Dana Baird was manager of a new Medical Supplies Division. She had just finished her second year and had been visiting with the company’s vice president of operations. In the first year, the operating income for the division had shown a substantial increase over the prior year. Her second year saw an even greater increase. The vice president was extremely pleased and promised Dana a $5,000 bonus if the division showed a similar increase in profits for the upcoming year. Dana was elated. She was completely confident that the goal could be met. Sales contracts were already well ahead of last year’s performance, and she knew that there would be no increases in costs.

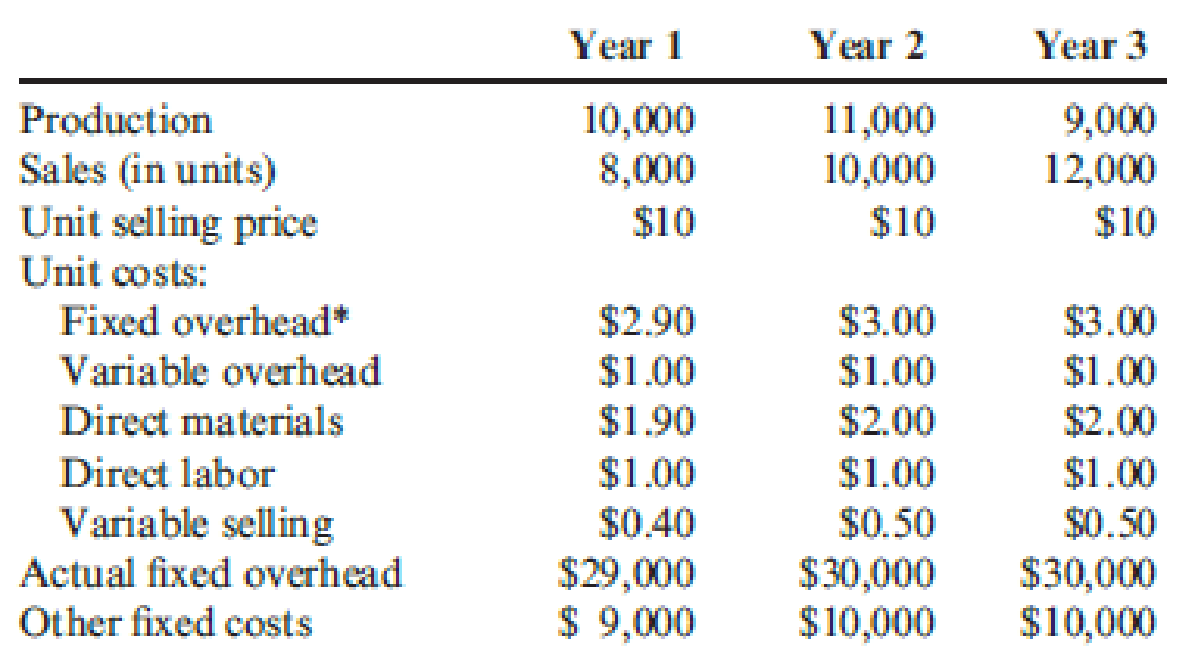

At the end of the third year, Dana received the following data regarding operations for the first three years:

*The predetermined fixed

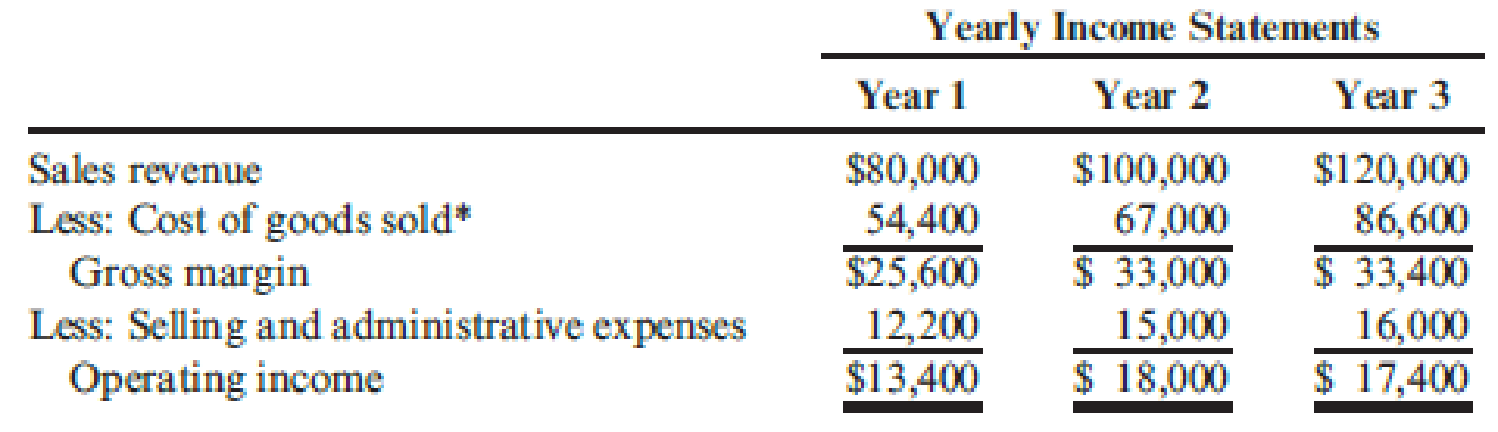

*Assumes a LIFO inventory flow.

Upon examining the operating data, Dana was pleased. Sales had increased by 20 percent over the previous year, and costs had remained stable. However, when she saw the yearly income statements, she was dismayed and perplexed. Instead of seeing a significant increase in income for the third year, she saw a small decrease. Surely, the Accounting Department had made an error.

Required:

- 1. Explain to Dana why she lost her $5,000 bonus.

- 2. Prepare variable-costing income statements for each of the three years. Reconcile the differences between the absorption-costing and variable-costing incomes.

- 3. If you were the vice president of Dana’s company, which income statement (variable-costing or absorption-costing) would you prefer to use for evaluating Dana’s performance? Why?

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Kent Tessman, manager of a Dairy Products Division, was pleased with his divisions performance over the past three years. Each year, divisional profits had increased, and he had earned a sizable bonus. (Bonuses are a linear function of the divisions reported income.) He had also received considerable attention from higher management. A vice president had told him in confidence that if his performance over the next three years matched his first three, he would be promoted to higher management. Determined to fulfill these expectations, Kent made sure that he personally reviewed every capital budget request. He wanted to be certain that any funds invested would provide good, solid returns. (The divisions cost of capital is 10 percent.) At the moment, he is reviewing two independent requests. Proposal A involves automating a manufacturing operation that is currently labor intensive. Proposal B centers on developing and marketing a new ice cream product. Proposal A requires an initial outlay of 250,000, and Proposal B requires 312,500. Both projects could be funded, given the status of the divisions capital budget. Both have an expected life of six years and have the following projected after-tax cash flows: After careful consideration of each investment, Kent approved funding of Proposal A and rejected Proposal B. Required: 1. Compute the NPV for each proposal. 2. Compute the payback period for each proposal. 3. According to your analysis, which proposal(s) should be accepted? Explain. 4. Explain why Kent accepted only Proposal A. Considering the possible reasons for rejection, would you judge his behavior to be ethical? Explain.arrow_forwardMalone Industries has been in business for five years and has been very successful. In the past year, it expanded operations by buying Hot Metal Manufacturing for a price greater than the value of the net assets purchased. In the past year, the customer base has expanded much more than expected, and the companys owners want to increase the goodwill account. Your CPA firm has been hired to help Malone prepare year-end financial statements, and your boss has asked you to talk to Malones managers about goodwill and whether an adjustment can be made to the goodwill account. How do you respond to the owners and managers?arrow_forwardTanya Williams is the new accounts manager at East Bank of Mississippi. She has just been asked to project how many new bank accounts she will generate during 20x2. The economy of the county in which the bank operates has been growing, and the bank has experienced a 10 percent increase in its number of bank accounts over each of the past five years. In 20x1, the bank had 10,000 accounts.The new accounts manager is paid a salary plus a bonus of $15 for every new account she generates above the budgeted amount. Thus, if the annual budget calls for 500 new accounts, and 540 new accounts are obtained, Williams’s bonus will be $600 (40 × $15).Williams believes the economy of the county will continue to grow at the same rate in 20x2 as it has in recent years. She has decided to submit a budgetary projection of 700 new accounts for 20x2.Required: Your consulting firm has been hired by the bank president to make recommendations for improving its operations. Write a memorandum to the president…arrow_forward

- Adli Yunus is the vice president of development for Eddlee Fried Chicken a rapidly expanding chain of restaurants featuring takeout fried chicken and other Malay food specialties. Currently, the chain has 150 units and the average unit volume is$800,000 per year. Annual per-unit revenue growth for opened units is 5 percent per year. Baba Tomi, the chain's president, has promised company stakeholders the chain will experience 12 percent overall revenue growth in the next year. Assuming that per-unit growth on existing units continues to average 5 percent, calculate the total revenue next year.arrow_forwardAn organization's objective is to increase its production by 20 percent next year. How do you consider the Accounting Department of the company? Line or staff? Justify your answer.arrow_forwardScott Healthcare provides a walk-in clinic for its patients and a pharmacy for any medication prescribed by the doctor. Last year, Scott generated total sales of $500,000 and $100,000 in profits.Scott also had average assets of $250,000 for the year. What are Scott Healthcare’s return on sales(ROS), asset turnover (AT), and return on investment (ROI) for the year?arrow_forward

- Richmond, Inc., operates a chain of 44 department stores. Two years ago, the board of directors of Richmond approved a large-scale remodeling of its stores to attract a more upscale clientele. Before finalizing these plans, two stores were remodeled as a test. Linda Perlman, assistant controller, was asked to oversee the financial reporting for these test stores, and she and other management personnel were offered bonuses based on the sales growth and profitability of these stores. While completing the financial reports, Perlman discovered a sizable inventory of outdated goods that should have been discounted for sale or returned to the manufacturer. She discussed the Situation with her management colleagues; the consensus was to ignore reporting this inventory as obsolete because reporting it would diminish the financial results and their bonuses. Required: According to the IMA’s Statement of Ethical Professional Practice, would it be ethical for Perlman not to report the inventory…arrow_forwardHarriet Moore is an accountant for New World Pharmaceuticals. Her duties include tracking research and development spending in the new product development division. Over the course of the past six months, Harriet has noticed that a great deal of funds have been spent on a particular project for a new drug. She hears “through the grapevine” that the company is about to patent the drug and expects it to be a major advance in antibiotics. Harriet believes that this new drug will greatly improve company performance and will cause the company’s stock to increase in value. Harriet decides to purchase shares of New World in order to benefit from this expected increase. Required What are Harriet’s ethical responsibilities, if any, with respect to the information she has learned through her duties as an accountant for New World Pharmaceuticals? What are the implications of her planned purchase of New World shares?arrow_forwardMadison is the newly appointed manager of spark communication a small computer monitor manfacturing company based out of halifox nova Scottia. During her first few days on the jobs she collected the following data about the company. The company has the capacity to produce 750 monitors per month and is currently producing 525monitors every month and selling it to wholesaler The company is expenses are :rent $4000 per month, salaries of $12500 per month, insurance of $1500 per month , material is of $6 permonth, labour of $35 per month and sales commissions of $19 per month. Each month is sold for $105. a. What is the contribution margin and the contribution rate? b. What is the break even volume and break even revenue per month? c. How much net income per month we earned at the current level of presentation.?arrow_forward

- The president is considering two proposals prepared by members of his staff, For next year, the sales manager would to increase the unit selling price by 20%, increase the sales commission by 9%, and increase advertising by $100,00. Basaed on marketing studies, he is confident this would increase unit sales by one third. what profits would be under the sales manager's proposal?arrow_forwardJennifer Caratini has recently accepted the job as the foodservice director for Techmar Industries, a corporation with 1,000 employees. As their foodservice director, Jennifer’s role is to operate a company cafeteria, serving 800 to 900 meals per day, as well as an executive dining room, serving 100 to 200 meals per day. All of the meals are provided “free of charge” to the employees of Techmar. One of Jennifer’s first jobs is to prepare a budget for next year’s operations. In addition to the cost of food products and foodservice employees, what other expenses will Techmar incur by providing free meals to its employees? Since employees do not pay for their food directly, what will Jennifer likely use as the “revenue” portion of her budget? How do you think this number should be determined? In addition to her know-how as a foodservice director, what skills will Jennifer likely need as she interacts with the executives at Techmar who must approve her operating budget?arrow_forwardJennifer Caratini has recently accepted the job as the foodservice director for Techmar Industries, a corporation with 1,000 employees. As their foodservice director, Jennifer’s role is to operate a company cafeteria, serving 800 to 900 meals per day, as well as an executive dining room, serving 100 to 200 meals per day. All of the meals are provided “free of charge” to the employees of Techmar. One of Jennifer’s first jobs is to prepare a budget for next year’s operations. In addition to the cost of food products and foodservice employees, what other expenses will Techmar incur by providing free meals to its employees? Since employees do not pay for their food directly, what will Jennifer likely use as the “revenue” portion of her budget? How do you think this number should be determined? In addition to her know-how as a foodservice director, what skills will Jennifer likely need as she interacts with the executives at Techmar who must approve her operating budget? For additional…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE LBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE LBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage