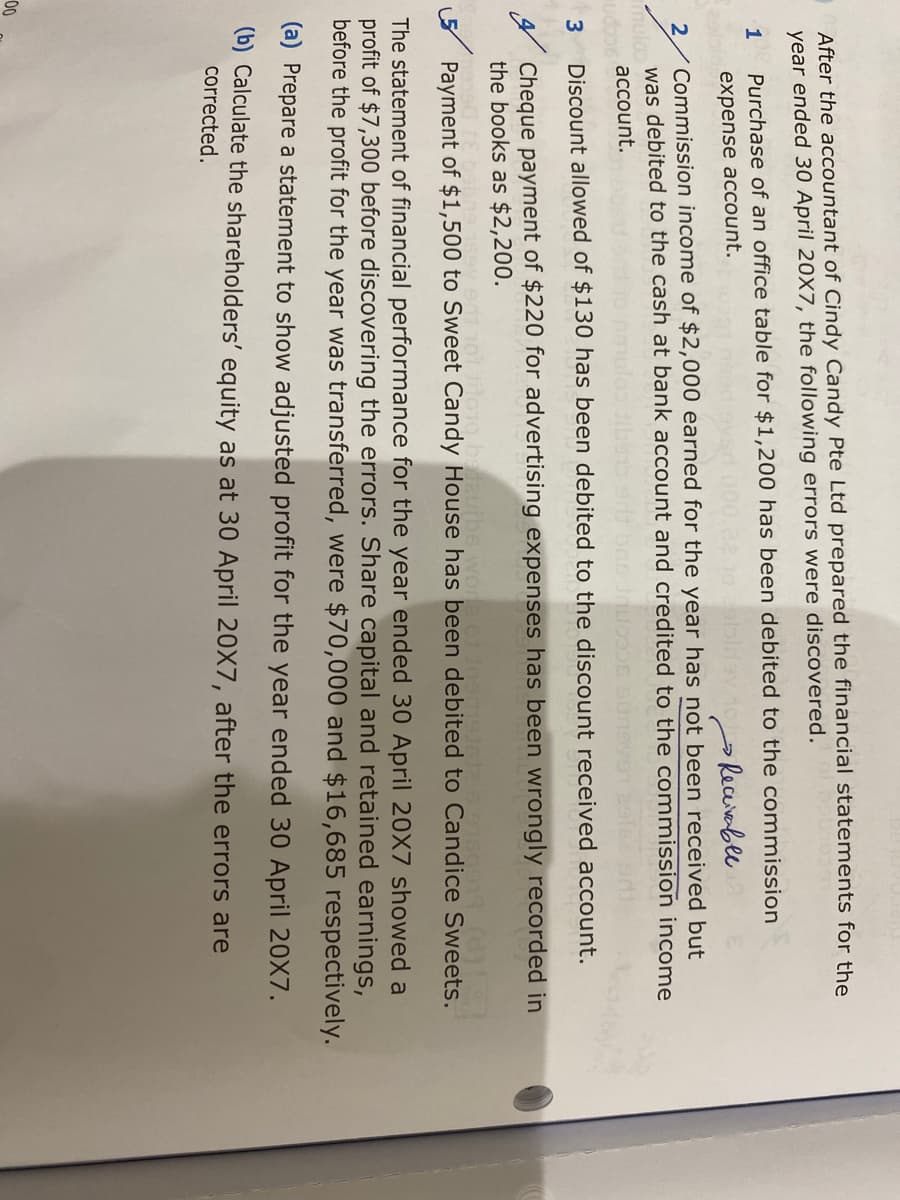

After the accountant of Cindy Candy Pte Ltd prepared the financial statements for the year ended 30 April 20X7, the following errors were discovered. 1 Purchase of an office table for $1,200 has been debited to the commission expense account. Receivable 2. Commission income of $2,000 earned for the year has not been received but was debited to the cash at bank account and credited to the commission income muloo account. Discount allowed of $130 has been debited to the discount received account. 4 Cheque payment of $220 for advertising expenses has been wrongly recorded in the books as $2,200. urbe.wore.o 5 Payment of $1,500 to Sweet Candy House has been debited to Candice Sweets. The statement of financial performance for the year ended 30 April 20X7 showed a profit of $7,300 before discovering the errors. Share capital and retained earnings, before the profit for the year was transferred, were $70,000 and $16,685 respectively. (a) Prepare a statement to show adjusted profit for the year ended 30 April 20X7. (b) Calculate the shareholders' equity as at 30 April 20X7, after the errors are corrected.

After the accountant of Cindy Candy Pte Ltd prepared the financial statements for the year ended 30 April 20X7, the following errors were discovered. 1 Purchase of an office table for $1,200 has been debited to the commission expense account. Receivable 2. Commission income of $2,000 earned for the year has not been received but was debited to the cash at bank account and credited to the commission income muloo account. Discount allowed of $130 has been debited to the discount received account. 4 Cheque payment of $220 for advertising expenses has been wrongly recorded in the books as $2,200. urbe.wore.o 5 Payment of $1,500 to Sweet Candy House has been debited to Candice Sweets. The statement of financial performance for the year ended 30 April 20X7 showed a profit of $7,300 before discovering the errors. Share capital and retained earnings, before the profit for the year was transferred, were $70,000 and $16,685 respectively. (a) Prepare a statement to show adjusted profit for the year ended 30 April 20X7. (b) Calculate the shareholders' equity as at 30 April 20X7, after the errors are corrected.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter2: Analyzing Transactions

Section: Chapter Questions

Problem 5PA: The Colby Group has the following unadjusted trial balance as of August 31, 2019: The debit and...

Related questions

Question

Secondary school accounting. Please teach me the journal too thankyou ?

Transcribed Image Text:After the accountant of Cindy Candy Pte Ltd prepared the financial statements for the

year ended 30 April 20X7, the following errors were discovered.

1

Purchase of an office table for $1,200 has been debited to the commission

expense account.

Recavable

Commission income of $2,000 earned for the year has not been received but

was debited to the cash at bank account and credited to the commission income

muloo

account.

Discount allowed of $130 has been debited to the discount received account.

4 Cheque payment of $220 for advertising expenses has been wrongly recorded in

the books as $2,200.

rbe.wo

Payment of $1,500 to Sweet Candy House has been debited to Candice Sweets.

The statement of financial performance for the year ended 30 April 20X7 showed a

profit of $7,300 before discovering the errors. Share capital and retained earnings,

before the profit for the year was transferred, were $70,000 and $16,685 respectively.

(a) Prepare a statement to show adjusted profit for the year ended 30 April 20X7.

(b) Calculate the shareholders' equity as at 30 April 20X7, after the errors are

corrected.

00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub