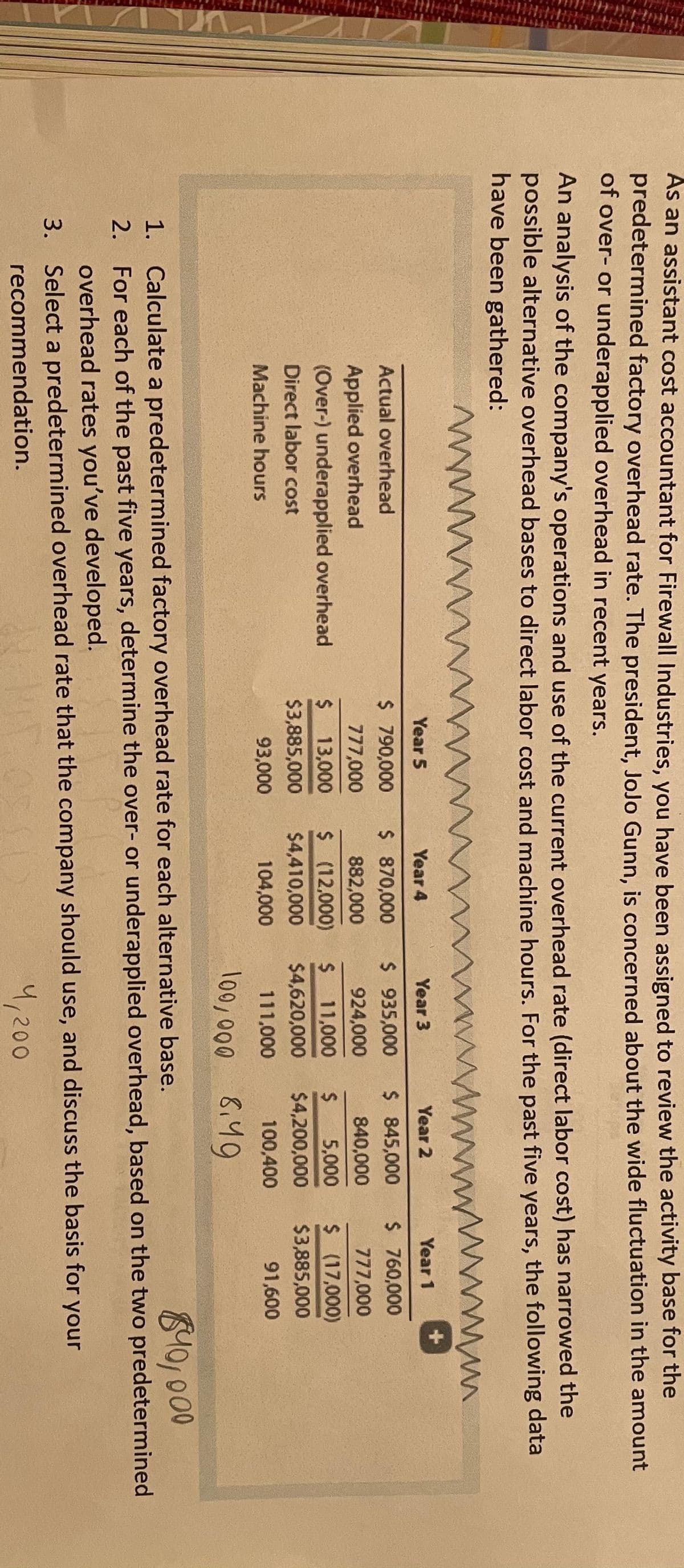

As an assistant cost accountant for Firewall Industries, you have been assigned to review the activity base for the predetermined factory overhead rate. The president, JoJo Gunn, is concerned about the wide fluctuation in the amount of over- or underapplied overhead in recent years. An analysis of the company's operations and use of the current overhead rate (direct labor cost) has narrowed the possible alternative overhead bases to direct labor cost and machine hours. For the past five years, the following data have been gathered: ww mwwwww M M w Year 5 Year 4 Year 3 Year 2 Year 1 Actual overhead $ 790,000 $ 870,000 $ 935,000 $ 845,000 $ 760,000 Applied overhead 777,000 882,000 924,000 840,000 777,000 (Over-) underapplied overhead $ 13,000 $ (12,000) %24 $ 11,000 5,000 $ (17,000) Direct labor cost $3,885,000 $4,410,000 $4,620,000 $4,200,000 $3,885,000 Machine hours 93,000 104,000 111,000 100,400 91,600 8,49 840,000 1. Calculate a predetermined factory overhead rate for each alternative base. 2. For each of the past five years, determine the over- or underapplied overhead, based on the two predetermined overhead rates you've developed. 3. Select a predetermined overhead rate that the company should use, and discuss the basis for your recommendation. 4,200

As an assistant cost accountant for Firewall Industries, you have been assigned to review the activity base for the predetermined factory overhead rate. The president, JoJo Gunn, is concerned about the wide fluctuation in the amount of over- or underapplied overhead in recent years. An analysis of the company's operations and use of the current overhead rate (direct labor cost) has narrowed the possible alternative overhead bases to direct labor cost and machine hours. For the past five years, the following data have been gathered: ww mwwwww M M w Year 5 Year 4 Year 3 Year 2 Year 1 Actual overhead $ 790,000 $ 870,000 $ 935,000 $ 845,000 $ 760,000 Applied overhead 777,000 882,000 924,000 840,000 777,000 (Over-) underapplied overhead $ 13,000 $ (12,000) %24 $ 11,000 5,000 $ (17,000) Direct labor cost $3,885,000 $4,410,000 $4,620,000 $4,200,000 $3,885,000 Machine hours 93,000 104,000 111,000 100,400 91,600 8,49 840,000 1. Calculate a predetermined factory overhead rate for each alternative base. 2. For each of the past five years, determine the over- or underapplied overhead, based on the two predetermined overhead rates you've developed. 3. Select a predetermined overhead rate that the company should use, and discuss the basis for your recommendation. 4,200

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter2: Job Order Costing

Section: Chapter Questions

Problem 2TIF

Related questions

Question

Transcribed Image Text:As an assistant cost accountant for Firewall Industries, you have been assigned to review the activity base for the

predetermined factory overhead rate. The president, JoJo Gunn, is concerned about the wide fluctuation in the amount

of over- or underapplied overhead in recent years.

An analysis of the company's operations and use of the current overhead rate (direct labor cost) has narrowed the

possible alternative overhead bases to direct labor cost and machine hours. For the past five years, the following data

have been gathered:

ww mwwwww M M w

Year 5

Year 4

Year 3

Year 2

Year 1

Actual overhead

$ 790,000

$ 870,000

$ 935,000

$ 845,000

$ 760,000

Applied overhead

777,000

882,000

924,000

840,000

777,000

(Over-) underapplied overhead

$ 13,000

$ (12,000)

%24

$ 11,000

5,000

$ (17,000)

Direct labor cost

$3,885,000

$4,410,000

$4,620,000

$4,200,000

$3,885,000

Machine hours

93,000

104,000

111,000

100,400

91,600

8,49

840,000

1. Calculate a predetermined factory overhead rate for each alternative base.

2. For each of the past five years, determine the over- or underapplied overhead, based on the two predetermined

overhead rates you've developed.

3. Select a predetermined overhead rate that the company should use, and discuss the basis for your

recommendation.

4,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning